Analysis

July 9, 2020

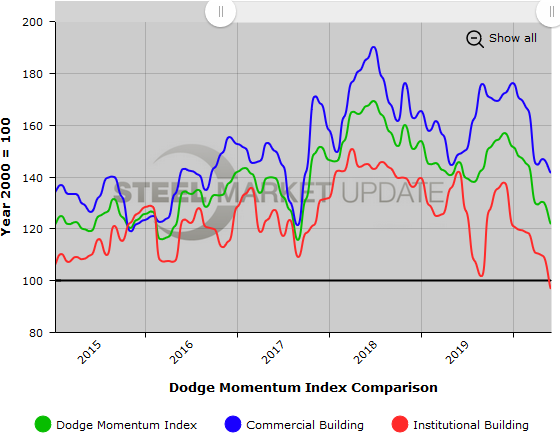

Dodge Momentum Index Declines in June

Written by Sandy Williams

A measure of the initial report of nonresidential construction projects slipped in June after an upward revision for May. The Dodge Momentum Index posted at 121.5, a 6.6 percent decline from the May index of 130.1. Planning for institutional construction dropped 11.7 percent, while the commercial component fell 3.5 percent.

“The Momentum Index has shifted noticeably lower as the fallout from recession continues to hold its grip on the construction sector,” wrote Dodge Data & Analytics. “The overall Momentum Index fell 13 percent in the second quarter from the first three months of the year, with the commercial component 14 percent lower and the institutional component down 11 percent.

“While the recession has ended and recovery is underway, the return from one of the steepest downturns in U.S. history will be slow and fraught with risk. This holds true for the construction sector as well. While projects continue to enter planning, the slower pace suggests that recovery in the construction sector will be modest in coming months.”

Seven projects valued at $100 million or more entered the planning stage in June.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.