Market Data

May 29, 2020

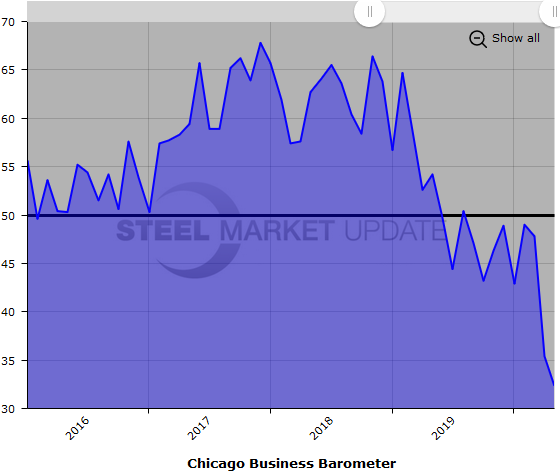

Chicago Business Barometer Sinks Further in May

Written by Sandy Williams

The Chicago Business Barometer dropped to 32.3 in May, indicating further pressure on the manufacturing sector due to the COVID-19 crisis. The barometer was at its lowest level since March 1982.

After seeing a dramatic drop in demand during April, new orders fell 2.3 points in May. Production fell 6.3 percent putting the index at a 40-year low due to temporary pandemic shutdowns, said MNI Indicators.

Order backlogs fell 28.0 percent in May to the lowest index level since March 2009 and posted the ninth straight month in contraction.

Inventories were noted as too high in May, while the supplier deliveries index eased downward 4.8 percent following a 46-year high in April.

Employment levels rebounded somewhat from April’s decline, but anecdotal comments pointed to layoffs and/or salary reductions for some firms, while others looked for new hires.

Looking forward, most survey respondents expect COVID-19 to impact business plans for the rest of the year or longer. The breakdown was as follows:

- 10.4 percent – less than 3 months

- 20.8 percent – 3-6 months

- 27.1 percent – 6-9 months

- 22.9 percent – 9-12 months

- 18.8 percent – more than a year

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.