Market Data

May 31, 2020

SMU Steel Buyers Sentiment Index: Trending in the Right Direction

Written by Tim Triplett

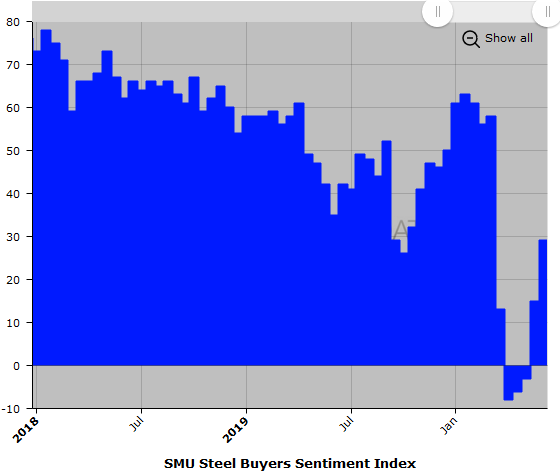

Steel buyers’ attitudes appear to be mirroring the economy—improving in painfully slow increments as coronavirus restrictions ease and more companies get back to work. Both Current and Future Sentiment as measured by Steel Market Update saw a 14-point improvement in the past two weeks and are up more than 30 points from the lows recorded in the first week of April.

Steel Market Update asked steel buyers how they view their company’s current prospects for success, as well as their chances for success three to six months in the future. The Current Sentiment reading in late May was +29, a 37-point rebound over the past two months.

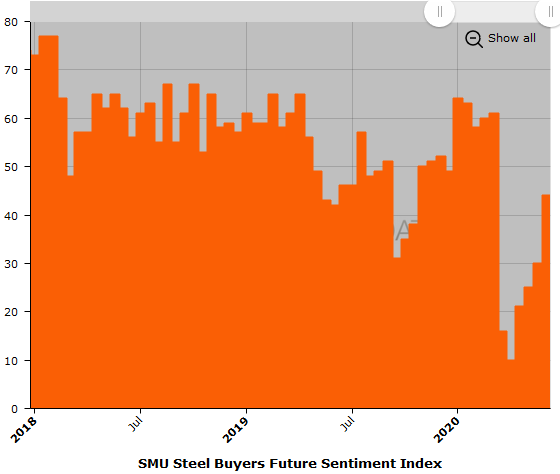

Future Sentiment

SMU’s Future Sentiment Index registered +44 in the latest canvass of the market, up 34 points since early April. While still below the more typical readings in the +50s, sentiment is definitely trending in a positive direction, which bodes well for the second half of the year, barring a second wave of COVID-19 infections.

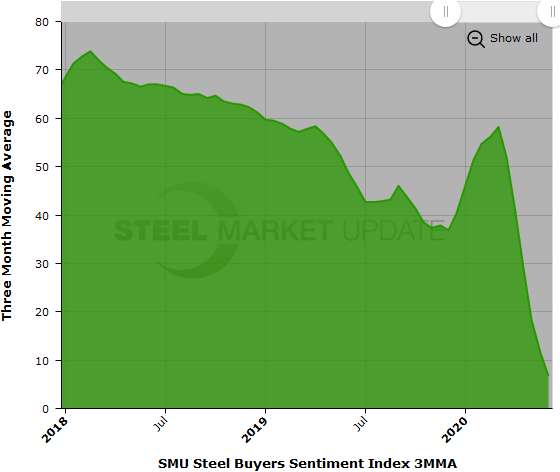

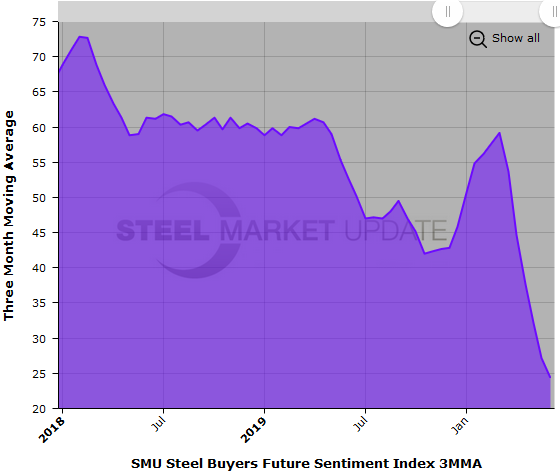

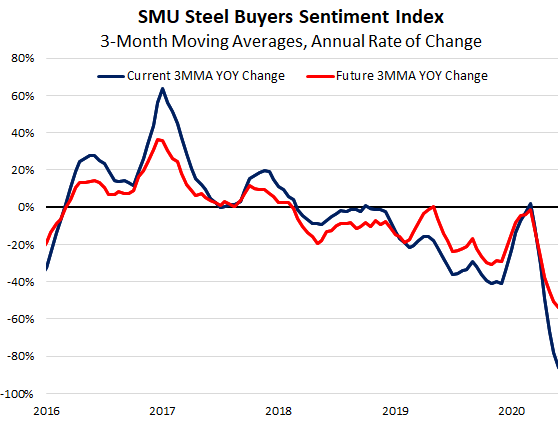

Three-Month Moving Averages

Results from SMU’s market trends questionnaire are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend. Both Current and Future Sentiment measured as 3MMAs are still trending downward. The Current Sentiment 3MMA declined to +6.67, down from +11.50 in mid-May. The Future Sentiment 3MMA dipped to +24.33 from +27.17 during the same period.

What Respondents Had to Say

“Demand is slowly improving.”

“Definitely better than April. Price increases helped stabilize the downside. Let’s hope the mills don’t overreact and fire up their furnaces and flood the market. Everyone needs to stay disciplined and move slowly.”

“Depends on how fast the market rebounds. This may not recover till Q1 2021.”

“Our Northeast state has opened all construction. Most projects will now be restarted for completion unless the business it is being built for does not anticipate surviving the pandemic.”

“Business is improving, but many contract customers have far too much inventory.”

“As the economy opens up, business will improve. The economy wasn’t the problem (never was). The coronavirus shut it down. As we control the virus, the economy will bounce back. The steel business will find an equilibrium.”

“Although current commercial construction projects are now restarting, future project starts are in question. Financial challenges in the public sector will definitely create downward pressure on starting new capital projects. I am not sure the consumer is ready to have construction/renovation done in their homes by contractors yet.”

“Demand is questionable in the future. Construction is potentially going to be weak next year if the ABI is an accurate predictor.”

“The biggest challenge will be demand and whether the economy will truly rebound as forecasted by many.”

“We’re still not sure the overall impact COVID-19 will have on demand for the second half of the year.”

“If business conditions improve in Q3 as predicted, we just need to fight through Q2 and put this ugliness behind us.”

“We will feel a lot better if construction projects start up again and the commercial and residential markets stay strong. If they don’t, we will remain pessimistic.”

“We anticipate very slow improvement over the next six months and do NOT anticipate a V-type scenario.”

“There’s too much uncertainty still and the future is cloudy.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.