Overseas

July 9, 2020

CRU: Global Steel Prices Still Have Not Realigned

Written by George Pearson

By CRU Prices Analyst George Pearson, from CRU’s Steel Monitor

Sheet prices in the U.S. Midwest market have fallen from their early June peak as end-user demand, although higher than April and May, remains historically low. Over the near term, sheet prices will fall further as demand is limited by weak underlying economic activity and seasonal pressure, while supply will increase and scrap costs fall. One key factor affecting market sentiment has been the return of idled blast furnaces.

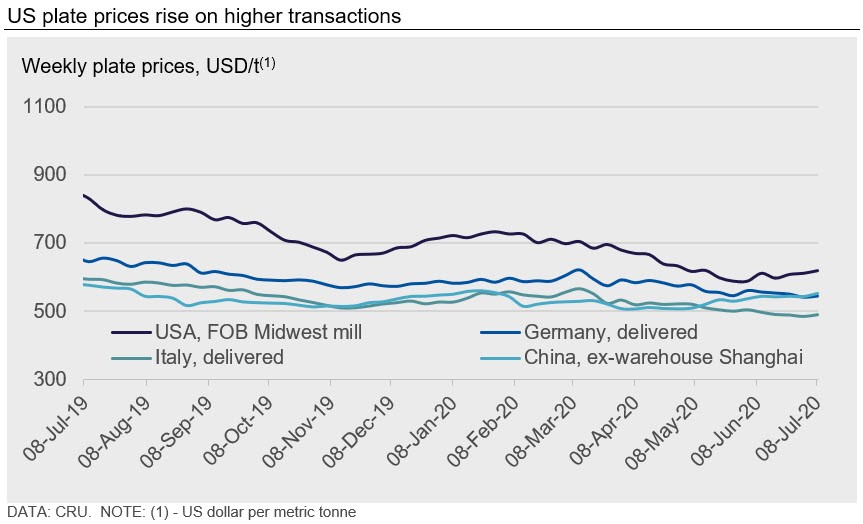

Submission volumes decreased last week because of the national holiday, but buyers have also reported a reluctance to build inventory as Covid-19 cases rise and the demand outlook remains uncertain. Plate prices gained $7 /s.ton w/w to $561. This gain comes as most transaction data was higher w/w while some of the lower-priced data points have gone quiet, possibly reflecting the absence of lower-priced deals in the market.

European sheet prices were mixed this week with small adjustments in both directions. German HDG coil increased €2 /t w/w. We have heard of small increases for firm HDG coil business after mills followed ArcelorMittal in raising prices. However, some European mills have continued to sell at the same prices as before to fill order books. This goes part of the way to explaining why prices have risen slightly or not at all from the bottom: the price of German HR coil has been unchanged for four consecutive weeks at €410 /t. Market participants expect the increase of €20 /t to be more achievable across the market in 3-4 weeks if import offers remain at these levels. Italian plate increased by €2 /t to €434 /t w/w, while German plate was unchanged at €482 /t. Although plate import offers have generally decreased, some sellers are still dipping in and out of the market. The lowest plate sale prices heard for import recently have been from South Korea, at €410 /t CFR South European port. CIS offers were heard at €420-425 CFR, while Indian offers were reportedly higher than this level.

Chinese steel prices edged up this week because of rising raw material prices and a rallying Chinese stock market. HR coil prices increased by RMB120 /t to RMB3,860 /t. Rebar prices increased by RMB60 /t to RMB3,580 /t. However, steel consumption, especially of longs, declined due to weaker construction activity in the southern part of the country. Consequently, the destocking rate has slowed significantly, and overall steel inventory has increased for two consecutive weeks, rising by 3 percent this week, while weekly output has continued to remain at historically high levels.

Speculation about upcoming output restrictions in Tangshan, Hebei province has continued, but so far there are no signs of production being curbed. CRU does not expect any voluntary production cuts at current steel margins unless the local government in Tangshan city enforces the restrictions. We do not believe the current steel price increase is sustainable and may experience setbacks if and when the stock market cools down.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com