Market Data

May 19, 2020

SMU Market Trends: Early Signs of Improving Demand

Written by Tim Triplett

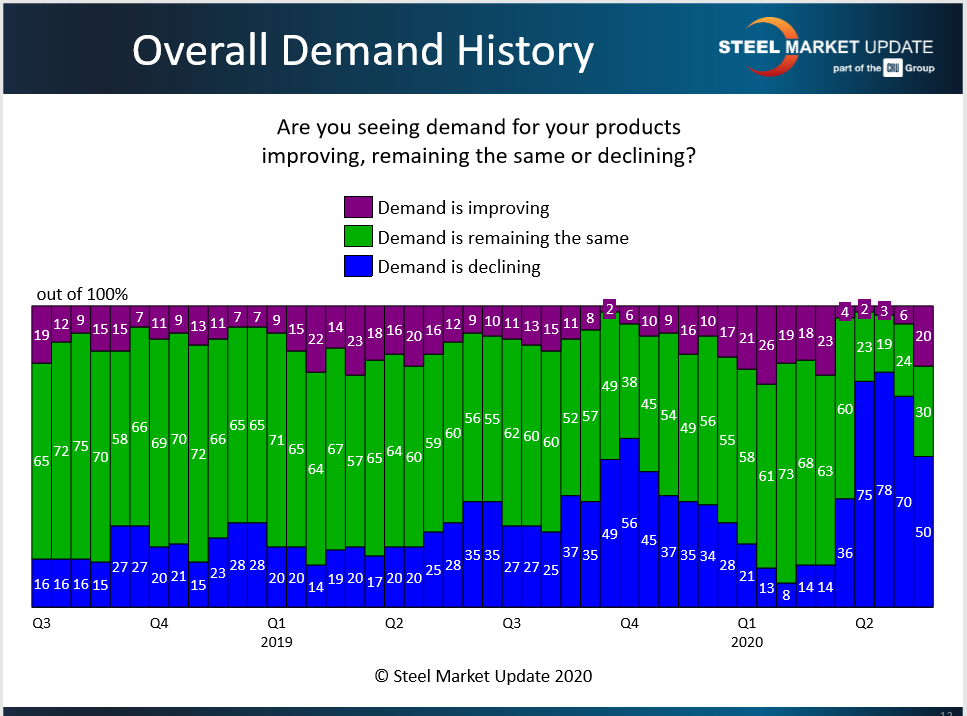

Steel demand is showing early signs of strengthening, said manufacturing and service center executives during Steel Market Update’s canvass of the market May 11-14, as officials in various states begin to ease coronavirus restrictions allowing businesses to slowly reopen.

Half said demand for their products is stable or even improving, while the other half said demand is still declining. That’s a notable improvement from one month ago when 78 percent of those responding to SMU’s questionnaire reported declining demand for steel.

Here’s what some respondents had to say:

“We’re seeing seasonal construction demand improvement and relaxed COVID-19 guidelines on industry.”

“Not a big improvement, but better. Maybe it snowballs and keeps momentum going.”

“Declining from March. Staying the same from April.”

“Demand is down a bit, but much of that is due to pure caution on the buyers’ side.”

“Remaining the same (at low levels).”

“In line with a declining economy.”

“We see a slight improvement in orders over the prior week in anticipation of manufacturing being allowed to reopen in Michigan.”

“Only because we are starting to see some auto stampers and such come back to work.”

“Overall demand is down 30 percent from Q1 levels.”

“We are starting to see companies come back online, though producing at much lower volumes. They are having problems getting workers to come back, as they can make more money sitting at home with unemployment and the federal $600 kicker per week. They are enjoying the free handout at the expense of the taxpayers. Those who refuse to come back to work should be hog tied and dragged through the cow pasture.”

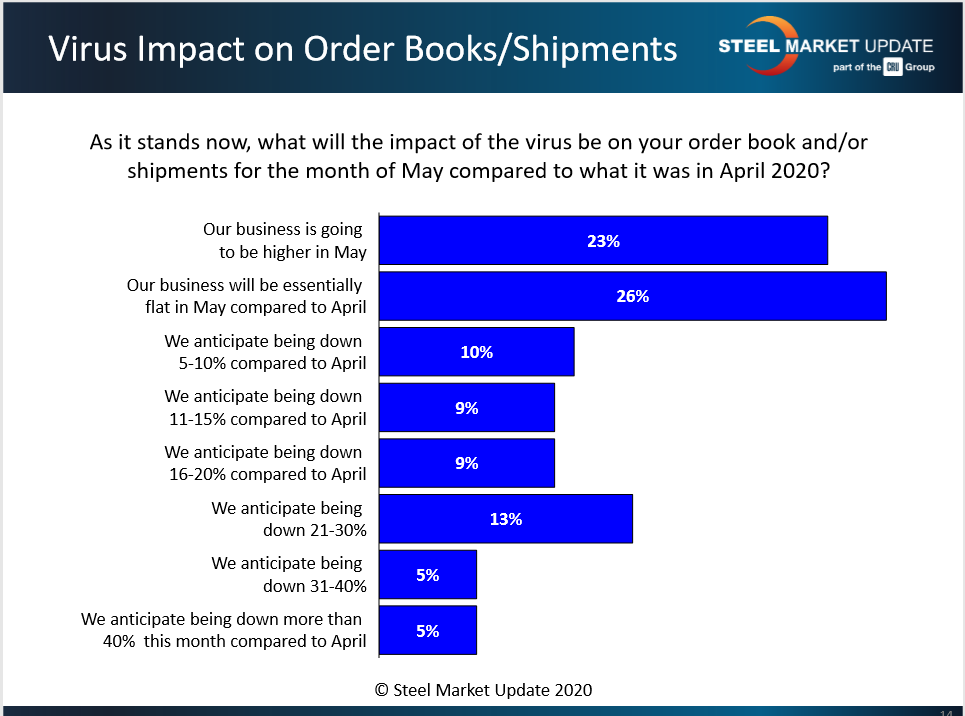

Impact on the Order Book

SMU asked: What will the impact of the virus be on your order book and shipments for the month of May compared with April? Approximately half of respondents said business will be flat or higher in May versus April. The other half predicted business would be down by a weighted average of around 20 percent. Said one executive: “In April we were down 50 percent year over year. We pray we do better than that in May.”

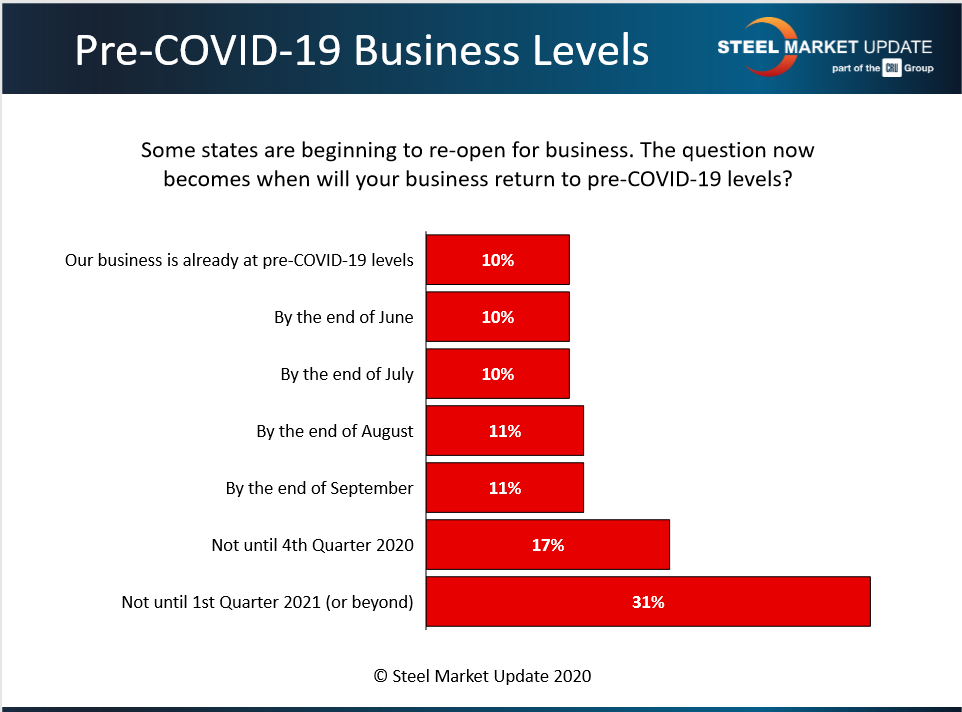

When Will Business Return to Normal?

SMU asked: When will your business return to pre-COVID-19 levels? Nearly half of the respondents to last week’s poll predicted business would not recover until Q4 2020 or Q1 2021. The other half were evenly split over the next four months, predicting a gradual return of business by the end of September as states continue to ease restrictions on commerce.

Here’s what some respondents had to say:

“We are deemed essential; thus, we have not stopped manufacturing.”

“It’s hard to predict. We’re down about 5 percent now, but how many customers pulled their jobs ahead?”

“To me the glass is always half-full. Our government shattered most of our glassware, so now we only have a shot glass. Unfortunately, it is only half-full, but maybe we will have new glassware by September?”

“Q1 2021 may be early in Canada. Individuals will not have enough discretionary money, or the desire to part with it, for significant dollar purchases of autos or housing for some time.”

“I think it’s folly to believe things will be anywhere near normal anytime soon.”

“It will take time to rebuild our economy.”

“No idea.”