Market Data

June 25, 2020

Steel Mill Negotiations: Buyers Bargaining

Written by Tim Triplett

Steel demand is slowly improving as the economy moves on from the coronavirus shutdowns, but the environment remains very competitive, and buyers report that most mills are willing to negotiate on price to win orders of flat rolled steel.

Steel prices have moved up erratically since hot rolled bottomed at $460 per ton in late April. Flat rolled steel prices hit $515 per ton last week but declined this week as supplies continue to exceed orders even with the increasing demand. The benchmark price for hot rolled dipped below the $500 per ton mark for the first time since the third week of May to $490, according to Steel Market Update’s canvass of the market this week. The average price for cold rolled moved down to $665 a ton, while galvanized declined to $660 per ton.

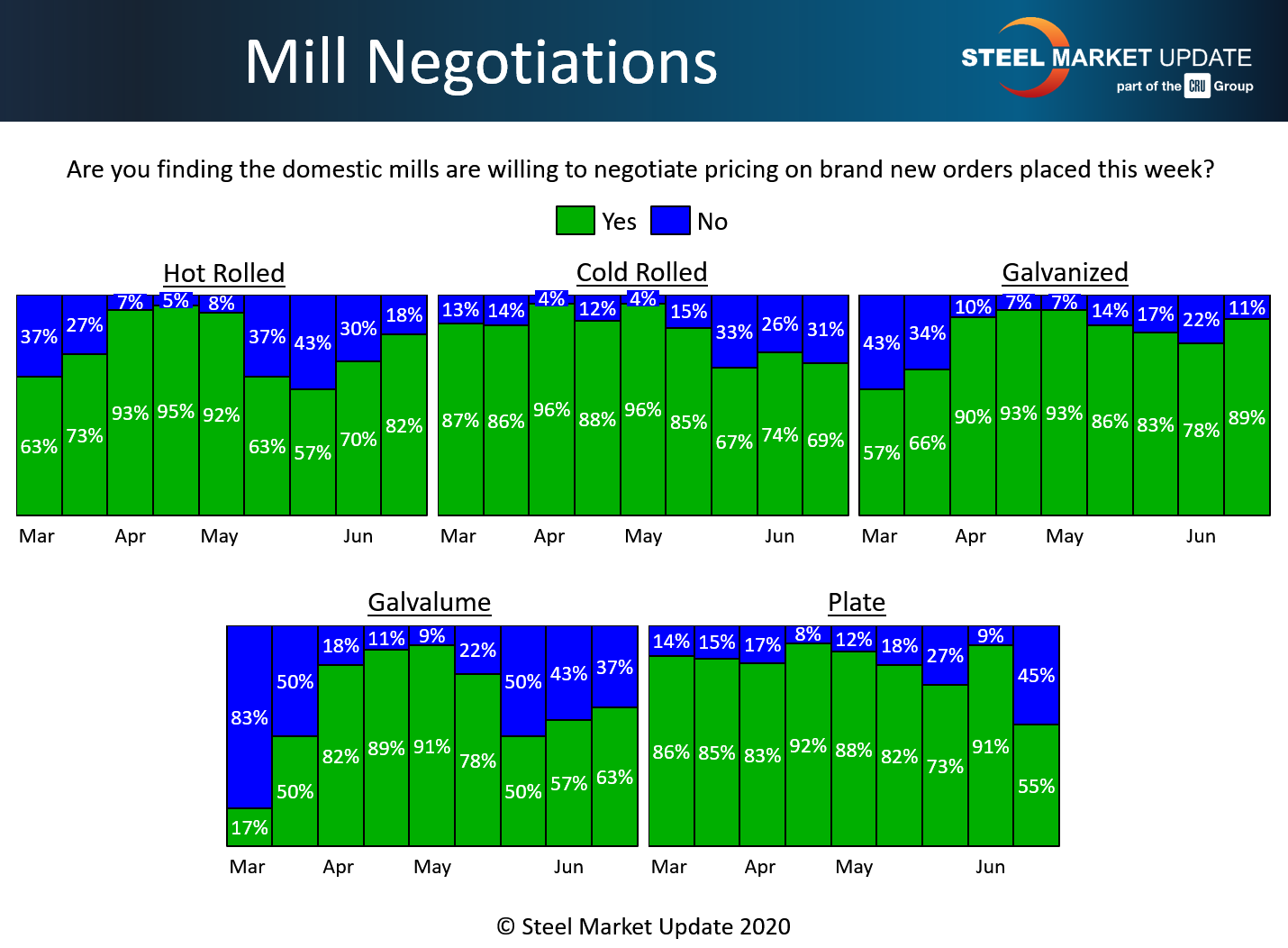

In the hot rolled segment, 82 percent of the steel buyers responding to SMU’s questionnaire this week said the mills are now open to negotiation, while just 18 percent said the mills are standing firm on prices. That’s a 12-point shift from two weeks ago and a 25-point increase from this time last month.

In the cold rolled segment, 69 percent reported the mills willing to talk price, down five points from 74 percent two weeks ago and about the same as last month.

In galvanized, 89 percent reported the mills open to price negotiation this week, up 11 points from 78 percent in SMU’s last canvass of the market. The majority, about 63 percent, have found the mills willing to compromise on Galvalume prices lately as well.

Negotiations have tightened in the plate market, where 55 percent said the mills are still willing to bargain to capture the sale, while 45 percent reported the mills saying no to discounts. That compares to 91 percent who said the mills were talking price two weeks ago.

SMU is keeping its Price Momentum Indicator at Neutral until the dynamic between buyers and sellers becomes clearer.

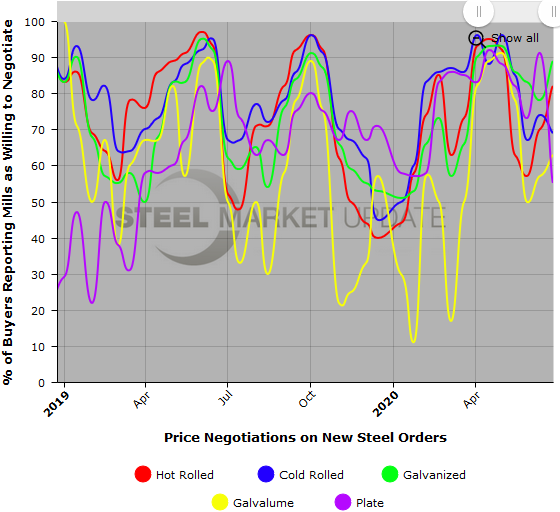

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (second example below), visit our website here.