Analysis

June 19, 2020

Final Thoughts

Written by John Packard

Happy Father’s Day to all the dads out there. I hope you got to enjoy some quality time with your kids earlier today.

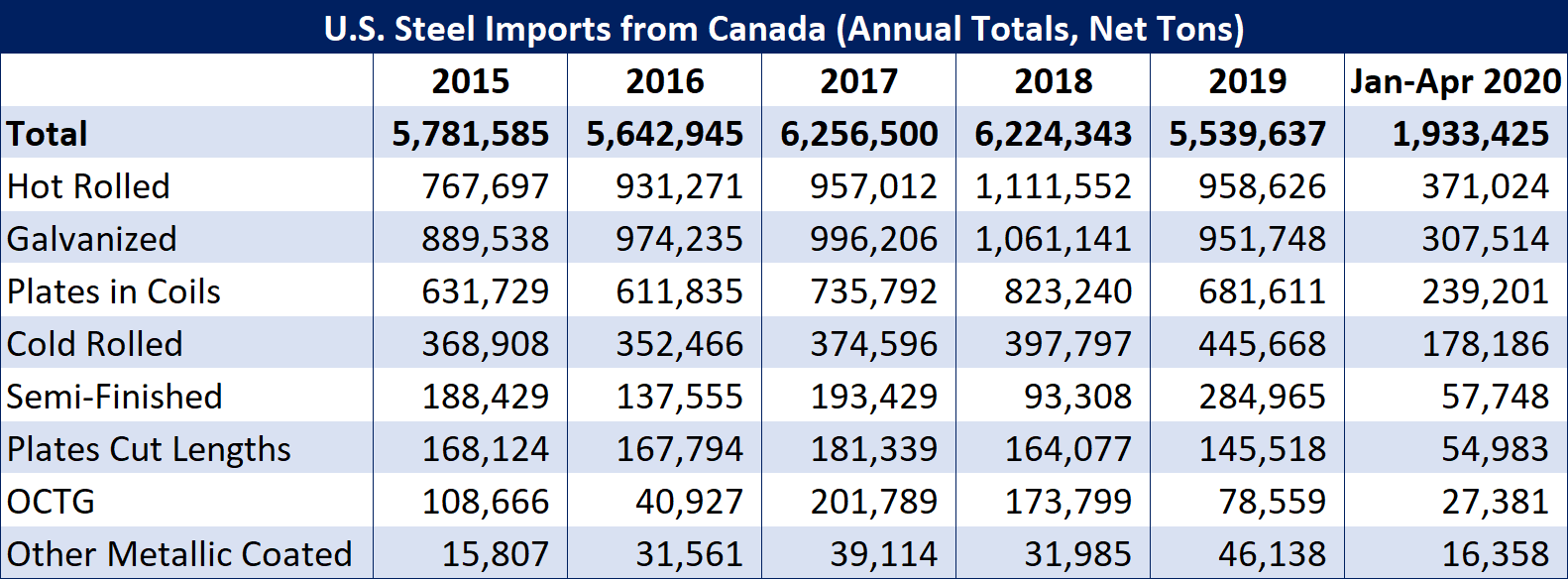

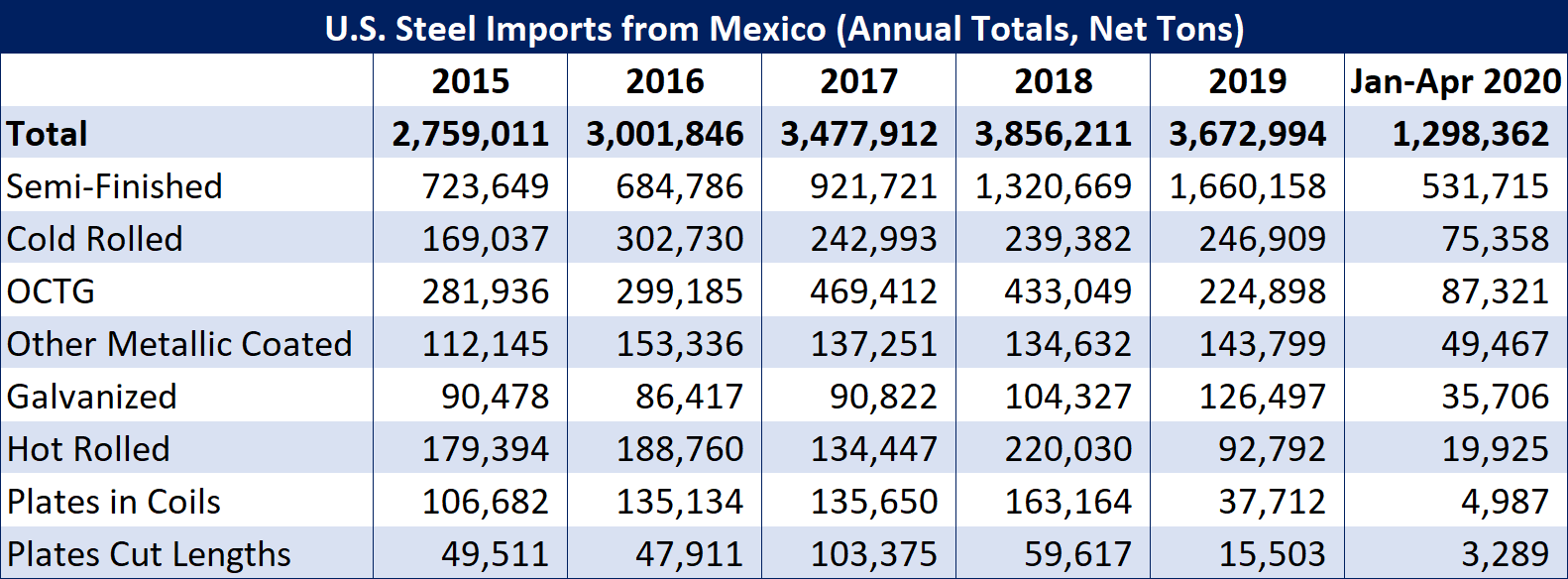

There has been a call on the Commerce Department to review exports of steel and aluminum from Canada and Mexico. There is a question if exports of these products have “surged” since the two countries were eliminated from Section 232 tariffs.

We did a quick review of the products we cover on a regular basis, and the only product that comes into question is semifinished (slabs), which cannot (or are not) being supported by the domestic steel mills. Please review the following two tables (one Canada and one Mexico) and you can come to your own conclusions:

A reminder, SMU will not host our Wednesday SMU Community Chat webinar this week. Instead, we are deferring to the free CRU Steel Briefing webinar that is scheduled for 10 AM on Tuesday. This webinar will focus on the CRU steel outlook with Chris Houlden (Head of Steel for CRU), Josh Spoores (Principal Analyst), Ryan McKinley (senior analyst) and Anissa Chabib (economist). I think you will find it quite interesting. You can register for the CRU webinar by clicking here.

On Wednesday, July 1, our Community Chat speaker will be Eddie Lehner, President & CEO of Ryerson. We will have registration available later this week.

I am not going to spend time this evening providing information about the 2020 SMU Virtual Steel Summit Conference; you can find more details, including the companies that are currently registered, by clicking here.

On Wednesday, July 8, we will take a portion of the time allocated to our SMU Community Chat webinar to give some insights into our conference.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, President & CEO