Prices

May 12, 2020

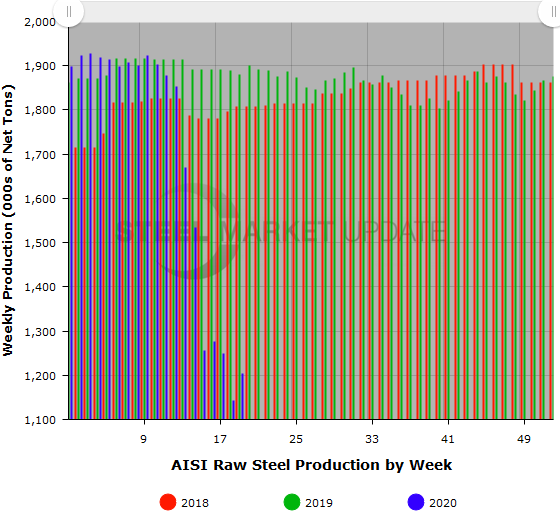

Steel Mill Utilization Inches Up to 53.7 Percent

Written by Tim Triplett

Has steel production turned a corner? After a series of sharp declines since the coronavirus shutdowns in mid-March, the mill utilization rate actually saw a small uptick last week.

In the week ending May 9, steel production totaled 1,204,000 net tons with the mills operating at an average capability utilization rate of 53.7 percent. Production was up 5.2 percent from the prior week when output totaled 1,144,000 tons at a utilization rate of 51.1 percent, reported the American Iron and Steel Institute.

Adjusted year-to-date production through May 9 totaled 30,859,000 net tons at an average utilization rate of 72.2 percent–down 12.4 percent from production in the same period last year when the average utilization rate was 81.4 percent.

Following is production by district for the May 9 week: North East: 94,000 net tons; Great Lakes, 398,000 net tons; Midwest, 122,000 net tons; South, 525,000 net tons; and West, 65,000 net tons, for a total of 1,204,000 tons. Production actually increased in three of the five regions by a total of 60,000 tons.

Such a small increase over a single week is hardly sufficient to declare a new trend, especially since AISI gets weekly data from only a portion of its membership. But with states beginning to lift restrictions and allow manufacturers to get back to work, as long as they take steps to protect workers and customers from exposure to COVID-19, steel demand can be expected to improve soon. A utilization rate in the low 50s is comparable to rates in the summer of 2009 when the market was coming out of the last Great Recession.

The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage from 50 percent of the domestic producers combined with monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI monthly production report provides a more detailed summary of steel production based on data supplied by companies representing 75 percent of U.S. production capacity.