Market Data

June 28, 2020

SMU Steel Buyers Sentiment: Less Bullish on the Future?

Written by Tim Triplett

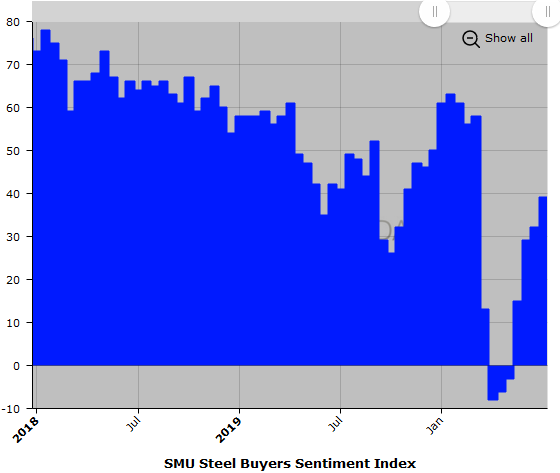

While industry sentiment improved at a double-digit rate in May, as measured by Steel Market Update’s Sentiment Indexes, June has seen more moderate changes in optimism. Current Sentiment increased by a further 7 points in the past two weeks, but Future Sentiment actually declined by 3 points. This leveling of sentiment most likely reflects ongoing concerns about the coronavirus’ effect on steel demand and the reported possibility of a resurgence in COVID-19 infections in the next few months.

Since April 2 when Current Sentiment hit -8, the lowest reading since November 2010, the index has improved by 47 points. The current reading of +39 is still below the average of +48 in the 12 months prior to the pandemic.

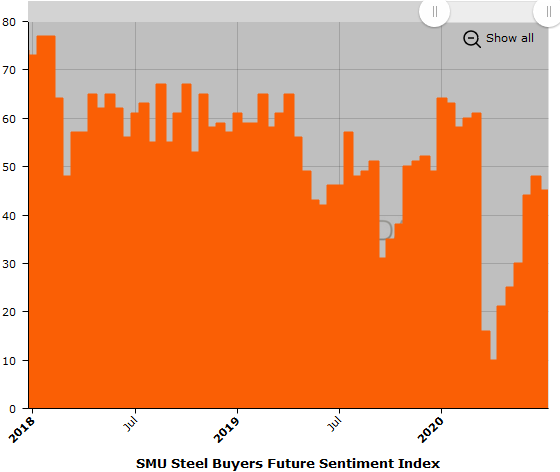

Future Sentiment

Steel Market Update asks steel buyers how they view their company’s chances for success three to six months in the future, as well as their current prospects for success. SMU’s Future Sentiment Index registered +45 this week, up 35 points since early April, but down 3 points over the past two weeks.

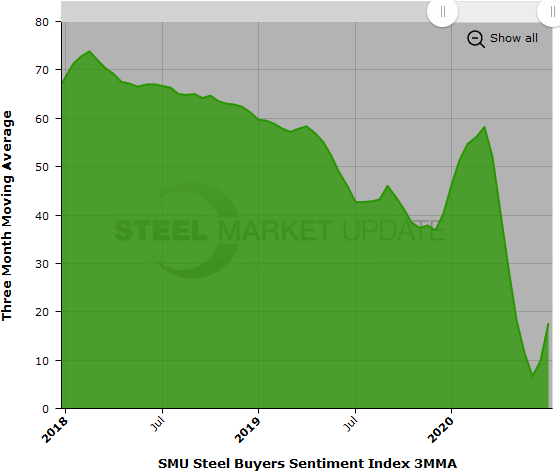

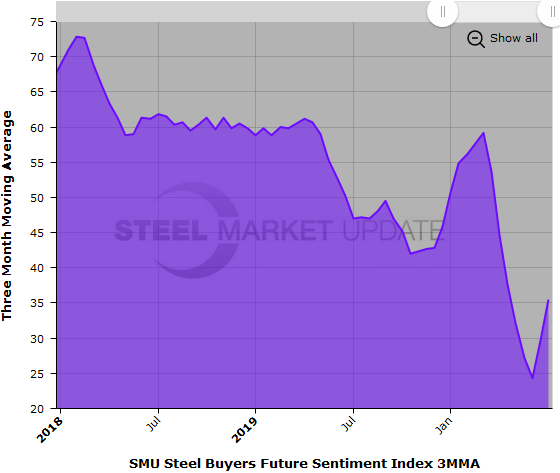

Three-Month Moving Averages

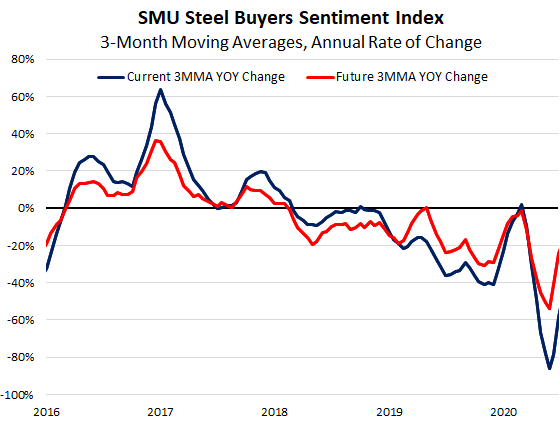

Results from SMU’s market trends questionnaire are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend. Both Current and Future Sentiment measured as 3MMAs continue to trend upward. The Current Sentiment 3MMA increased to +17.67 from +6.67 one month ago. The Future Sentiment 3MMA rose to +35.50 from +24.33 four weeks ago.

The chart below shows the recent uptrend in the annual rate of change in the three-month moving averages for both Current and Future Sentiment.

What Respondents Had to Say

“Things are moving in the wrong direction. April was bad, in May we rebounded, now June is back to April numbers.”

“We’re holding our own, anticipating the third and fourth quarters to be the litmus test for the pandemic.”

“We also need lumber to reach our full potential. If that area does not get a little better in the near future, it is reasonable to think we will feel that shortage move into our steel orders.”

“No real positive change these days. COVID-19 is all the news, and how our country handles opening up will determine business. But these decisions seem to be politicized and not focused on science.”

“Hopefully, there will be some pent-up demand in third and fourth quarter.”

“Business appears to be spotty.”

“As COVID-19 surges in many states in the U.S. and the world, I think we will see more lockdowns and this will soften business in 3-6 months.”

“It all depends on how the markets respond to COVID.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.