Analysis

July 10, 2020

Final Thoughts

Written by Tim Triplett

John Packard (who is traveling) says his sources are telling him that JSW’s flat roll mill in Mingo Junction, Ohio, may be shutting down (not taking orders) for an unknown amount of time. No confirmation or details yet from the company.

John also reports that Steel Dynamics ran the first coil through the new #3 galvanizing line at its mill in Columbus, Miss., last week. SDI announced in June 2018 that it planned to invest $140 million to add a third galvanizing line at its Columbus Flat Roll Division. The new galvanizing line has an annual coating capability of 400,000 tons.

The coronavirus pandemic has been dominating the headlines since mid-March. Public opinion seems to have vacillated between panic and indifference from one week to the next. Within the steel industry, views have evolved dramatically over the past few months as seen in the charts below.

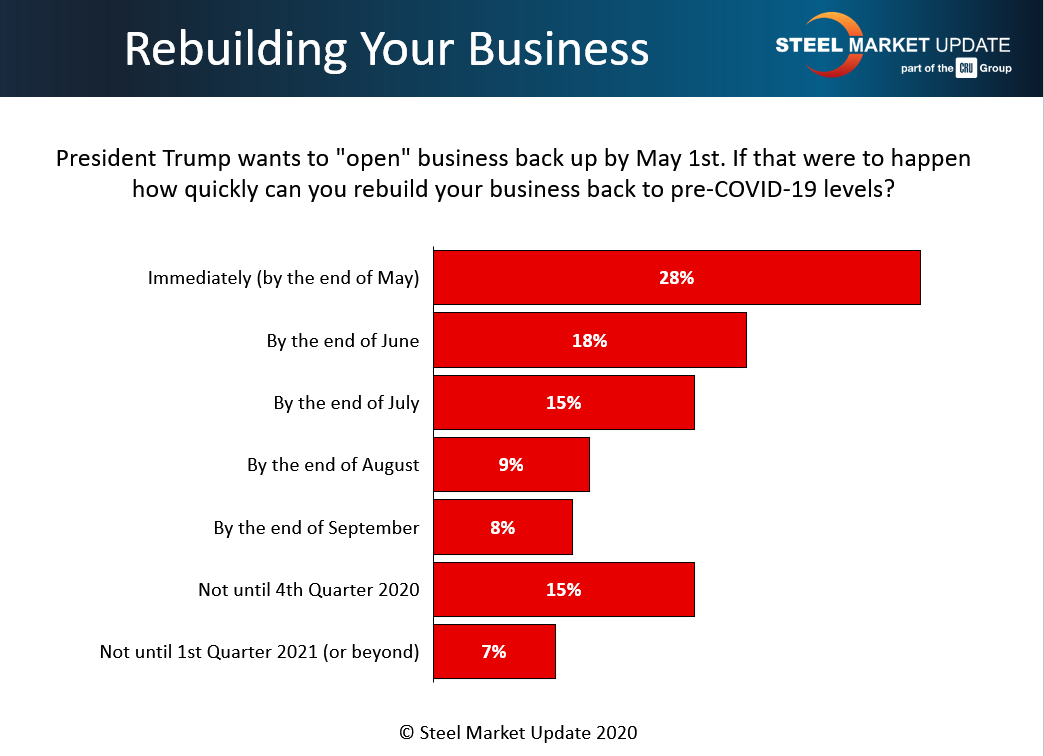

In May when we asked readers how quickly they thought business would return to pre-COVID levels, this was the distribution of responses to SMU’s market trends questionnaire. The majority saw the virus running its course by the end of July, and almost all by the end of the year. Only 7 percent acknowledged the crisis could extend into next year.

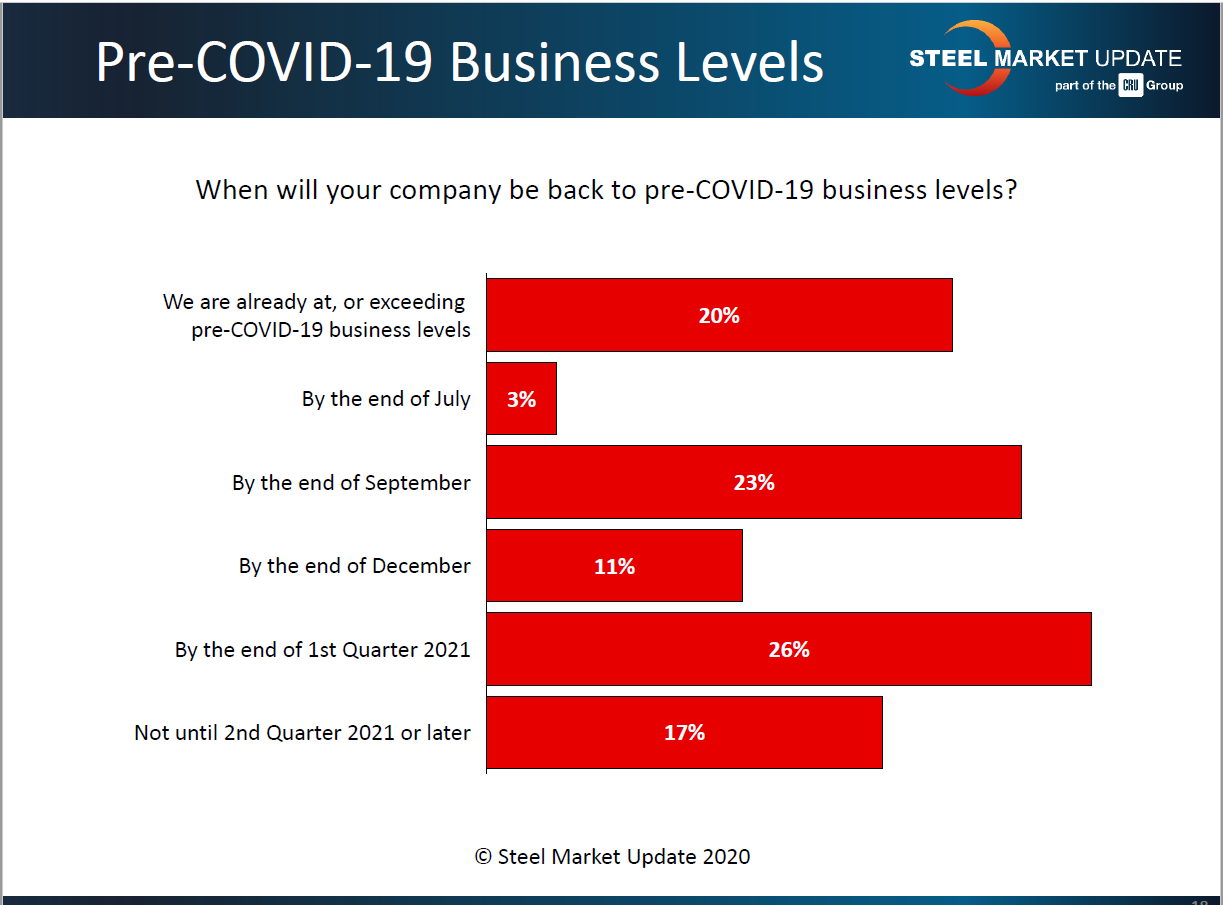

This week’s responses reveal a much more sobering outlook, with 43 percent anticipating the virus will impact their businesses into the first or even second quarter of 2021.

As disconcerting as the pandemic is, especially with reports of surges in various parts of the country this week, we know a lot more about the virus than we did a couple months ago and can now make more informed and realistic plans on how to deal with it.

Andre Marshall, president and founder of Crunch Risk, LLC, will offer his insights on how the coronavirus is impacting the steel futures market as the featured speaker during SMU’s next Community Chat webinar this Wednesday, July 15. The webinar begins at 11 a.m. ET and is free to anyone in the industry. Click here to register.

Registrations continue to grow for the 2020 SMU Virtual Steel Summit Conference For more information visit www.SteelMarketUpdate.com and click on the SMU Virtual Steel Summit link. Or to register, click here.

As always, your business is truly appreciated by all of us here at Steel Market Update.

Tim Triplett, Executive Editor