Community Events

May 14, 2020

Kuehl: Recovery Could Begin This Summer

Written by Sandy Williams

We are in the middle of a black swan event—an event that is expected but unexpected, said Chris Kuehl, managing director of Armada Corporate Intelligence during Wednesday’s SMU Community Chat Webinar. “Viral threats are not new and have been frequent in the past few decades, but we don’t know from year to year how they will manifest, where they will break out and how they will impact us. We are trying to deal with something that we weren’t prepared for and that we probably should have been prepared for,” said Kuehl.

The restart of the economy is under way and we are left between a rock and a hard place, says Kuehl. “No matter what you do for either the economy or to deal with COVID 19, it’s going to make the other problem worse.”

Without a viable system of testing, tracking, treatment or vaccines, the U.S. is left with containment as a “sledgehammer” way to handle the COVID-19 virus. The problem is that containment collapsed the economy. Keeping Americans at home hurts the economy, but releasing them to resume business activity opens the door to new infections.

The U.S. economy is in its biggest contraction in 12 years, with GDP sinking 4.8 percent in the first quarter and the second quarter expected to be worse, said Kuehl. Second-quarter GDP is estimated to fall as much as 27.7 percent, according to data from MarketWatch. The good news is that prior to COVID-19, other than the oil industry and some weakness in auto, the economy was doing well, unlike the circumstances leading to the Great Recession in 2008-2009. Recovery from that recession took 6-7 years.

“This was a sudden, imposed recession, which means it could be a sudden imposed recovery, depending on how the government, business and consumers respond,” said Kuehl. The overwhelming opinion among economists is that we are looking at a fast recovery with a rebound in May and June.

The COVID-19 crisis caused widespread impacts across the economy, affecting supply chains, consumer spending, ability of governments to cope and putting us more seriously into debt than before. The impacts, including increased debt, were global-wide. “We don’t usually get a recession that hits the entire world,” said Kuehl, although noting that was the case in 2008.

2019 was not impressive for most of the world’s economies and 2020 will be a mess with declines coming close to record levels of 7-10 percent, said Kuehl. Most economists, however, think there will be a rebound in 2021. A classic V recession goes down in a hurry and comes back up quickly, so there is an expectation of pent-up demand and that consumers will react favorably to reopening.

Recession stimulus packages are based on the traditional assumption that if you put money in people’s hands, they will spend it. “That’s great unless there is no place for the consumer to spend the money,” said Kuehl. Normally Americans save at a 4-5 percent level, but are now saving at a rate of 24 percent. People are getting expanded unemployment checks, personal stimulus checks and other government support. Some are spending it immediately on necessities and the rest are saving it because the service sector is closed down. Once services reopen, it is likely spending will improve, Kuehl said.

The concern going forward is that it will take a lengthy period to recover from the damage done in the first and second quarters. It will take months before growth allows companies to get back to normal. The automotive industry recovery will depend on consumers’ interest in buying new vehicles.

The oil industry collapsed over the past three months and production is down due to low demand during the pandemic. Once demand and production return, oil prices could come up extremely fast with predictions of $100 to $110 per barrel by fall. The oil market tends to be volatile in the best of times, Kuehl noted.

COVID-19 is being blamed for every economic issue, but that is not necessarily true. For example, headlines indicate that COVID-19 has killed off J.C. Penney. “Are you kidding me. Penney has been on death row for four years now along with every other department store,” said Kuehl. “Unless COVID-19 is a new code name for Amazon, that is not what is killing off that particular sector of the retail community.” The crisis could be the final straw for some businesses, however.

The stock markets have returned to their normal volatile behavior. Some analysts suggest that the lower trading level is the correction that was expected after so many years of a bull market.

In regard to viral infection, the most likely scenario as a result of reopening the economy, said Kuehl, is a series of serious outbreaks in specific areas with vulnerable populations or large crowded urban areas. The next most likely is that waves of infections will occur in areas where people who were not exposed before become infected due to increased travel. Least likely is a massive second wave of infections that looks like the first one and spreads at the same rate.

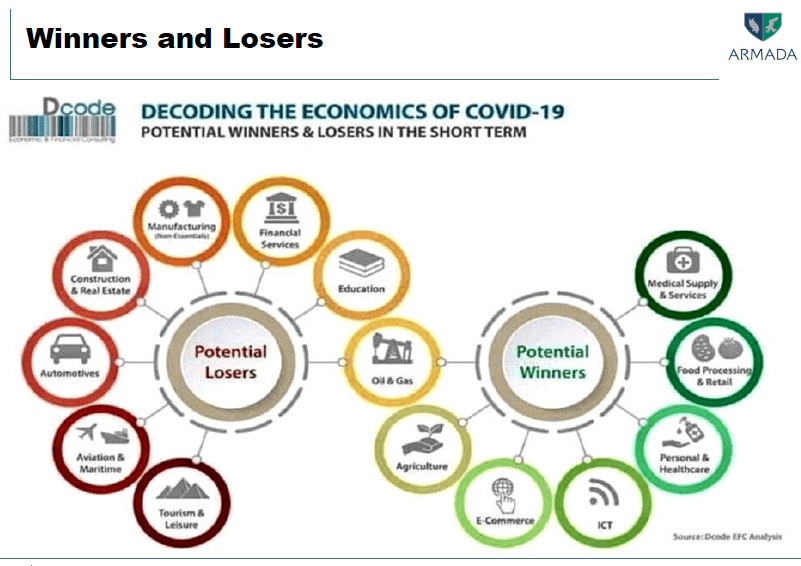

How will the steel industry fare during the recovery? It depends on the sector, said Kuehl. Oil and gas, agriculture, food processing, and warehouse and medical construction should recover fairly well. Recovery of automotive and general manufacturing will depend on consumer interest.

In nonresidential construction, there is are indicators that millennials are showing more interest in home ownership following stay-at-home measures. Also, working from home may continue, prompting city dwellers to move further from job locations.

Some reshoring is to be expected as reliability of oversea supply chains is questioned, but it will be more North American reshoring rather than specifically U.S. “Mexico may become the new China,” said Kuehl.

He advises businesses to “hunker down and see what the consumer does.” If the recession lifts as quickly as it came, business could be back to near normal by the end of summer.

Said one listener on the SMU webinar after hearing Kuehl, “Thanks for taking me off the ledge.”

Editor’s note: Next week’s webinar on Wednesday, May 20, at 11 a.m. Eastern Time will feature John Anton, Associate Director of Pricing and Purchasing at IHS Markit. This free webinar is open to SMU & CRU members, as well as anyone in the industry. Click here to register.