Market Data

May 14, 2020

Steel Mill Negotiations: Tighter, But Price Still in Play

Written by Tim Triplett

Negotiations between producers and buyers of flat rolled steel have tightened somewhat following the price increase announcements by the mills earlier this month. Steel Market Update’s canvass of the market this week shows that mills are slightly less likely to negotiate on price than they were in April when competitors were scrambling to win orders in a market newly disrupted by the coronavirus.

Mills are holding firm in some negotiations in pursuit of price increases announced in the week ending May 1 ranging from $50 to $60 per ton. Other mills announced minimum base prices of $500-520 per ton for hot rolled and $700-720 per ton for cold rolled and coated products. Steel Market Update puts the current price for hot rolled at $470 per ton and cold rolled and coated at $675 per ton as the price hikes have not yet reached levels suggested in the mill announcements.

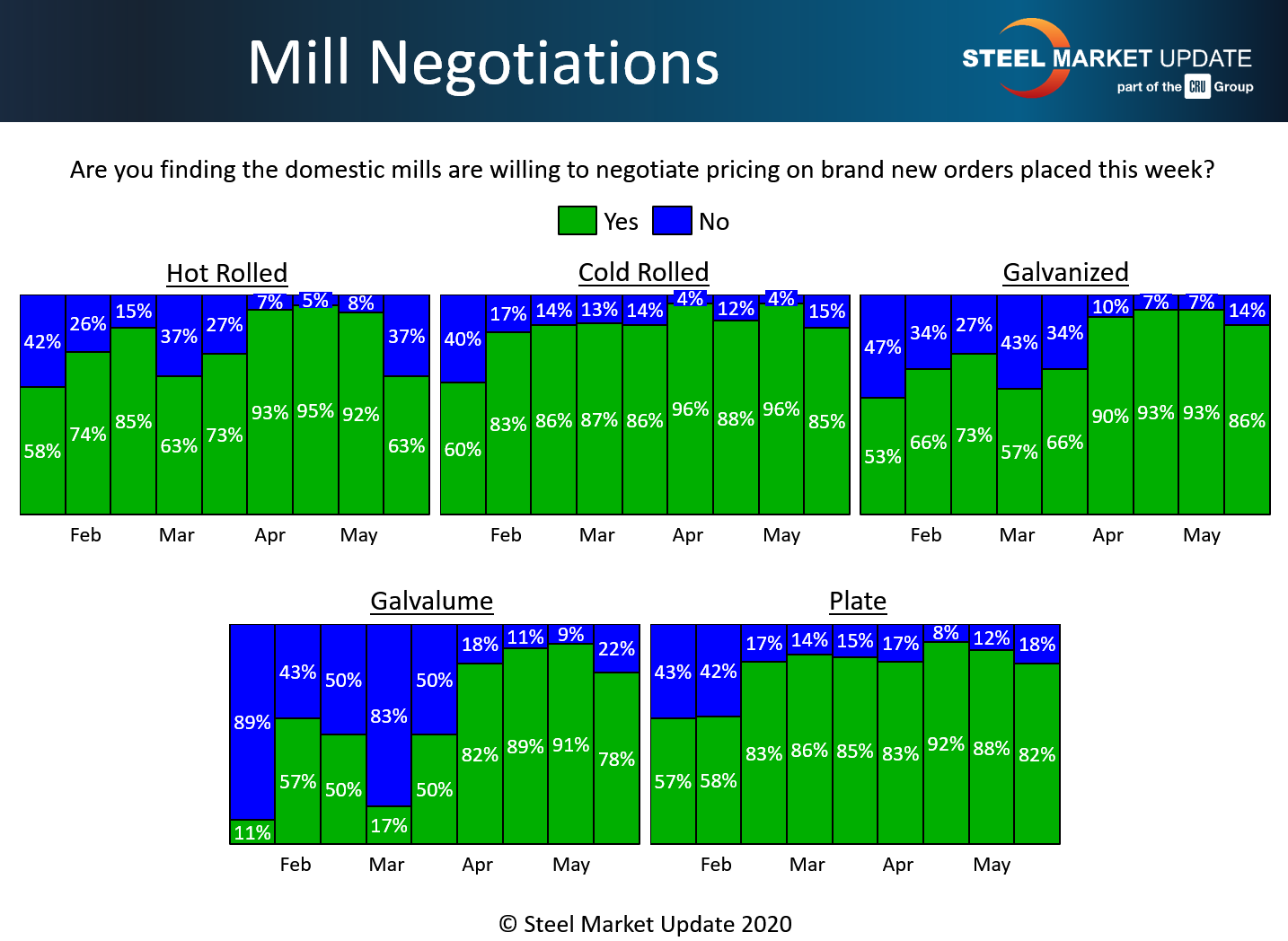

In the hot rolled segment, 63 percent of the steel buyers responding to SMU’s poll said the mills are now willing to negotiate prices on HR, down from 92 percent in the late April check of the market. In the cold rolled segment, 85 percent reported the mills willing to talk price, down from 96 percent two weeks ago. In galvanized, 86 percent reported the mills open to negotiation, down from 93 percent. Similarly, 78 percent said they have found mills willing to compromise on Galvalume prices, down from the 91 percent who said the mills were flexible last month. In the plate sector, the percentage declined to 82 percent from 88 percent.

Nevertheless, in every product category, fewer than one-quarter of buyers said the mills are holding the line on prices. SMU data suggests the mills are still very willing to make deals to secure orders in the face of the current weak demand, casting doubt on how much of their price increase they will be able to collect.

SMU’s Price Momentum Indicator continues to point to Neutral indicating a market in transition, but not referencing a specific price direction from here.

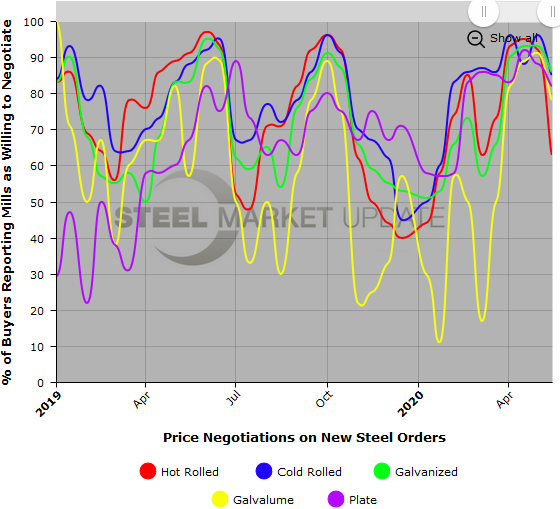

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (second example below), visit our website here.