Market Data

May 7, 2020

Tanners Predicts Slow Recovery for Economy, Steel Demand

Written by Tim Triplett

Bank of America is forecasting a slow recovery from the coronavirus crisis, one that will take years not just months, said Metals and Mining Analyst Timna Tanners, who was the featured guest speaker during Steel Market Update’s Community Chat on Wednesday.

Bank of America economists anticipate a global recession in the second and third quarters. Looking back at the last recession, it took four to five years for apparent steel consumption in the U.S. to regain pre-financial-crisis levels. “We don’t expect an easy recovery out of this downturn. The worst of the hit is going to be in the second quarter because energy and auto saw such a sharp drop-off,” Tanners told the 500 industry executives who logged into the webinar.

The two biggest markets for steel—construction and automotive—face serious headwinds from the government-ordered shutdowns to stem the spread of COVID-19. Even when auto production resumes, analysts predict an annual run rate of 11 million vehicles, down from 16-17 million for much of the past decade. “The appetite for a new car is diminished if you are out of work or watching the decline in the stock market, even though automakers are offering quite a few incentives,” Tanners said.

Construction demand is difficult to forecast, but private construction projects are being postponed and canceled. Revenues available to the states for highway construction could be off by 30 percent, according to some estimates. The FAST Act, the federal surface transportation spending bill, will likely have bipartisan support and be reinstated in September, but further infrastructure stimulus is less certain.

Bank of America continues to predict that steel mills will add too much capacity in the next few years, resulting in an oversupply that drives steel prices down to unprofitable levels. Tanners still believes the market is on course for what she has dubbed “Steelmageddon,” though perhaps on a slightly delayed timeline due to the coronavirus.

“This new capacity is absolutely still coming on. The fact is when you make these investments and you order this equipment you can’t just flip a switch and turn that off. Several mills have delayed their timing by a quarter or two, but I don’t think that will change much,” she said. Some of the new capacity already came online in 2018-19; the big thrust from here will be 2021-22.

“The convenient solution would be if idled blast furnaces stayed shut to offset the new minimill capacity coming on, but I don’t believe that outcome is likely,” she said. In fact, she added, Steelmageddon could be even worse than originally anticipated if the mills proceed with capacity additions before demand has had a chance to recover from the coronavirus crisis.

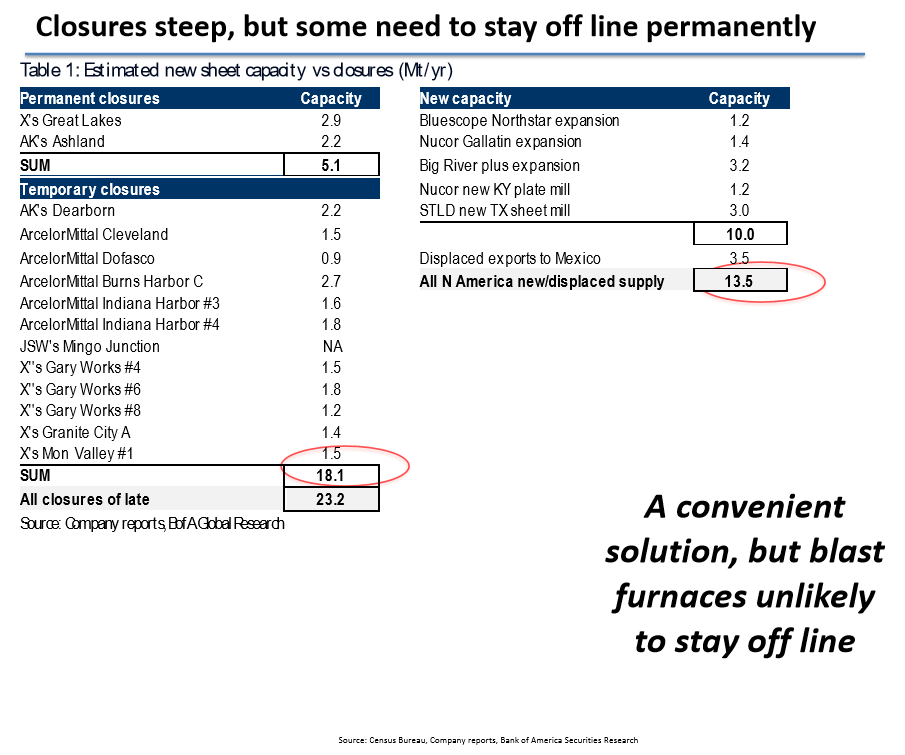

Referring to the chart below on hot melt capacity in the U.S., Tanners noted that U.S. Steel and AK Steel have removed 5.1 million tons of capacity from the market with permanent closures at their Great Lakes and Ashland facilities. Temporary idling of furnaces by U.S. Steel, AK Steel and ArcelorMittal have removed another 18.1 million tons. New capacity planned to come online in the next few years will total 10 million tons—including expansions at North Star Bluescope, Nucor Gallatin, and Big River Steel, plus Nucor’s new plate mill and Steel Dynamics’ new sheet mill. Adding 3.5 million tons of displaced exports that will no longer go to Mexico because of added production south of the border, that totals 13.5 million tons of new steel that will be seeking buyers in the U.S. The net difference between new supply and permanent closures, by Bank of America calculations, is an increase of approximately 8.4 million tons for the U.S. market. Which begs the question: How much, if any, of that 18.1 million tons in temporary closures will be made permanent? “If you ask the mills, they are very adamant that these closures are just temporary. They say the timing of the restarts will be dictated by demand,” Tanners said.

Tanners said that steel prices will rise from current levels later this year as demand slowly recovers, noting the price increases announced by the mills last week. The benchmark hot rolled price will reach $515 per ton in the third quarter and $525 in the fourth quarter, she predicts, before trending downward again over the next several years as the market is oversupplied.

“Part of why we don’t think steel prices can rebound easily in the near term is because if they do, we will get new import offers, even with the 25 percent import tariff. Delivered prices to the U.S. could be in the low $400s. Right now, there is not a lot of demand, but if the mills raise prices and they succeed in getting to $500 or higher, those import offers are going to look attractive again,” Tanners said.

Summarizing Bank of America’s economic forecast, Tanners said, expect Q2 to be the worst, down 20-40 percent for most companies, followed by Q3 down 10-15 percent, and Q4 down single digits, year over year. “Conceptually, it could be 2023-24 before the market returns to normal. We don’t expect a quick recovery. But remember, it’s always darkest at the beginning of any correction,” she added.

Click here to view the recording of the May 6 webinar (you will need to register if you have not done so already).

SMU’s next Community Chat will feature popular economist Chris Kuehl of Armada Corporate Intelligence. The free webinar, open to all, will begin at 11 a.m. ET on Wednesday, May 13. Click here to register.