Market Data

June 11, 2020

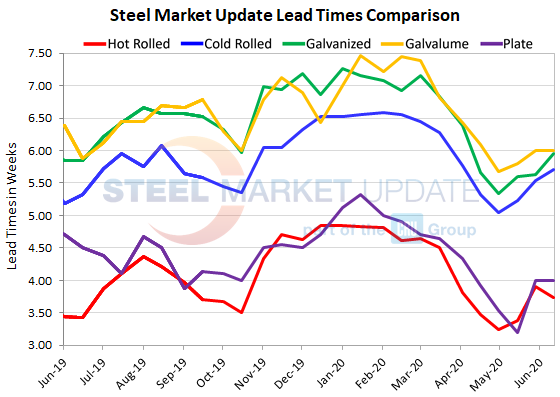

Steel Mill Lead Times: Continue to Extend as Mills Get Busier

Written by Tim Triplett

Lead times for spot orders of flat rolled and plate steels have extended in the past four weeks as demand has picked up and mill production has come down. In response to the COVID-19 shutdowns of nonessential businesses in March, steel producers idled furnaces to sync their output with demand. Lengthening lead times this week suggest the mills are busier than they were a month ago and that demand may be improving as government restrictions ease and more companies get back to work.

Hot rolled lead times now average 3.73 weeks, up from 3.38 in mid-May. Cold rolled orders currently have a lead time of 5.71 weeks, up from 5.23 a month ago. The current lead time for galvanized steel is 5.95 weeks, up from 5.60, while Galvalume is at 6.00 weeks, up from 5.80 in SMU’s check of the market four weeks ago.

Plate lead times have also extended over the past month to 4.00 weeks from 3.20.

A few mills have begun to bring idled capacity back online already in anticipation of rising demand. Steel Market Update will be watching lead times closely for signs that production additions are outpacing new orders.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.