Market Data

July 23, 2020

Steel Mill Lead Times: Not Much Change

Written by Tim Triplett

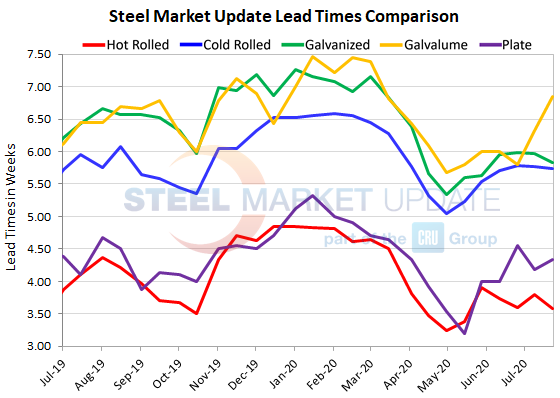

Lead times for spot orders of flat rolled and plate steel have seen relatively little change over the past month, but remain about a half week shorter than this time last year as the market tries to come to grips with doing business in a pandemic. Lead times are an indicator of steel demand—shorter lead times suggest the mills are less busy and more inclined to negotiate on prices.

According to Steel Market Update’s check of the market this week, hot rolled lead times now average 3.58 weeks, down from 3.79 two weeks ago. Cold rolled was virtually unchanged at 5.74 weeks. Galvanized and plate lead times were slightly extended at 6.85 and 4.33 weeks, respectively.

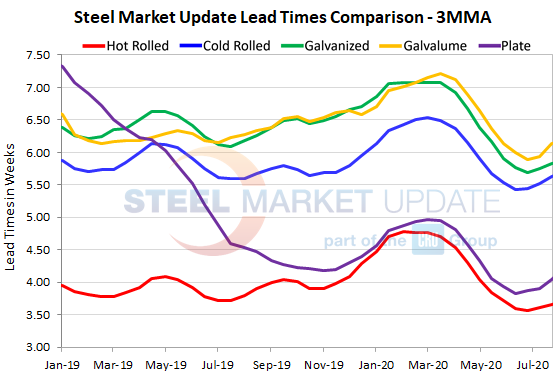

Looking at three-month moving averages, which smooth out the variability in the biweekly readings, lead times for flat rolled and plate saw a small upturn for the second time in the past month. The current 3MMA for hot rolled is 3.66 weeks, cold rolled is 5.63 weeks, galvanized is 5.83 weeks, Galvalume is 6.13 weeks and plate is 4.04 weeks.

Commented one OEM executive: “It depends on the mill. Some lead times are shorter than others, but that is mainly due to the amount of capacity each mill took out. USS took down five furnaces, so their lead times are stretched out more than a minimill like Nucor Berkeley.”

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.