Market Data

July 9, 2020

Steel Mill Lead Times: No Clear Trend

Written by Tim Triplett

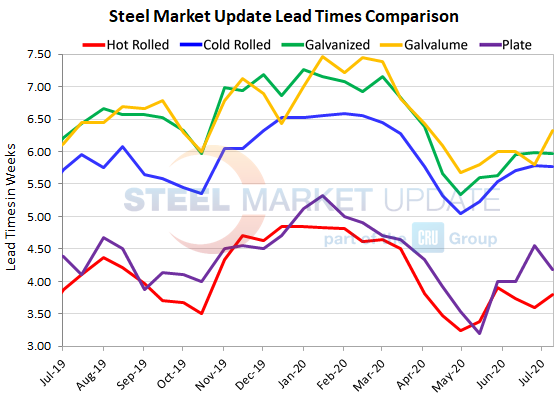

Lead times for spot orders of flat rolled steel saw minor and inconsistent changes in the past two weeks, revealing no clear trend. Hot rolled lead times extended slightly, while lead times for cold rolled and galvanized were flat and plate lead times declined, according to Steel Market Update’s check of the market this week. Lead times are an indicator of steel demand—longer lead times suggest the mills are getting busier and are less likely to discount prices. Shorter lead times indicate the opposite.

Hot rolled lead times now average 3.79 weeks, up from 3.59 in the last week of June. Cold rolled and galvanized lead times were virtually unchanged at 5.77 and 5.97 weeks, respectively. The current lead time for Galvalume averages 6.33 weeks, up from 5.80 last month, while the average plate lead time has shortened to 4.18 weeks from 4.55 in SMU’s prior poll.

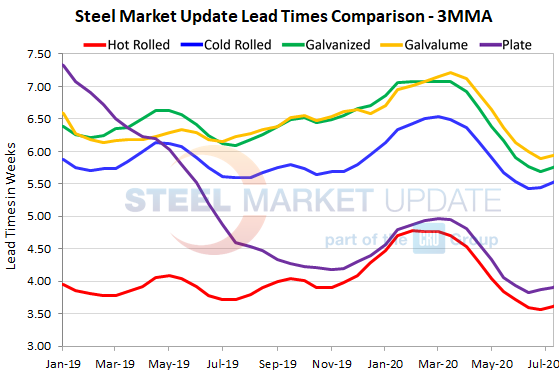

Looking at three-month moving averages, which smooth out the variability in the biweekly readings, lead times have trended downward since the coronavirus struck and are about a week shorter than prior to the pandemic. This week, however, the 3MMAs for all the flat rolled products showed a small uptick for the first time since March. The current 3MMA for hot rolled is 3.61 weeks, cold rolled is 5.51 weeks, galvanized is 5.75 weeks, Galvalume is 5.93 weeks and plate is 3.91 weeks.

The slight increase in the lead time for hot rolled is the only such indicator even hinting yet at new demand for flat rolled steel as the economy struggles to recover from a coronavirus that appears to be surging in many parts of the country.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.