Market Data

April 30, 2020

Steel Mill Negotiations: Buyers Still Have Leverage

Written by Tim Triplett

On Monday of this week, Steel Market Update began canvassing the markets as we conducted one of our flat rolled and plate steel market trends suveys. The vast majority of the responses were received early in the week and the results of those responses are presented below. However, SMU continued to speak directly to both buyers and sellers of steel as the week progressed, and we found the market changing from Monday to Thursday. What we picked up today was a not in sync with what we are going to show you below. Steel mills have begun to move off the bottom feeding steel price numbers, and are becoming more aggressive. This caused us to change our Price Momentum Indicator to Neutral earlier today.

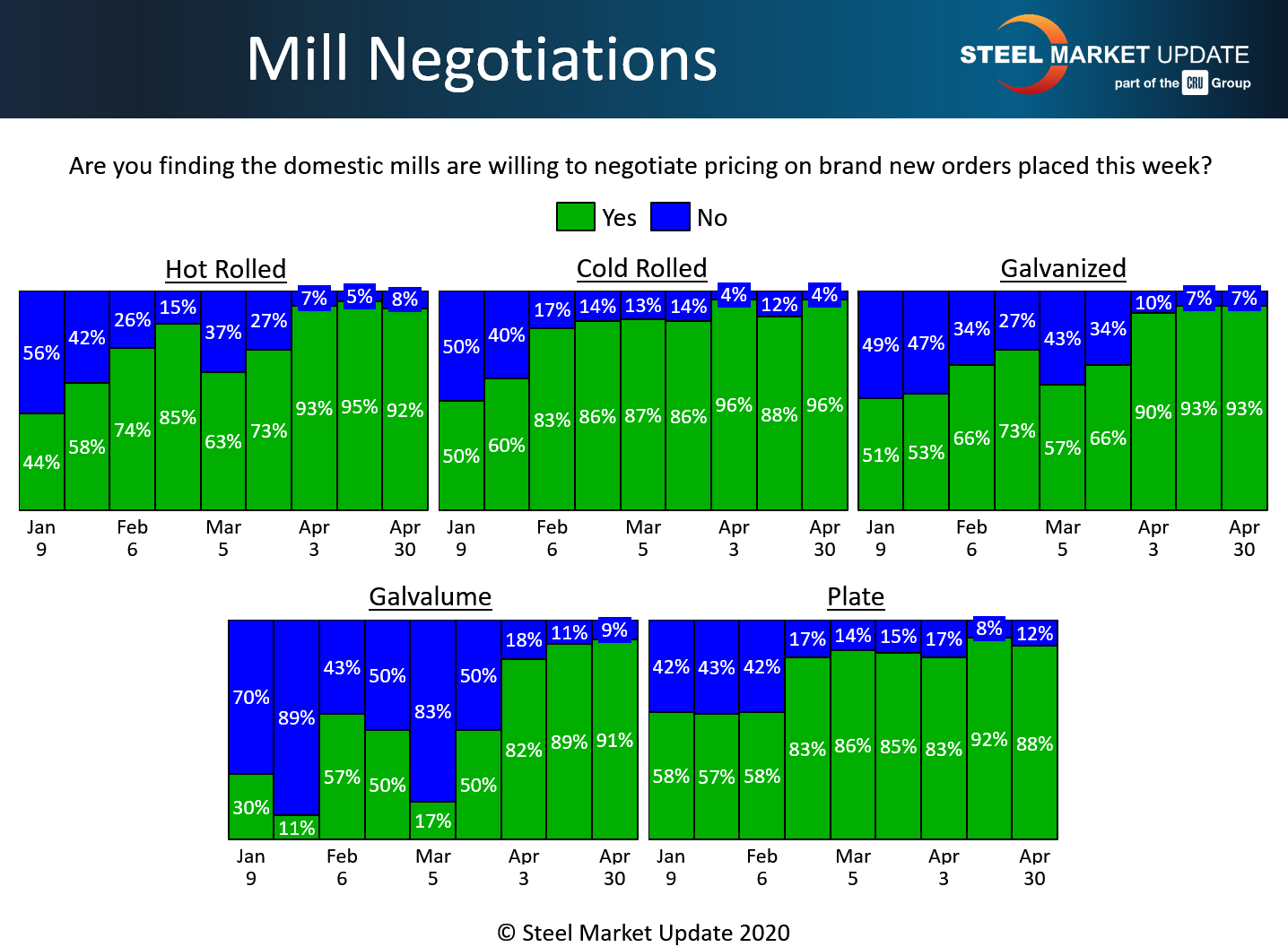

The negotiations data from Steel Market Update’s canvass of the market this week shows that buyers still have most of the leverage when it comes to negotiating prices on spot orders of all types of steel products. Roughly nine out of 10 buyers responding to SMU’s questionnaire said the mills still remain flexible on price as they compete to win the limited orders up for grabs in a market disrupted by the coronavirus.

In the hot rolled segment, 92 percent of the steel buyers said the mills are willing to negotiate prices on HR. In the cold rolled segment, 96 percent reported the mills willing to talk price. In galvanized, 93 percent reported the mills open to negotiation. Similarly, 91 percent said they have found mills willing to compromise on Galvalume prices. In the plate sector, 88 percent said the plate mills are now open to negotiations.

The benchmark price for hot rolled steel dipped to $460 per ton this week, down $80 from the $540 at the beginning of April. Mills are hopeful that with automotive and other manufacturing plants reopening in May, steel demand will improve enough to give them some bargaining power once again.

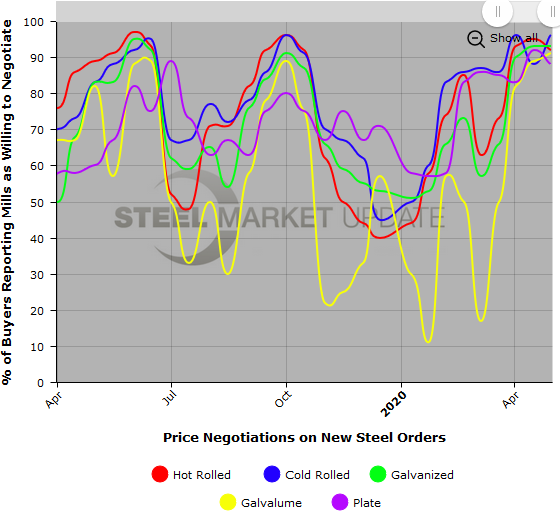

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (second example below), visit our website here.