Market Segment

April 28, 2020

Nucor Posts Profit in Q1 But Expects Loss in Q2

Written by Sandy Williams

Nucor Corp.’s sales and shipments saw healthy increases in the first quarter, prior to the coronavirus crisis. The first quarter was still a profitable one for the steelmaker, but the company is expecting a loss in the second quarter as the economy struggles with the government restrictions to stop the spead of COVID-19.

Nucor reported net earnings of $20.3 million in the first quarter of 2020 that included a $287.8 million writedown associated with its Italian beam mill, Nucor Duferdofin. Net sales increased 10 percent from the previous quarter to $5.62 billion. Average sales price per ton decreased 1 percent compared with Q4 2019 and 13 percent compared with Q1 2019.

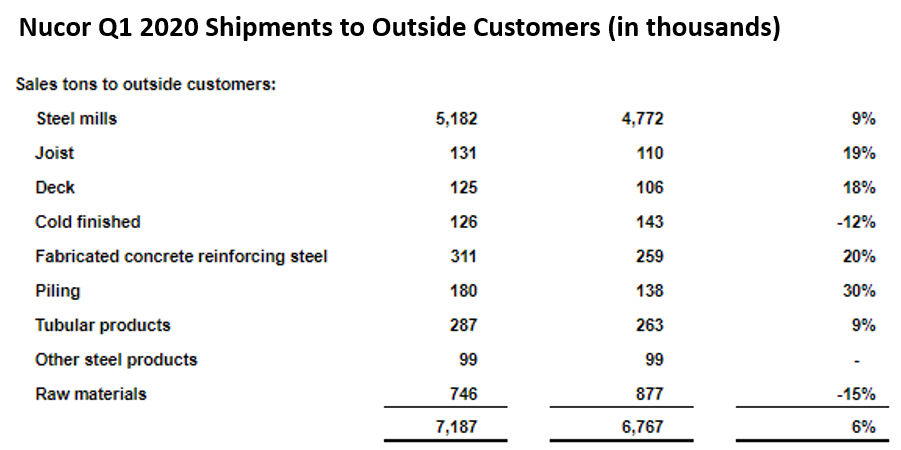

Nucor shipped 7,187,000 tons to outside customers in the first quarter, an 11 percent increase from Q4 2019 and a 6 percent increase from a year ago. Total steel mill shipments in Q1 were up 12 percent to 6,498,000 tons compared to the previous quarter.

The average scrap and scrap substitute cost per gross ton used in the first quarter of 2020 was $293, up 7 percent compared to the fourth quarter of 2019.

The impact of COVID-19 varied across Nucor’s business segments with energy and automotive hit the hardest. Nonresidential construction has been “resilient,” said Nucor, despite some project delays. Strong demand and backlogs are expected through the second and third quarters.

Nucor noted that capacity cuts by competitors had reduced steel supply in the market. Operating rates at Nucor’s steel mills increased to 89 percent in the first quarter compared to 83 percent in Q4.

Nucor idled production at its Trinidad DRI plant on March 30 and at the Louisiana DRI facility on April 2. Louisiana resumed production on April 25 with additional precautions in place to protect workers from virus infection. As of today, Louisiana is producing prime DRI.

To help weather the impact of the pandemic, Nucor has frozen or delayed about $500 million in spending on capital projects. Projects that are due for completion this year will continue, with Gallatin and Brandenburg expansions paused along with some smaller projects.

Compensation plans are heavily weighted toward productivity and profitability, which means employees will “share the pain” during the crisis but the company will avoid layoffs. Normal benefits will be maintained and a compensation floor has been established for production and non-production teammates. Executives will also see significant reduction in incentive compensation.

A reduction in net working capital will provide liquidity, as will a deliberate reduction in raw material inventory to align with expected near-term production requirements, the company said.

During the earnings call, President and CEO Leon Topalian urged the government to pass a strong infrastructure bill that will help put Americans back to work and to encourage Made in America goods to reduce U.S. reliance on the China supply chain.

Looking forward, Nucor expects to report a loss in the second quarter of 2020. Said Topalian, “While the economic outlook is highly uncertain at present, with the duration of the COVID-19 induced downturn difficult to predict, we currently believe that market conditions will bottom in the second quarter and Nucor will return to profitability in the second half of this year.”