Analysis

June 29, 2020

Final Thoughts

Written by John Packard

Today we officially took our SMU Price Momentum Indicator on hot rolled, cold rolled, and galvanized to Lower from Neutral. We are leaving Galvalume and plate at Neutral. We have seen prices slipping over the past few weeks, and we do not see any immediate signs of that trend reversing itself. There will be questions about supply and demand as integrated mills bring back capacity. Scrap prices are primed to move lower during the month of July. Contract prices are well below spot and contract buyers are not able to utilize all of the tons available to them. Demand will be the key moving forward, and there are concerns regarding the rising wave of coronavirus infections in the South and Western states.

U.S. Steel sent out a press statement late this afternoon advising they will be bringing back a blast furnace at their Gary Works. Here is what the mill had to say:

“U.S. Steel will commence restarting Gary Works #6 Blast Furnace after the holiday weekend consistent with the growth we have been seeing in customer demand. We remain ready to serve our customers as they adjust to changing market conditions by utilizing the flexibility of our banked blast furnaces, including if needed adjusting operations intermittently to accommodate changes in our order book.”

The #6 furnace at Gary Works is rated at 3,800 net tons per day of pig iron production (AIST), which is then fed into a basic oxygen furnace to make steel. It is an average size furnace for U.S. Steel (exception being #14 at Gary Works which produces 8,200 net tons of pig iron per day.)

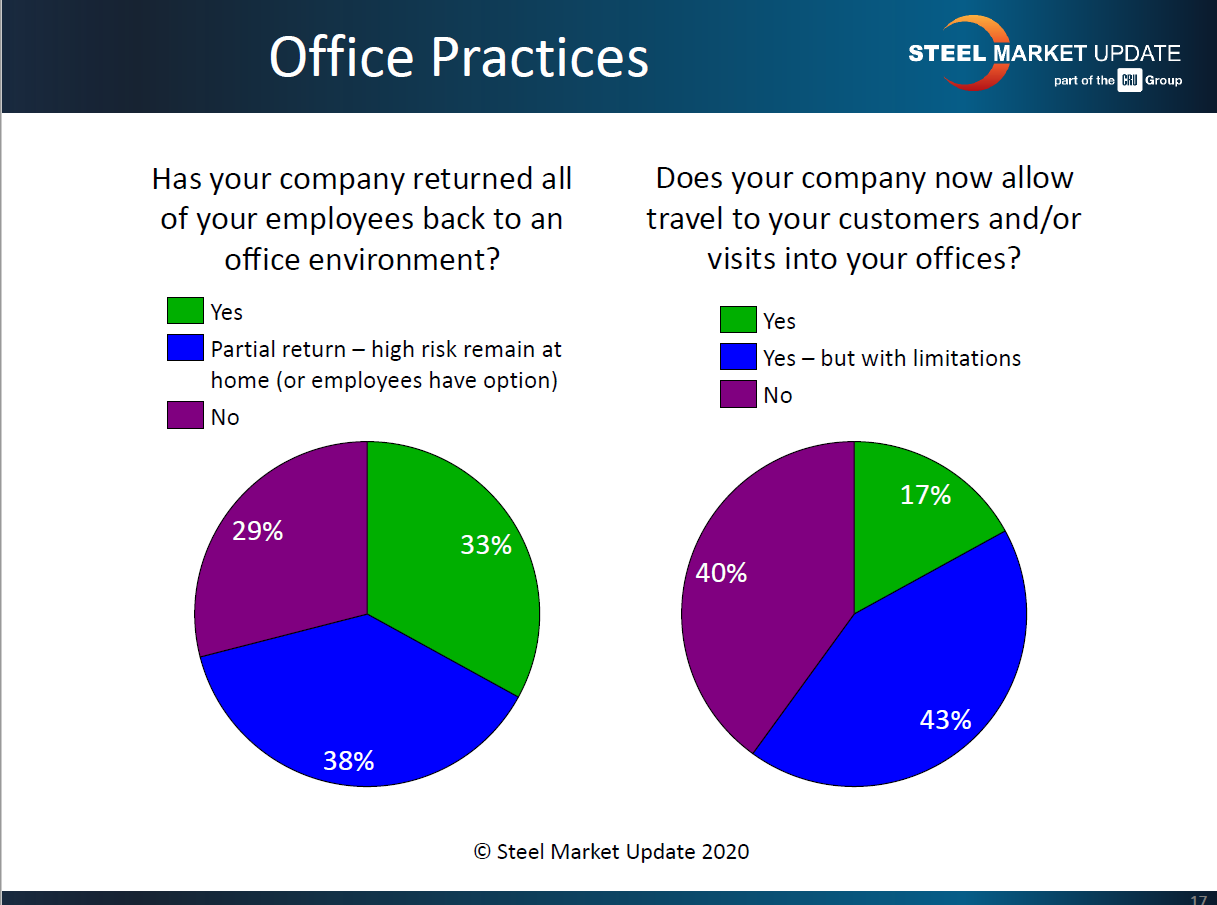

Last week we asked those participating in our flat rolled and plate steel market trends questionnaire to comment on whether their company had returned their employees back to the office, and was their company allowing for travel to customers (or visits to their office)?

As you can see by the results below, one-third of the companies have returned to normal office operations, 38 percent have split rules with some employees working from home and some in the office, and 29 percent continue to work from home.

When it came to allowing travel or visits, we found 17 percent of the companies are now allowing travel and/or visitors, 43 percent are allowing travel/visits with some limitations and 40 percent are not allowing either travel or visitations at this time.

Our next SMU Community Chat webinar will host Eddie Lehner, President & CEO of Ryerson. This free webinar will begin at 11 AM ET (10 CT, 9 MT, 8 PT) and you can register by clicking here. Ryerson is one of the largest flat rolled and plate steel distributors in North America. If you have a question you would like to ask Mr. Lehner, you can send it to: chat@SteelMarketUpdate.com

I have been spending a large portion of my time over the past week working on the new program we will be presenting at this year’s SMU Virtual Steel Summit Conference. With the virtual platform, we will have the ability to provide information in different formats. As I have mentioned before, we will have segments that will be “on-demand” and others that will be scheduled just like our live event. Our goal is to make sure the content is valuable, interesting and entertaining so it keeps your attention when we do not have you in a captive location without day-to-day work distractions.

We will have a powerful program featuring a strong lineup of keynote speakers, roundtables, one-on-one discussions and more.

We are adding more content, but here is a taste of some of the presenters at this year’s event: Alan Beaulieu of ITR Economics; David Burritt, President and CEO, U.S. Steel; Leon Topalian, President & CEO, Nucor; Lourenco Goncalves, Chairman, President & CEO, Cleveland Cliffs/AK Steel; Phil Bell, President, ![]() Steel Manufacturers Association; Tom Valvo, President – Global Residential, MiTek; Steve Sukup, President & CEO, Sukup Manufacturing; Frank Ruane, Executive Vice President, Olympic Steel; Paul Lowrey, Managing Director, Steel Research Associates; Timna Tanners, Metals & Mining Analyst, Bank of America; Ken Simonson, Chief Economist, Associated General Contractors; Rick Preckel, Partner, Preston Pipe and Tube; Steven Brown, Senior Director Corporate Ratings, Fitch Ratings; Todd Leebow, President & CEO, Majestic Steel; Jim Vincent, Senior Director Sales, Big Ass Fans; John Anton, Associate Director Steel Analytics, Pricing & Purchasing, IHS Markit; Ryan Avery, THE Keynote Speaker, Avery Today, Inc.; Chris Houlden, Finished Steel Business Unit Head & Head of Prices Development, CRU; Ryan Smith, Steel Analyst, CRU; Ryan McKinley, Senior Analyst, CRU; Josh Spoores, Principal Analyst, CRU; and there will also be a not yet named CRU economist and me.

Steel Manufacturers Association; Tom Valvo, President – Global Residential, MiTek; Steve Sukup, President & CEO, Sukup Manufacturing; Frank Ruane, Executive Vice President, Olympic Steel; Paul Lowrey, Managing Director, Steel Research Associates; Timna Tanners, Metals & Mining Analyst, Bank of America; Ken Simonson, Chief Economist, Associated General Contractors; Rick Preckel, Partner, Preston Pipe and Tube; Steven Brown, Senior Director Corporate Ratings, Fitch Ratings; Todd Leebow, President & CEO, Majestic Steel; Jim Vincent, Senior Director Sales, Big Ass Fans; John Anton, Associate Director Steel Analytics, Pricing & Purchasing, IHS Markit; Ryan Avery, THE Keynote Speaker, Avery Today, Inc.; Chris Houlden, Finished Steel Business Unit Head & Head of Prices Development, CRU; Ryan Smith, Steel Analyst, CRU; Ryan McKinley, Senior Analyst, CRU; Josh Spoores, Principal Analyst, CRU; and there will also be a not yet named CRU economist and me.

I am working on adding a few more speakers for this year’s event. One to handle discussions about the COVID-19 pandemic, one to discuss the upcoming election and perhaps a few more surprises.

You can find information about each of our speakers by clicking here.

You can register for the conference by clicking here.

I am already getting questions about head coverings for the 2020 event. What do you think? Should I bring back the hat(s)? You can respond to John@SteelMarketUpdate.com

Mike Kruse recently celebrated his 50th anniversary with Heidtman Steel. I don’t think there are too many people who make it 50 years with one company anymore. I spoke with him last week and I understand he will be retiring at the end of the month (although there may be some “float” in that date). Mike has been a strong supporter of Steel Market Update. His presence will be missed once we go back to live events. I wish him well in retirement. Mike, let me know if you need something to read…?

Would you like to become a new subscriber to Steel Market Update? Would you like to renew your existing membership or perhaps expand the number of employees who receive our newsletters? Would you like to upgrade to Premium? You can do all these things by reaching out to Paige Mayhair at Paige@SteelMarketUpdate.com or by phone at 724-720-1012.

NOTE: SMU is NOT publishing on Thursday, July 2, and Sunday, July 5 (we are giving our hard-working employees some time off to celebrate the Fourth of July holiday). Please be safe over the weekend and we will pick it up in earnest when we return to publishing next Tuesday.

As always, your business is truly appreciated by all of us at Steel Market Update.

John Packard, President & CEO