Market Data

April 30, 2020

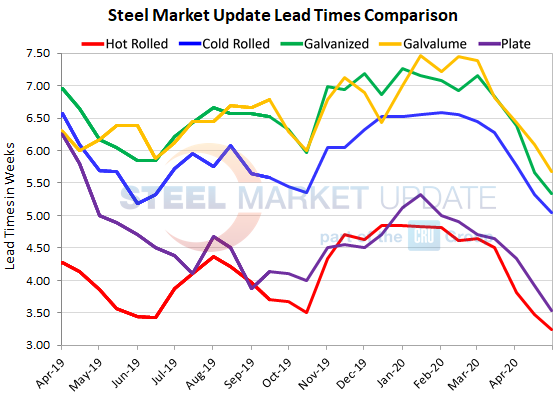

Steel Mill Lead Times: Sharp Declines in April

Written by Tim Triplett

Lead times for spot orders of flat rolled and plate steels declined sharply in April. Lead times ranged from a half-week to a full week shorter at the end of the month than they did at the beginning, depending on the product, according to Steel Market Update’s latest market trends questionnaire.

Lead times for steel delivery are a measure of demand at the mill level—the shorter the lead time, the less busy the mill. Lead times have continued to shorten despite the mills’ best efforts to idle furnaces and curtail production to sync supply with the demand that has survived the coronavirus shutdowns.

Hot rolled lead times now average 3.25 weeks, down from 3.81 at the beginning of April. Cold rolled orders currently have a lead time of 5.04 weeks, down from 5.77 four weeks ago. The current lead time for galvanized steel is 5.34 weeks, down from 6.39, while Galvalume is at 5.67 weeks, down from 6.43 in SMU’s early April check of the market.

Auto plants and other manufacturing facilities are expected to begin reopening in May, which could give a boost to steel demand and stabilize mill lead times.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.