Market Data

May 3, 2020

SMU Steel Buyers Sentiment Index: Still in Negative Territory

Written by Tim Triplett

Having lived through the difficult month of April, steel buyers remain pessimistic about current business conditions, but more hopeful about the future.

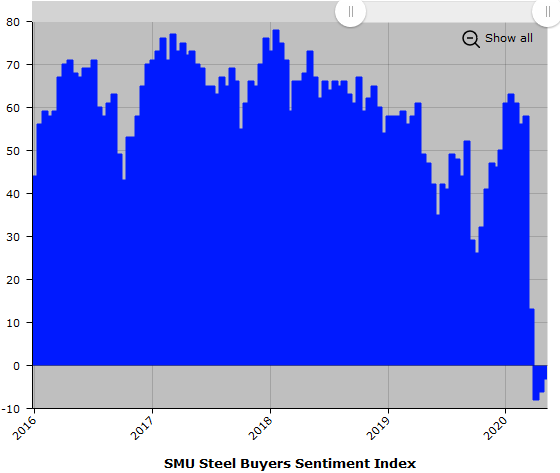

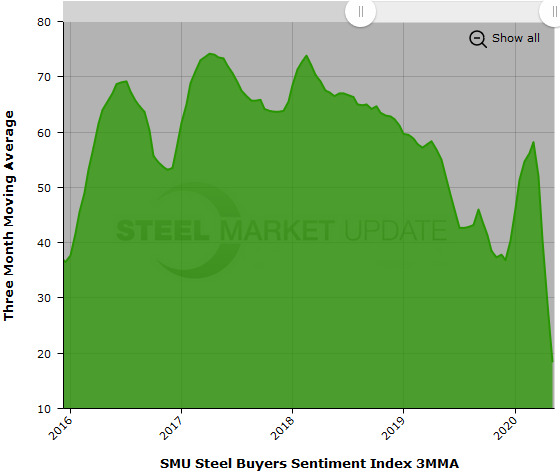

Steel Market Update asked steel buyers how they view their company’s current prospects for success, as well as their chances for success three to six months in the future. The Current Sentiment reading at the end of April was -3, a small improvement from -8 in the beginning of the month, but still in negative territory. Prior to last month, the last time Current Sentiment was in the negative range was November 2010. In early March, prior to the coronavirus shutdowns, Current Sentiment registered +58.

Future Sentiment

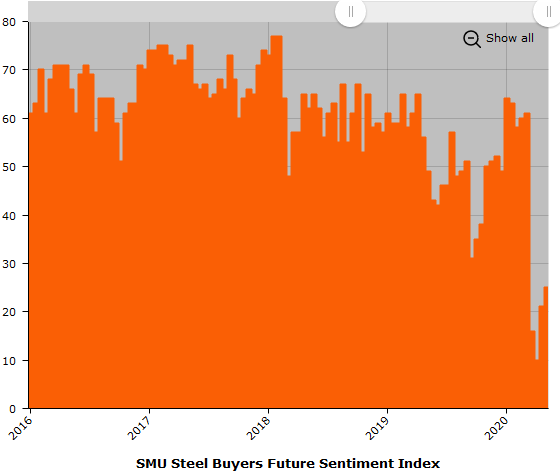

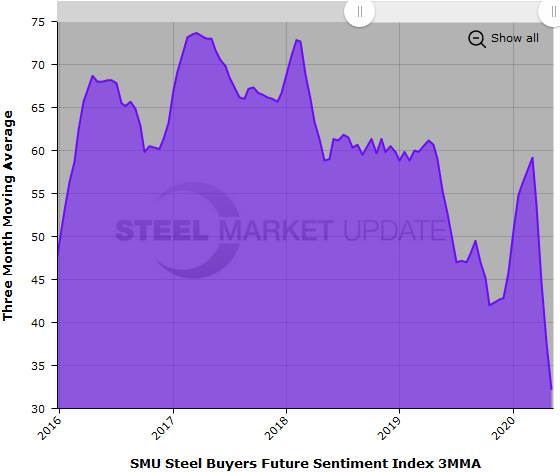

SMU’s Future Sentiment Index registered +25 in the latest canvass of the market, up 15 points over the last four weeks. Still far below the more typical +61 reading at the beginning of March, the slight uptrend is positive and suggests steel executives are hopeful business conditions will improve as government restrictions on commerce begin to loosen this month.

Results from SMU’s market trends questionnaire are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend. Both Current and Future Sentiment measured as 3MMAs saw big declines in the past month. The Current Sentiment 3MMA declined to +18.33, down from +40.50 in early April. The Future Sentiment 3MMA dipped to +32.17 from +44.67. The difference between the 3MMAs also shows that buyers are much more positive about their future prospects.

In a related question, SMU also asked buyers when they expect their business to return to pre-COVID-19 levels. The median response, the point at which half said sooner and half later, was by the end of September. Nearly 20 percent said they don’t expect recovery until Q1 2021 or beyond.

What Respondents Had to Say

Comments from the service center and manufacturing executives responding to SMU’s April 27 survey reflect the discouraging market conditions they face:

“Business conditions today are pathetic.”

“The true impact for unemployment and reduced consumer demand on the economy remains to be seen. Headwinds are strong. It won’t be good for a while.”

“Right now, due to heavy automotive customers, our business is terrible due to the COVID-19 closings. So, unless auto opens, we cannot succeed in the current market.”

“Spotty business with prices falling.”

“Our state remains closed until at least May 15; our operations are shut down.”

“In the New York City region, construction is severely constrained by government edict.”

“Hitting budget won’t happen. Our best hope is to break even. It’s hard to even revise the budget in the face of such uncertainty. Our facilities have remained operational, but many of our customers have either shut down temporarily or cut production considerably to adjust for lower demand.”

“We’re down 60 percent, looking for a rebound soon.”

“Nothing has changed fundamentally from last month. Hopefully, as the states open up business, it will create more demand. Especially when automotive starts back up. But we don’t expect any return to ‘normalcy’ for a while.”

“Just when we start feeling good about turning the corner, we get notified of another plant closing.”

“We’re defining successful as being a viable business post the virus shutdowns.”

“It all depends on how fast things can return to some type of normalcy.”

“Unknown damage has been done to business in all sectors from the COVID-19 situation. When will it end and will it reappear in 5-6 months?”

“We’re hoping our industry still has demand after all this. We have to see where the economy takes us.”

“When government restrictions on construction are reduced, we may just improve our business from poor to fair. Pent-up demand may even move it to good.”

“The business climate should improve some in 3-6 months, but we will just be beginning to make up for the shut-downs. We may have some reasonably good months 5-6 months from now, but in the scheme of the annual budget, we’ll still be paddling against the current.”

“Depends if and when our customers go back to work.”

“There are encouraging signs that economies around the world are beginning to open up.”

“Time to get back to work America! Nap time is over. Work smart. Do all the right things. Let’s all get back to doing what we do best. Let’s prove to the world why we need to bring back manufacturing and jobs to the USA once and for all. Everything that was once cheap is no longer cheap when you factor in what this has cost all of us. We are now back to break even at best!”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.