Market Data

July 22, 2020

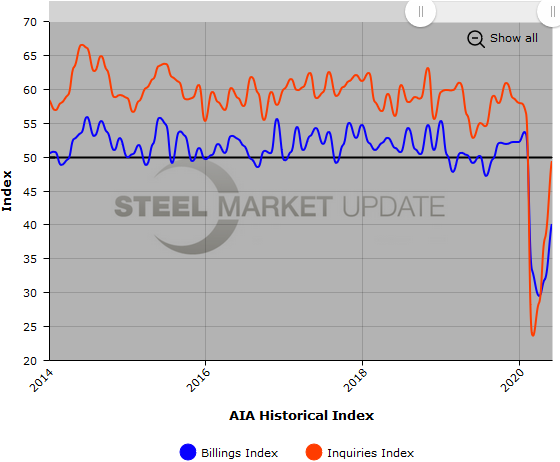

ABI Still in Contraction But Stabilizing in June

Written by Sandy Williams

Demand for design services by architectural firms showed signs of stabilizing in June. The Architecture Billings Index rose 8.0 points to post a score of 40.0. A score of 50 is the neutral point between contraction and expansion.

“While business conditions remained soft at firms across the country, those with a multifamily residential specialization saw the most positive signs,” said American Institute of Architects Chief Economist Kermit Baker. “Unfortunately, conditions at firms with a commercial/industrial specialization are likely to remain weak for an extended period of time, until hospitality, office and retail facilities can fully reopen and design demand for this space begins to increase.”

The index by sector showed the three-month moving average for billings in multi-family residential at 44.7, institutional at 38.9, mixed practice at 35.3 and commercial/industrial at 30.2.

Billings in regional areas, also calculated on a three-month moving average, improved slightly in June, although remaining in contraction. Regional averages rose by single digits in most regions with the the Midwest at 36.8, the Northeast at 34.2 and the South at 35.9. The billings index for the West rose 0.8 points to a score of 36.8.

The project inquiries index was 49.3 and the design contract index posted at 44.0.

Below is a graph showing the history of the Architecture Billings Index and Inquiries Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.