Market Data

June 29, 2020

Global Steel Production Through May

Written by Peter Wright

In May, China’s crude steel production hit 92.3 million metric tons, an all-time high, despite the coronavirus pandemic.

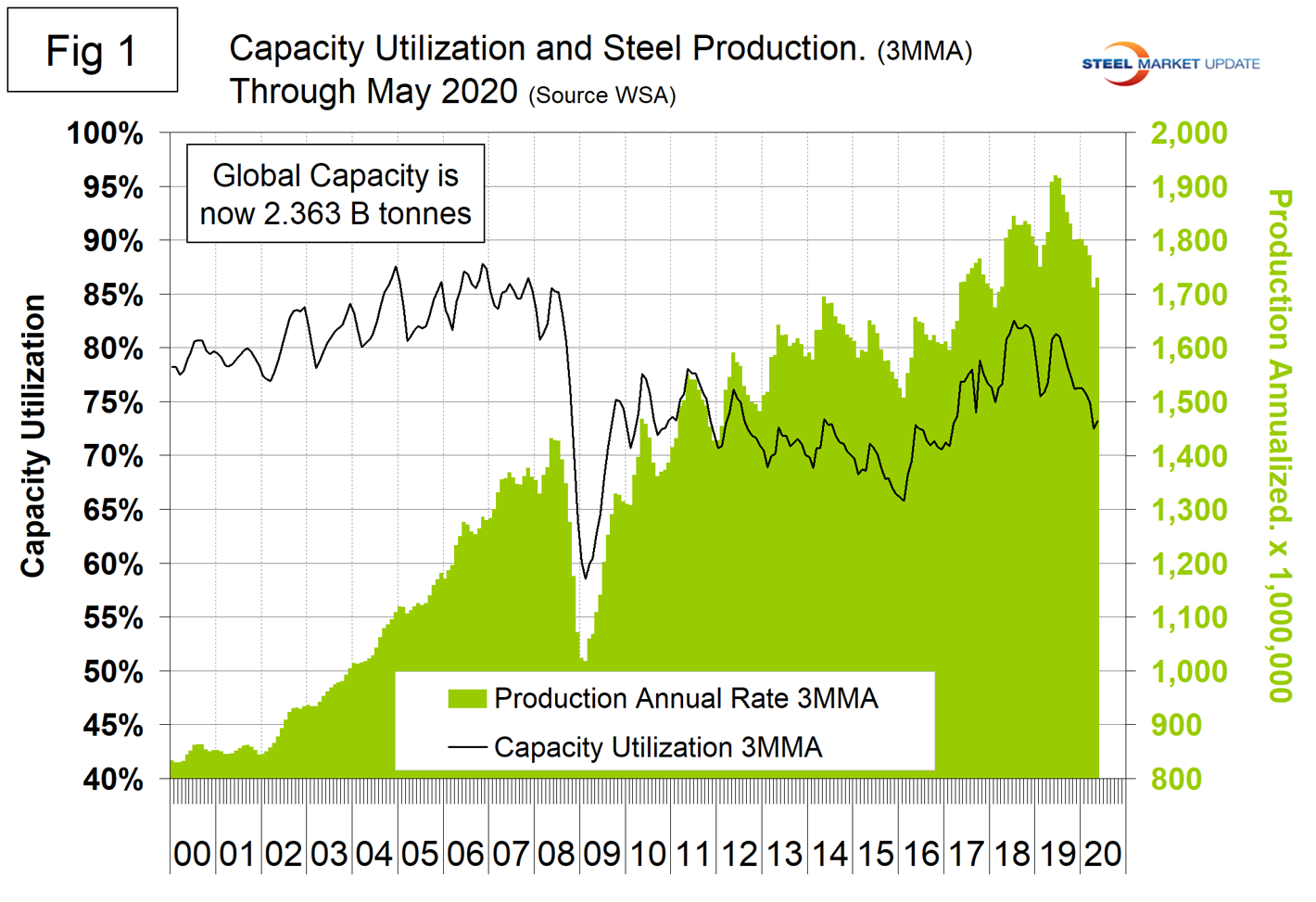

On June 24, the OECD released its updated report of steel production capacity by nation: “Global steelmaking capacity (in nominal crude terms) decreased from 2015 to 2018, but the latest available information (as of December 2019) suggests that capacity increased in 2019 for the first time since 2014. The OECD has revised its 2019 figures for global steelmaking capacity to 2,362.5 million metric tonnes (mmt) to incorporate new information on closures that was not previously available as well as updated information on the status of certain investment projects. Moreover, revisions to the aggregate capacity figures for the People’s Republic of China, the United States, Mexico, Japan, Korea and several other economies’ data contributed to the upward revision for 2019 and previous years. The net capacity change in 2019, taking into account new capacity additions and closures, represents a 1.5 percent increase from the level at the end of 2018.”

Figure 1 shows annualized monthly global steel production on a three-month moving average (3MMA) basis and capacity utilization since January 2000 based on the updated OECD data. Capacity utilization in May on a 3MMA basis was 75.6 percent. On a tons-per-day basis, production in May was 4.799 million metric tons, down from June 2019’s all-time high of 5.313 million metric tons.

Figure 2 shows the year-over-year growth rate of the 3MMA of global production since January 2013. Growth in three months through May on a year-over-year basis was negative 9.4 percent, down from positive 2.2 percent in February.

Table 1 shows global production broken down into regions, the production of the top 10 nations in the single month of May, and their share of the global total. It also shows the latest three months and 12 months of production through May with year-over-year growth rates for each period. Regions are shown in white font and individual nations in beige. The world overall had negative growth of 9.4 percent in three months and negative 1.5 percent in 12 months through May. When the three-month growth rate is lower than the 12-month growth rate, as it was in April and May, we interpret this to be a sign of negative momentum. On the same basis in May, China grew by 1.0 percent and 4.1 percent, and therefore also had negative momentum. China was the only country to have positive growth in three months through May. All other countries except Russia had double-digit declines in three months, the worst case being India, down 40.0 percent. Table 1 shows that North America was down by 23.5 percent in the three months through May. Within North America, production was down by 26.5 percent in the U.S., down by 20.6 percent in Canada, and down by 12.3 percent in Mexico. (Canada and Mexico are not shown in Table 1 and the North American total includes Cuba, El Salvador and Guatemala.)

In the 12 months through May, 112.03 million metric tons were produced in North America, of which 82.0 mmt was produced in the U.S., 12.2 mmt in Canada, and 17.4 mmt in Mexico. Based on the new OECD data, U.S. capacity in 2019 was 109.7 million metric tons with a capacity utilization of 80.0 percent.

Figure 3 shows China’s production since 2005 on a 3MMA basis. In the single month of May, China’s steel production was at an all-time high of 92.3 mmt with a 3MMA of 85.4 mmt. Production declined in January and February as a result of the pandemic and recovered each month in March through May. China’s capacity is now 1.152 bmt, a reduction from 1.215 bmt in January 2015. May capacity utilization was 86.8 percent, which as a result of the capacity reduction and production increases was up from 67.3 percent in January 2015.

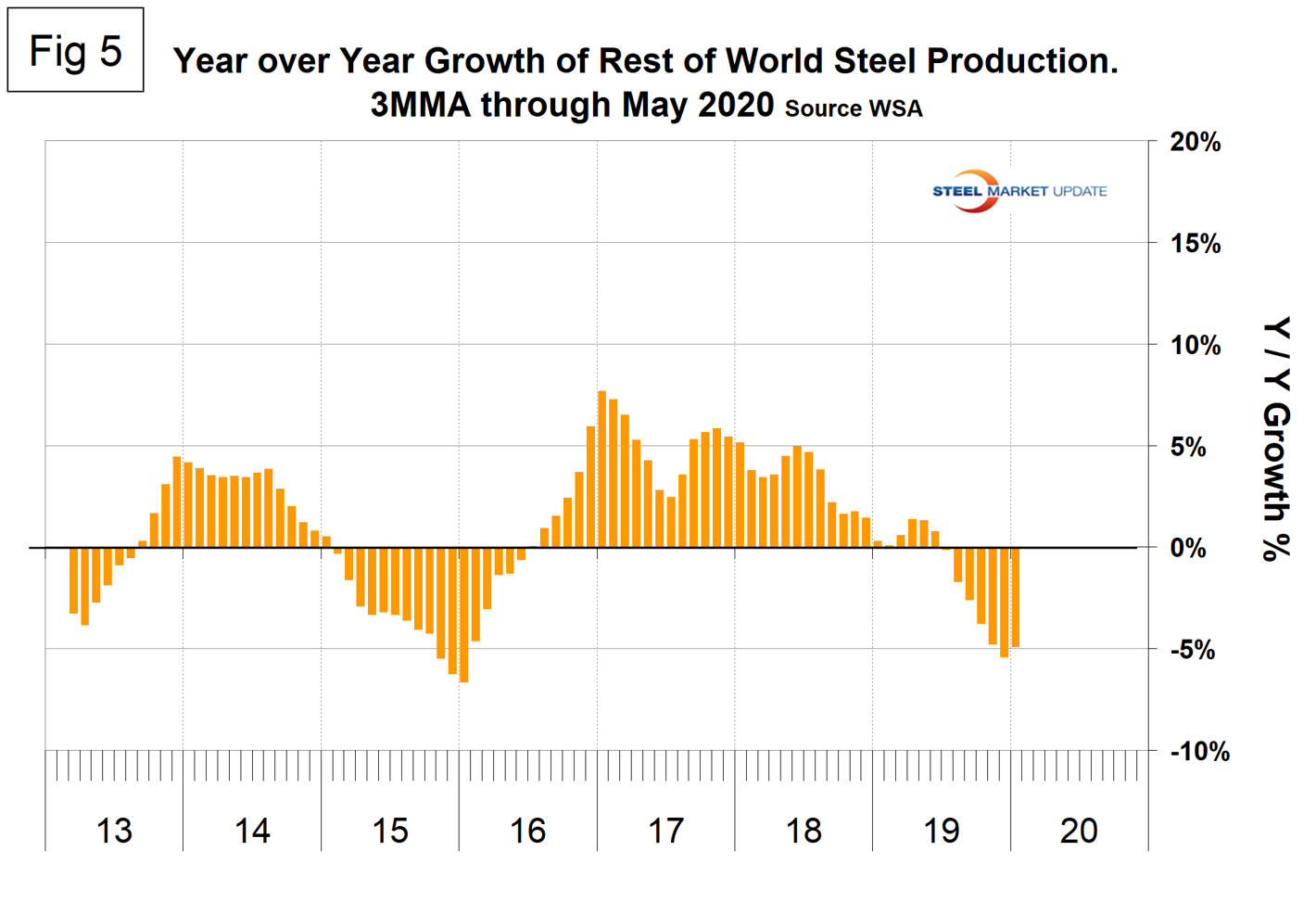

Figure 4 shows the growth of China’s steel production since March 2013 and Figure 5 shows the growth of global steel excluding China on the same scale, both on a 3MMA basis. The single month of May was much more dramatic, China’s production was up by 4.2 percent year over year, but the rest of the world was down by 24.1 percent. China’s domination of the global steel market continues to increase.

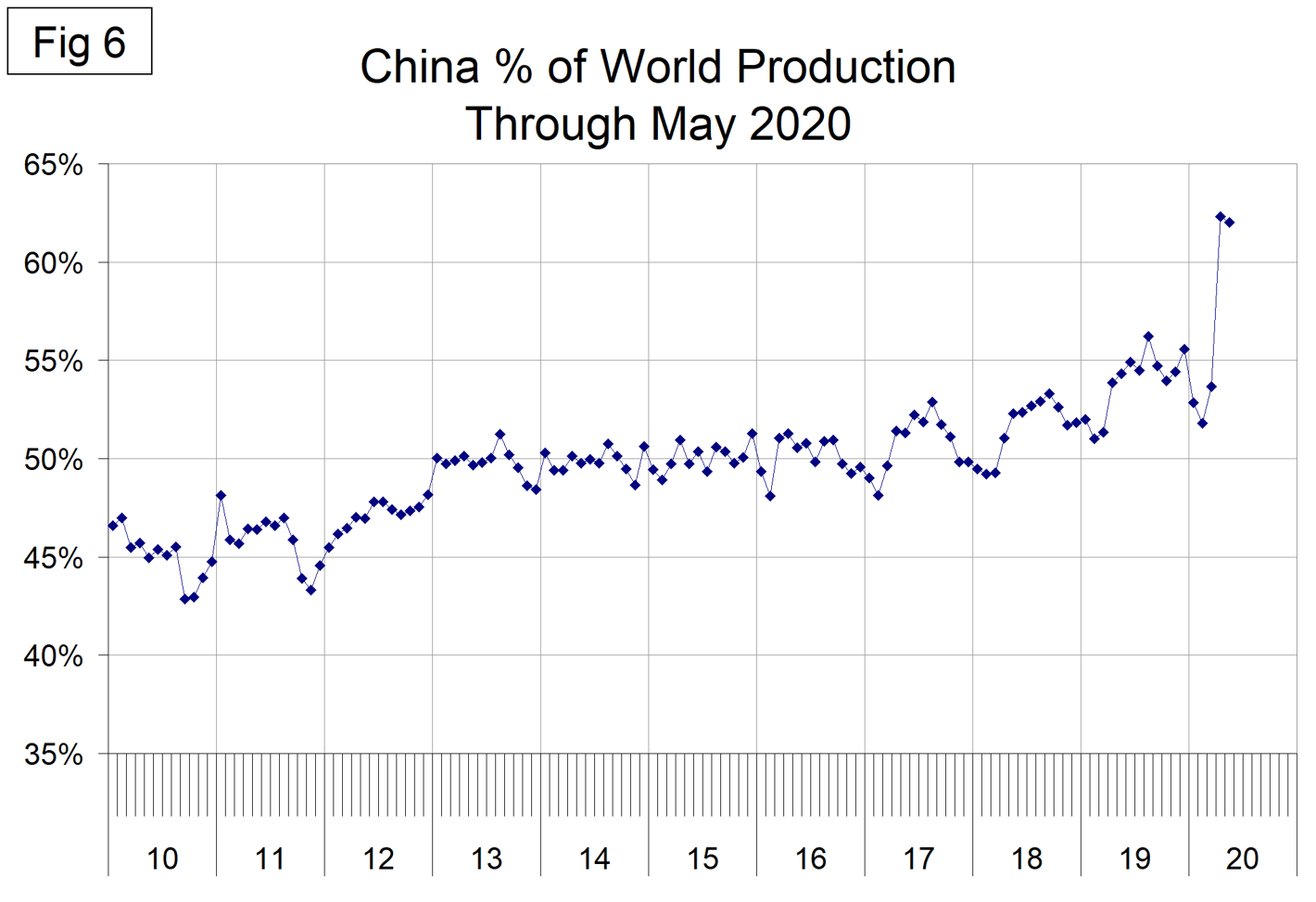

Figure 6 shows the growth of China’s share of global steel production, which in April was 62.3 percent, an all-time high, and in May was 62.0 percent.

The World Steel Association released its short range forecast on June 4. WSA anticipates that global production will be down by 6.4 percent in 2020 and up by 3.8 percent in 2021. On the same basis, North America will be down by 20.0 percent and up by 6.2 percent.

The WSA represents approximately 85 percent of the world’s steel production, including over 160 steel producers, national and regional steel industry associations, and steel research institutes. (Note at the bottom of Table 1 WSA says this represents 99 percent of steel production, so presumably there are reports of production by countries that include nonmembers.) The OECD has taken over responsibility for tracking global steel capacity and its latest update was for 2019, released in June 2020.