Prices

July 9, 2020

Hot Rolled Futures: What a Difference a Week Makes!

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

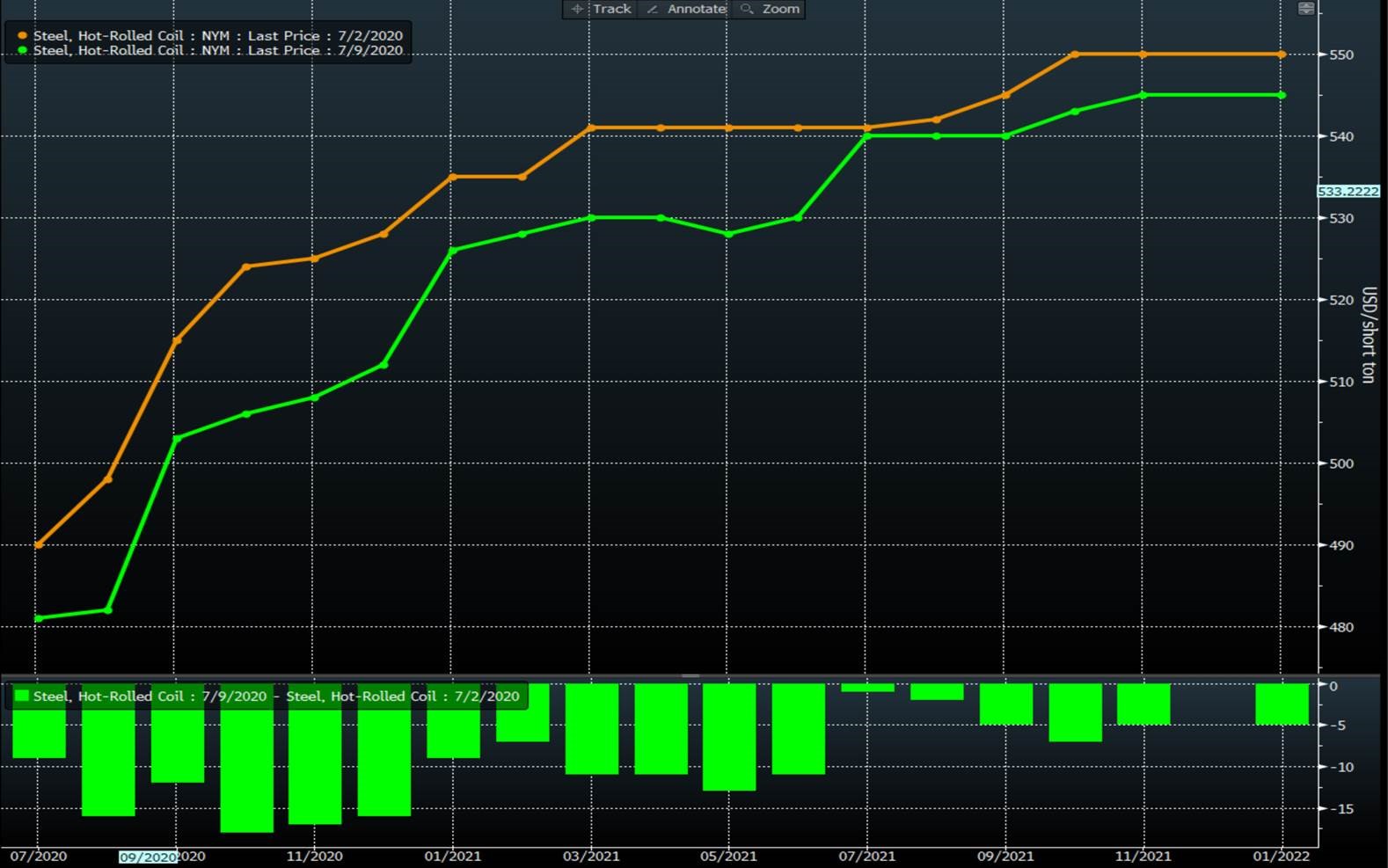

The past week has been a rough one for HRC futures. The potential for scrap to weaken more than expected, and negative developments related to COVID-19, have caused sellers to become more aggressive in the markets. You can see that week on week futures have dropped across the curve out into 2021:

The scrap market has been part of the catalyst. Consensus expectations a month ago were perhaps for a flattish to down $10 on busheling. Two to three weeks ago scrap market participants were thinking down $20-30. This week sentiment has worsened further, causing a significant drop in the curve versus one month ago:

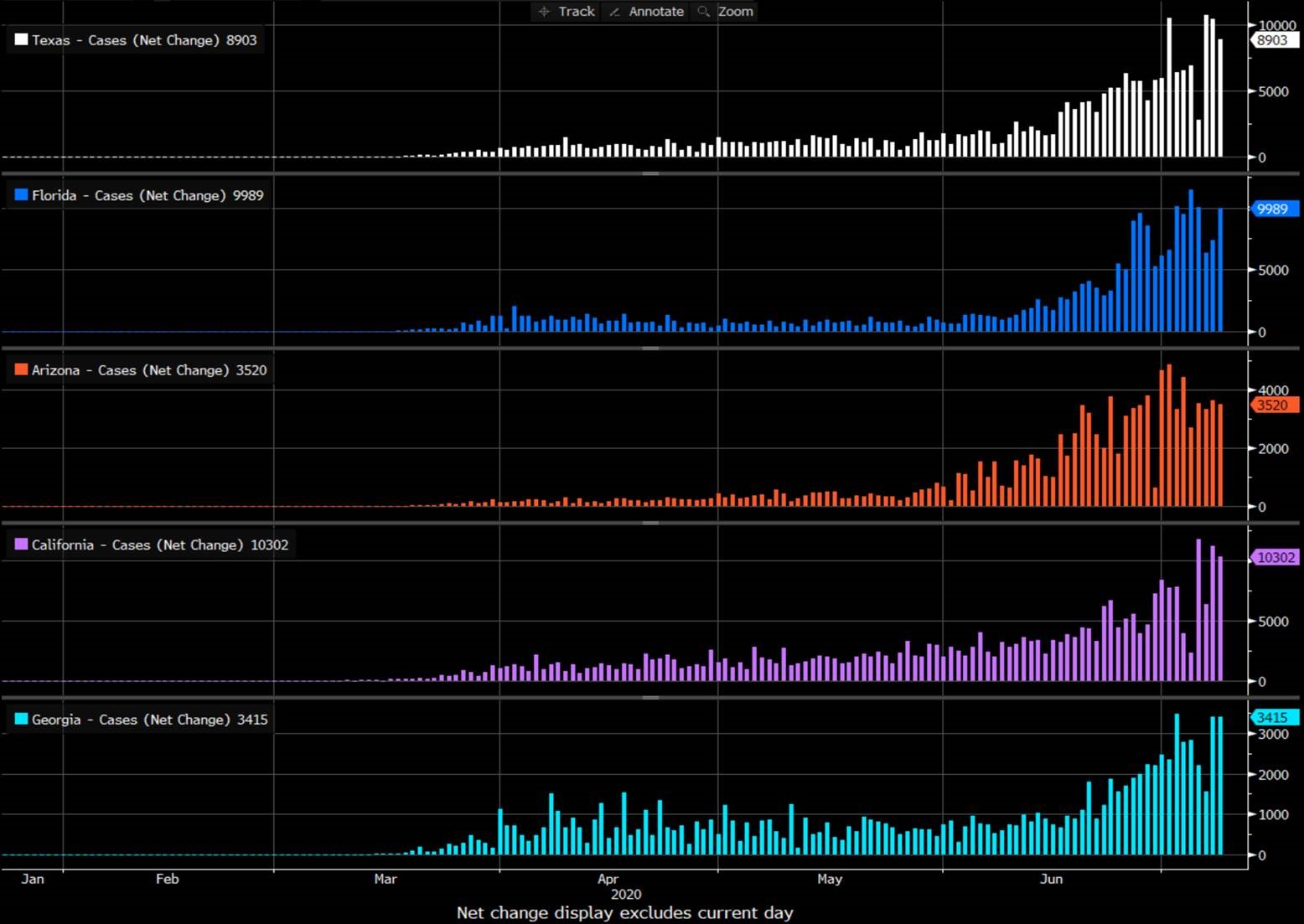

The other factor worth mentioning is the surge in virus cases in a number of states here in the U.S. This has caused traders to question how much we will need to “tap the brakes” on reopening the economy—and may be causing some steel demand jitters:

That said, the news is not all bad in the world of steel. The key region with positive news is clearly China, where steel prices hit a six-month high, driven by strong demand. The chart below shows China average HRC prices, shown in RMB/metric ton:

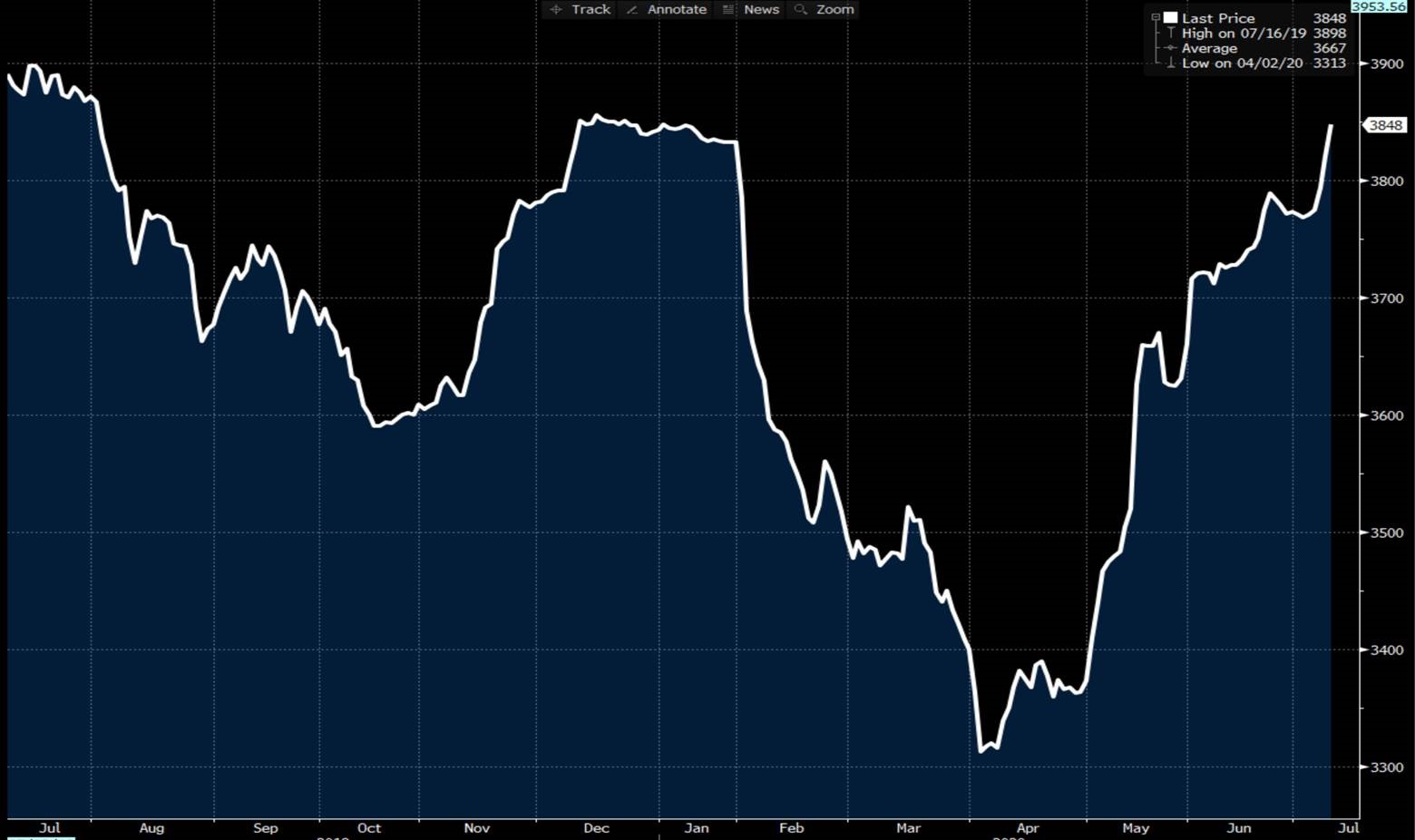

China’s stimulus has clearly driven a stunning rally in ore and domestic steel prices, even driving them to import HRC from other countries to satiate demand. This had driven a very divergent price trend between the two countries. The below chart shows the percentage change in U.S. steel prices (on the CME futures contract) versus ore prices over the past six months. While these two commodities can certainly have significant divergences over time, we are starting to stretch the rubber band.

It is also worth mentioning futures contract volumes. Last month in the U.S., just under 370,000 tons of HRC traded on the CME. This is a slight uptick from the prior month, and volumes so far in 2020 are pacing at over 4 million tons. In addition, the HDG contract saw its first trade recently, opening a new door for those interested in hedging that commodity.

In a nutshell, the markets here in the U.S. are clearly softening, and that is being reflected in the futures curves. Those interested in hedging steel costs may look at this as an opportunity to lock in at lower levels than they could have a month or two ago. The key question we should all be asking ourselves may be: Can China pull us out of the ditch?

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information