Market Data

July 26, 2020

SMU Steel Buyers Sentiment: Moves in the Wrong Direction

Written by Tim Triplett

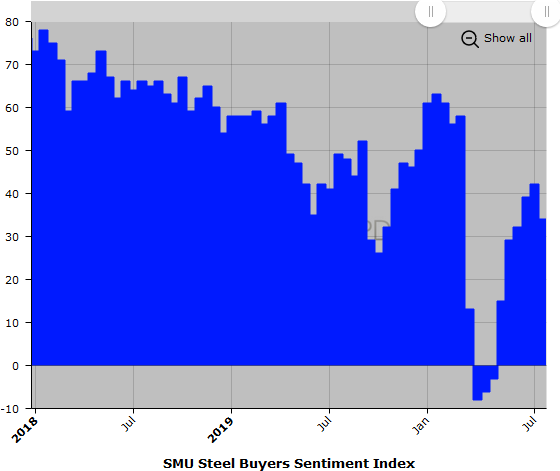

Industry sentiment had been trending positive since bottoming out in the first week of April—until this week. Steel Market Update’s Steel Buyers Sentiment Indexes slid back from levels earlier in the month on continued uncertainty over the coronavirus and its effects on the economy and steel demand.

SMU asks steel buyers how they view their company’s chances for success in the current environment and three to six months in the future. The Current Sentiment reading this week dipped to +34, down 8 points from two weeks ago. At this point in 2019 the index had a reading of +48.

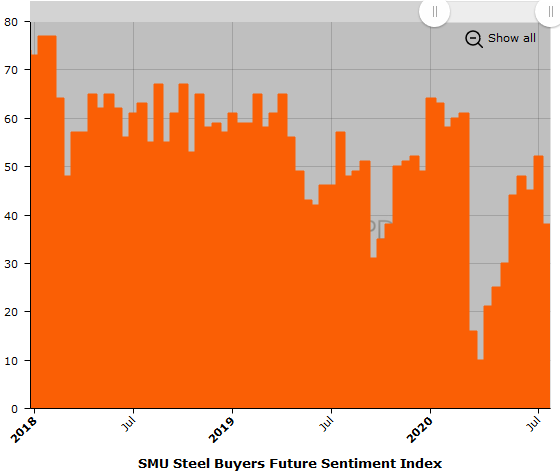

Future Sentiment

SMU’s Future Sentiment Index declined by 14 points since the first week of July to a reading of +38. That’s down from +57 at this time last year. Future Sentiment had been noticeably higher than Current Sentiment ever since the pandemic began, as buyers looked forward to better days ahead, but the two are now near parity—a sign of the frustratingly slow pace of recovery.

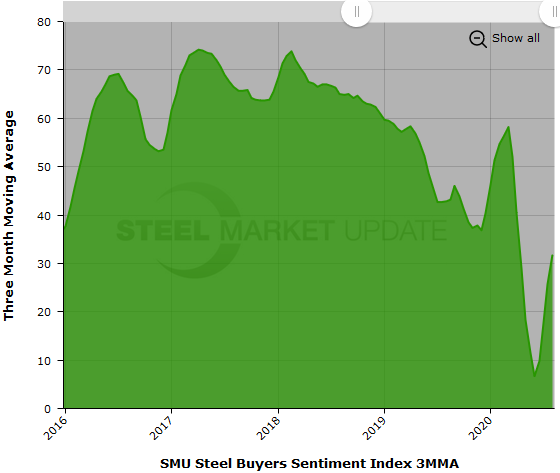

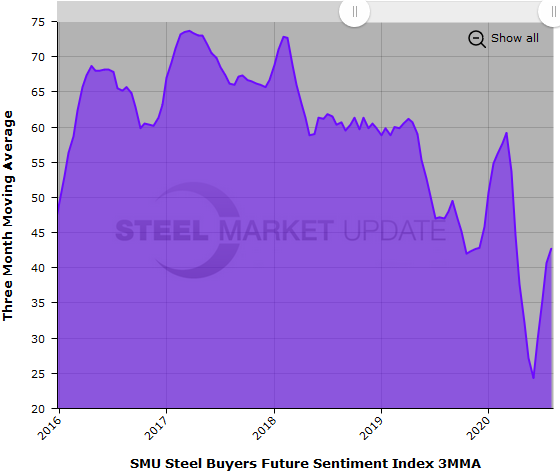

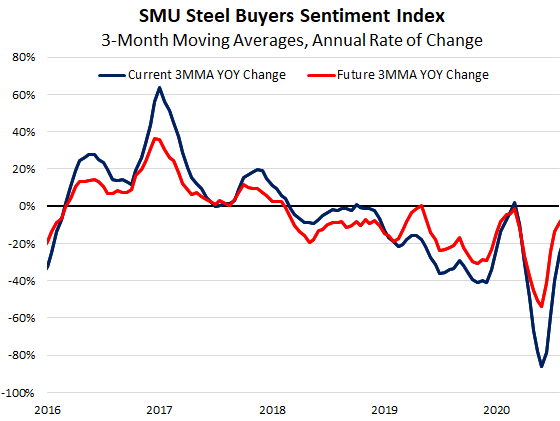

Three-Month Moving Averages

Results from SMU’s market trends questionnaire are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend. Both Current and Future Sentiment measured as 3MMAs continue to trend upward. The Current Sentiment 3MMA increased to +31.83, up from the recent low of +6.67 in late May. The Future Sentiment 3MMA rose to +42.83 from the May low of +24.33.

The chart below shows the recent uptrend in the annual rate of change in the three-month moving averages for both Current and Future Sentiment.

What Respondents Had to Say

“There’s too much uncertainty and weak demand.”

“With uncertainty comes pullback. I see the current business conditions making companies more risk averse. Buyers will be conservative and buy less, and more domestic.”

“Business has slowed down again because of the latest COVID outbreaks. The government isn’t giving extra federal money for furloughed employees. We risk losing our key skill plant workers.”

“Concerns about demand during the COVID issue are making the market hesitate.”

“I don’t see conditions changing for the better in the next 3-6 months.”

“I’m not sure how severely COVID may return and how long it will persist. Long-term construction projects seem to be declining in the design stages and other things are put on hold.”

“A critical error was made in opening up too soon, making the second round of closings even harder on companies.”

“Far too much uncertainty.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.