Market Data

May 17, 2020

SMU Steel Buyers Sentiment Index: Attitudes Improving

Written by Tim Triplett

Steel buyers’ attitudes have improved this month as coronavirus restrictions have eased in some areas and companies have begun to get back to business.

Steel Market Update asked steel buyers how they view their company’s current prospects for success, as well as their chances for success three to six months in the future. The Current Sentiment reading in mid-May was +15, a 21-point improvement from -6 one month ago and back into positive territory.

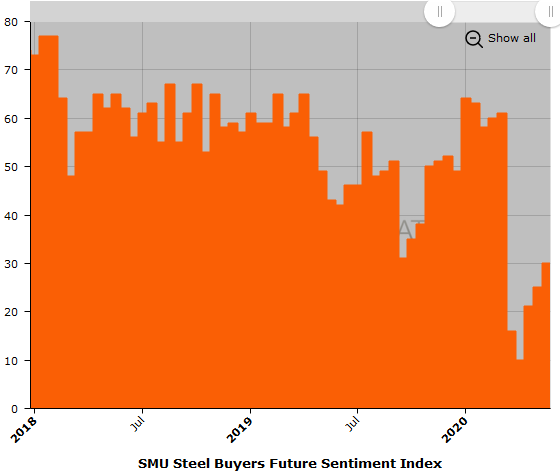

Future Sentiment

SMU’s Future Sentiment Index registered +30 in the latest canvass of the market, up nine points over the last four weeks. Still far below the more typical reading in the +50-60s, sentiment is trending in a positive direction as the government’s steps to stem the spread of COVID-19 appear to be bending the curve.

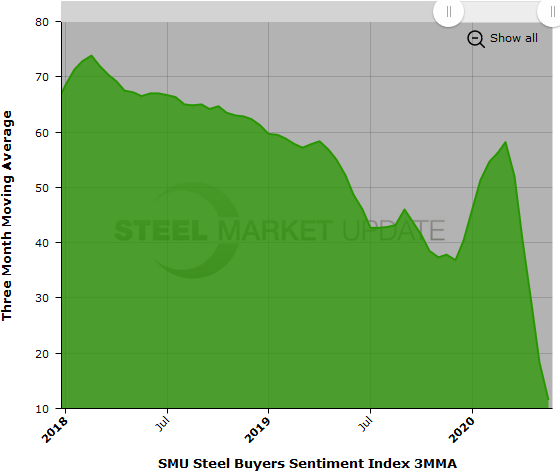

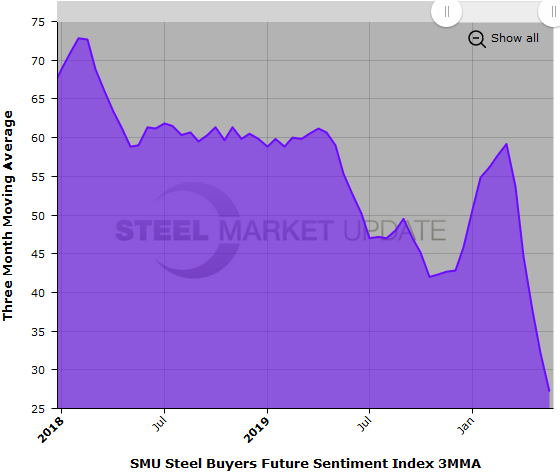

Three-Month Moving Averages

Results from SMU’s market trends questionnaire are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend. Both Current and Future Sentiment measured as 3MMAs are still trending downward. The Current Sentiment 3MMA declined to +11.50, down from +29.00 in mid-April. The Future Sentiment 3MMA dipped to +27.17 from +37.67 during the same period.

What Respondents Had to Say

“Our major customers are scheduling closures in the next month for a week at a time, not because of COVID, but because of lack of orders.”

“We prepared for the conditions we are currently facing. Our inventory is in a good place and many segments of our business have remained relatively busy.”

“We are somewhat optimistic that demand will begin a slow recovery starting in June.”

“We are still busy currently. We suspect it’s orders that are being pulled up that were due later and we may see a slight downturn later in the year.”

“With no plans announced in our state as to when we start up our mostly closed economy, the current outlook is poor.”

“Still some concern how things will look six weeks from now, but so far it has been very good.”

“Now more than ever before, uncertainty.”

“With the uncertainty, people are getting jobs done now that were already in process. New jobs may not begin and be delayed.”

“Two things need to happen : 1) economic restrictions lifted and 2) people need to overcome their fear of participating in the new economy.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.