Prices

April 21, 2020

How Does the COVID Pandemic Compare to the Great Recession for Steel?

Written by Tim Triplett

By John Packard and Tim Triplett

Steel Market Update has been asked: How does the COVID-19 pandemic compare to the Great Recession, in terms of its impact on the steel market? The full effect of the coronavirus crisis on the U.S. economy and steel demand is still to play out, of course, but some comparisons can be made. Generally speaking, steel production and steel prices have declined more sharply in the past few months, but so far to a lesser degree than during the recession in 2008-09.

Steel Market Update surveys steel buyers twice each month to track market sentiment. Buyers’ optimism or pessimism offers some insight into their likely decision-making. SMU’s Buyers Sentiment Index offers a sharp contrast between current attitudes and the way folks were feeling during the Great Recession. As of mid-April, the index had a reading of -6—down dramatically from +58 just the month before—but still considerably more optimistic than the all-time low reading of -85 hit in March 2009.

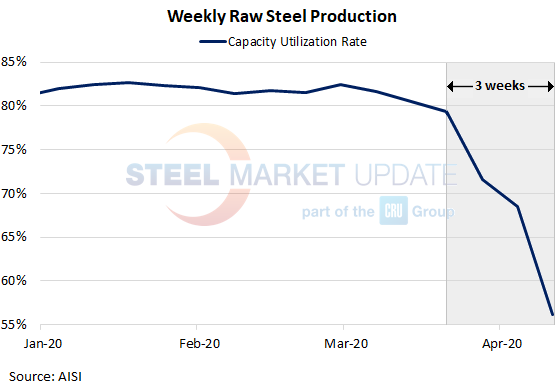

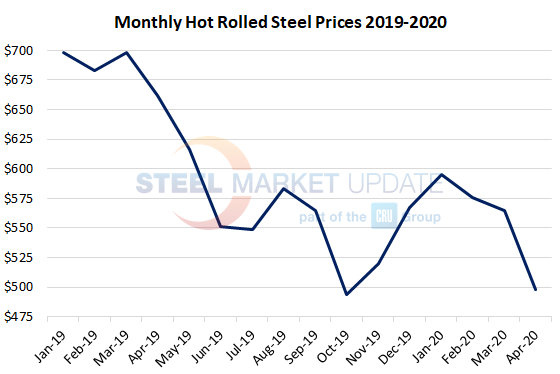

Both economic collapses were severe and unexpected and both took a serious toll on steel demand and prices. Looking at the mill utilization data from the American Iron and Steel Institute for March and April 2020, capacity utilization declined from more than 80 percent to around 56 percent in less than a month. During that period, the benchmark hot rolled price declined by roughly 15 percent, from $580 to $495 per ton (see charts below).

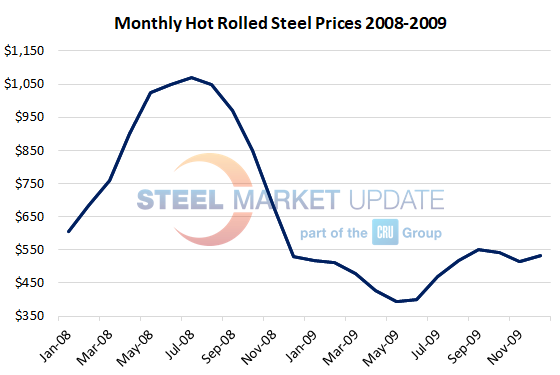

In comparison, in the summer of 2008, U.S. mills were cranking out steel at 90 percent of their capacity to capitalize on inflated hot rolled market prices in excess of $1,000 per ton (see charts). When the real estate bubble burst sending the economy into a tailspin, the price of steel lost half its value, to around $500 a ton, in a period of about five months. In the same 19-week period, mill capacity utilization plunged from 90 percent to 33 percent as the recession slashed steel demand. Steel prices did not immediately recover once the capacity utilization hit bottom at the end of August 2009. Prices continued to languish for another five months, hitting bottom in early June 2009 at $380 per ton. The subsequent recovery was prolonged and slow due to excessive inventories having been accumulated throughout the supply chain.

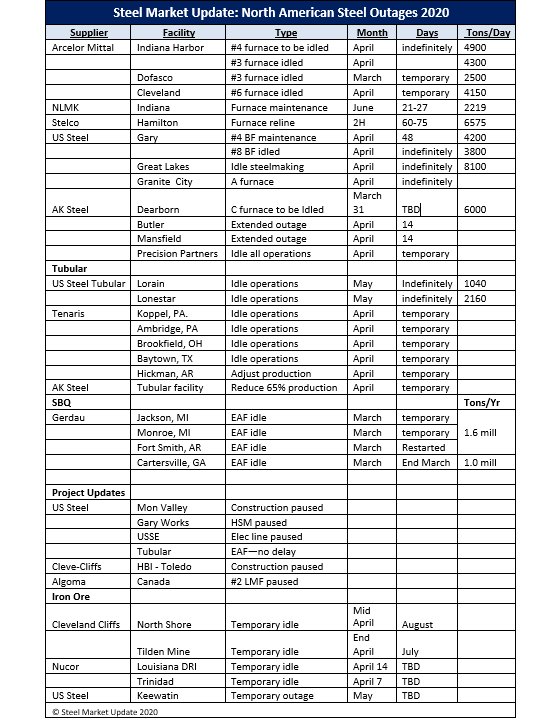

Being more proactive this time around, the domestic mills have acted quickly to idle some 10 million tons of their annual capacity in an effort to match supply with the declining demand and put a floor under steel prices. See the table below for a summary of the furnaces that were idled— some temporarily, some indefinitely—as of April 15.

Whether steel prices continue to decline or level out in the coming weeks or months depends on several factors. Before the government was forced to shut down commerce and enforce social distancing back in March, the economic fundamentals were strong, arguably much stronger than the economy of 12 years ago that was propped up by an inflated housing market. So, recovery from the pandemic could be more “V” shaped, say the experts.

Ferrous scrap prices are an indicator of finished steel prices. Unlike back in 2008, scrap collection is an issue today as dealers must avoid COVID-19 infection. Less prime scrap is available from auto plants and other manufacturers that have been forced to suspend production. Thus, scrap prices are likely to firm up as supplies tighten.

Service centers have been doing a much better job of managing inventories compared to the Great Recession. Steel Market Update proprietary service center inventories data put flat rolled inventories at 2.5 months supply (based on March shipping rates), which would be considered “balanced” in a reasonable market. These inventories will become inflated over the next couple of months, but buyers are making adjustments to accommodate anticipated lower volumes.

Steel demand remains the big question. How much of the business will come back once the virus is behind us and how much will be lost for good? Negative forecasts for automotive sales and oil prices don’t bode well for steel in the near term, but sources tell Steel Market Update that activity is still fairly strong in some sectors of the economy, such as construction and agriculture, and in some regions of the country. Distributors have put purchasing on hold, but will be quick to come off the sidelines at the first signs of a turnaround. Steel could get tight if the recovery of demand outpaces the mills’ ability to restart production. It will be critical for steel buyers to keep a close eye on the market to make sure their company does not get caught short. This year steel purchasing agents will be juggling supply and demand as never have before. Everything is one big question mark.