Market Segment

May 17, 2020

CRU: U.S. Unemployment in the Time of Coronavirus

Written by Anissa Chabib

By CRU Economist Anissa Chabib, from CRU’s Economic Outlook

On May 8, the U.S. Bureau of Labor Statistics released the official U.S. unemployment data for April. Unemployment increased to 14.7 percent from 4.4 percent in March. This is the highest rate and the largest month-on-month increase in the history of the series, which was created in 1948. This special feature shows that unemployment is likely to increase further in Q2 of 2020, before recovering back to 5-6 percent by the end of 2022. This is predicated on existing government policies being insufficient to ensure a faster return to full employment.

Historical Figures for the U.S. Labor Market

Layoffs across the board; no industry is spared: There is currently an unemployment crisis globally, and particularly in the United States, where many companies cannot sustain their operations and are laying off huge numbers of employees. In April, 23.1 million people were unemployed, almost 16 million more than in March. The unemployment rate reached 14.7 percent, the highest rate since the series started in 1948. In just one month, 20.5 million jobs have been lost; in contrast, it took two years to lose 2 million jobs during the Global Financial crisis. These unprecedented figures can be compared only with unemployment during the Great Depression.

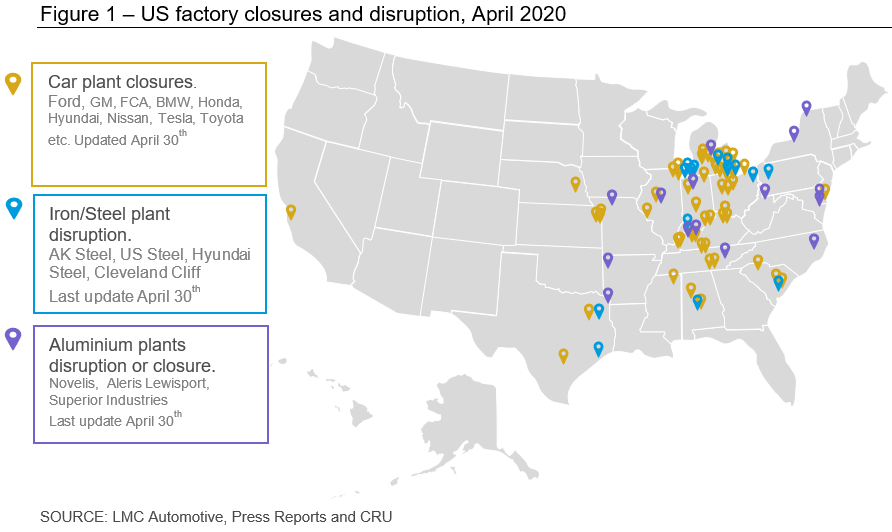

Many sectors are suffering, including the metal-intensive sectors. To give only a few examples, Ford, GM and Fiat-Chrysler closed plants in March affecting hundreds of thousands of employees. Construction sites were also affected; for instance, U.S. Steel announced in April a delay to the $1 billion project at the Mon Valley Works, putting at risk the 3,000 employees of the complex. Overall, motor vehicle and parts manufacturing employs more than 1 million people in the United States. However, some automakers (including Fiat-Chrysler, Ford, GM and Toyota) are planning to re-open most of their plants in mid-May.

Current U.S. Unemployment and the Estimated Q2 Unemployment Rate

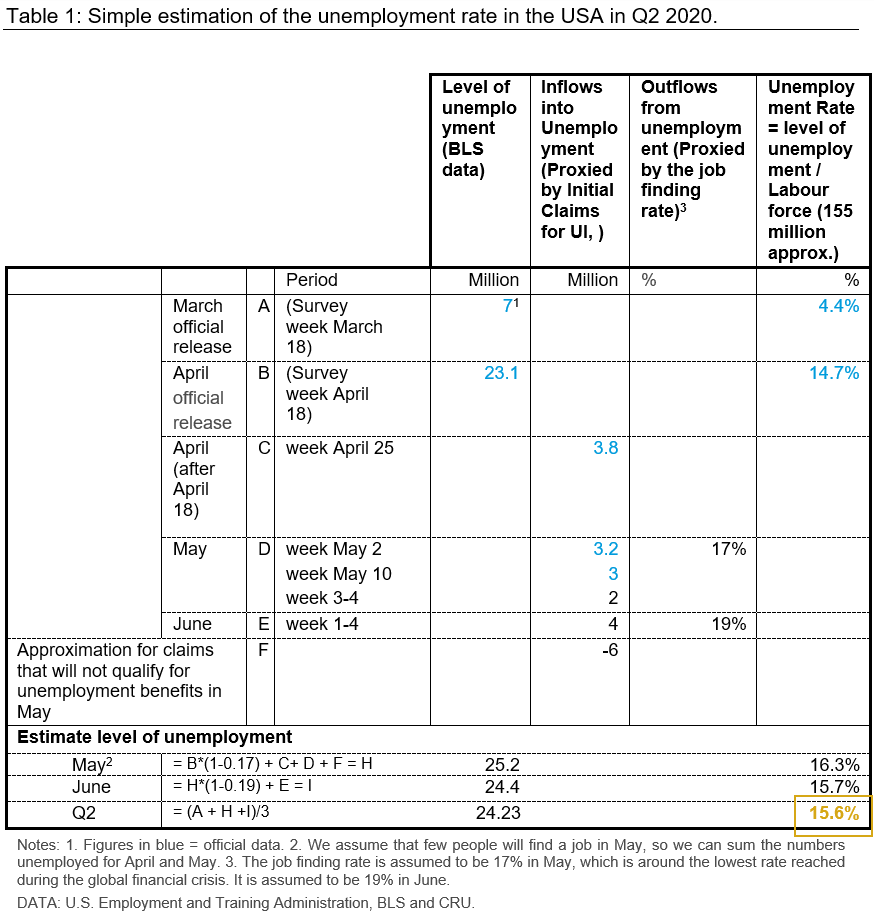

Using a methodology published by the Federal Reserve Bank of St. Louis, we have computed an updated U.S. unemployment rate for Q2 2020 (see Table 1). We used the latest data released by the Bureau of Labor Statistics and our own estimation of the total level of unemployment for the period April-June. The level of unemployment for a specific month can be defined as “total level of unemployment last month – total outflow + total inflow”. We use for our estimation:

- (i) The number of initial claims for unemployment benefits (UI) as a proxy for the total inflow of unemployed persons. During the past eight weeks, the U.S. Labor Department reported that more than 36 million Americans filed unemployment benefit claims, a record figure. However, the number of unemployment benefit claims is only a proxy for the number of unemployed persons because not everyone making a claim will be considered to be unemployed.

- (ii) The job finding rates during the GFC as a proxy for the outflow rate from unemployment.

This estimation gives us an unemployment rate of 16 percent in Q2 2020.

U.S. Unemployment Recovery, What Can We Expect?

We estimate above that the U.S. unemployment rate will reach almost 16 percent in Q2. Will this historically huge rate be structural or cyclical? When will unemployment go back to the desirable level of 5-6 percent? Figure 2 compares four potential outcomes for U.S. unemployment in 2020. These outcomes depend on two key elements:

- How the virus will spread and for how many months (vertical axis)

- The incentives created to limit unemployment. How the authorities will stimulate the economy and labor demand to maintain as far as possible the connection between employees and businesses (horizontal axis).

The four outcomes are outlined in each quadrant of the graph, and the table below details the type of recovery implied by each outcome.

Almost 80 percent of the 23.1 million unemployed in April declared themselves as being on temporary layoff. However, the longer the crisis lasts, the lower this ratio will be (and the larger will be the associated “scarring” effects). Many may permanently lose their jobs. As a result, and assuming that the sectors with the highest unemployment will slowly re-start, we predict that outcome No. 2 is the most likely. We therefore forecast a U recovery and a return to an unemployment rate of 5-6 percent by 2022.

What are the Simple Keys for a Good Policy Response?

If government and other authorities are to create good incentives for the overall labor market, they need to put in place some key fiscal and monetary policies. The main objective of these policies is to maintain the connection between the employee and the company.

Using a key policy framework suggested by the ILO, we describe here the main responses required to address the crisis, and the actions announced by the relevant U.S. authorities:

- Fiscal policy recommended responses: Fiscal stimulus should aim to stabilize the economy and therefore the labor market. Measures should support businesses and jobs and protect current workers. The government should provide protection to the most vulnerable workers and businesses through cash transfers, unemployment benefits, investment in health care systems and better access to credit for companies. The government should also extend social protection schemes to workers who are normally excluded from existing benefit schemes, such as migrants and the self-employed. The fiscal stimulus should ease the tax compliance burden and provide other financial support to SMEs to assure business continuity after the lockdown. These financial reliefs mainly aim to cover labor costs in order to maintain employment retention.

What the US government has announced: The U.S. government has introduced a massive stimulus equivalent to 11 percent of total GDP. This $2.3 trillion fiscal package includes an expansion of unemployment benefits. As a result, it offers $600 per week in state unemployment insurance benefits to all workers (for up to four months). Tax rebates have also been provided and deadlines have been pushed back. Loans will be provided to companies that furlough their employees, which should help to retain workers. Efforts to prevent bankruptcies are also included. An additional $484 billion act has been announced, including additional loans and assistance to small businesses.

- Monetary policy recommended responses: These should lower interest rates, inject liquidity, enhance lending and support the overall financial system.

What the Fed has announced: The Fed has taken major steps to support the U.S. economy. In March, the Fed cut interest rates by 150bp to 0-0.25bp. As a result, it is cheaper to borrow, and mortgage rates fell. The Federal Reserve has also announced unlimited quantitative easing (QE), including the purchase of Treasury and other securities. Additionally, the bank has introduced programs to buy corporate bonds, which are not included in QE, and a series of measures to support the flow of credit. All these programs aim to ensure the transmission of monetary policy and low interest rates to individuals.

These recommended measures aim to create business continuity after the lockdown. The main aim is to maintain the connection between businesses and their employees. The U.S. government and the Fed have offered good programs and measures, but these will not overcome the loss of income likely during the crisis, and the duration of the pandemic may still lead to large scale bankruptcies, credit defaults, reductions in company-specific human capital, and therefore a definite loss of jobs. As a result, we believe that U.S. labor demand will not return to normal by the end of 2020. We expect the current high unemployment rate to decrease only slowly, returning to 5-6 percent by 2022. For the commodity sector, higher unemployment means lower consumer spending on cars, manufactured goods and housing.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com