Prices

April 14, 2020

Domestic Mills Fall Below 60 Percent of Capacity

Written by Tim Triplett

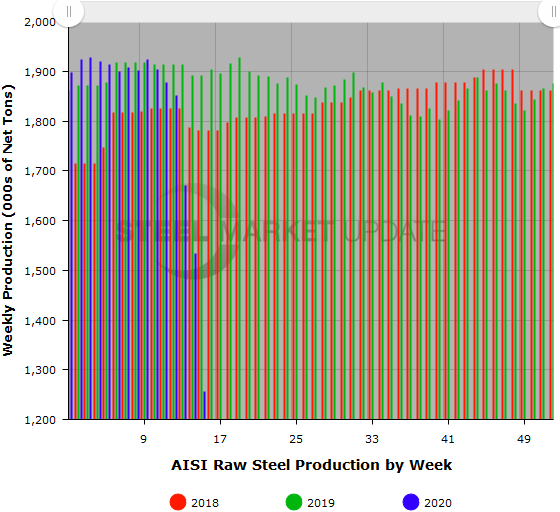

U.S. raw steel production continued to plummet last week as domestic steelmakers took further steps to adjust output to weak steel demand as the economy struggles with the coronavirus. Production in the April 11 week totaled 1,256,000 net tons with the mills operating at an average capability utilization rate of 56.1 percent, down from a rate of 68.5 percent in the week ending April 4, reported the American Iron and Steel Institute. The current week’s production represents a 33.6 percent decrease from the same week last year. The last time raw steel production was this low was the week ending July 25, 2009, during the Great Recession, when 1,254,000 tons were produced at a utilization rate of 52.6 percent.

AISI’s capacity utilization figures are somewhat misleading as they do not factor in furnaces that have been idled by various mills in the past few weeks. AISI considers a furnace to be part of a mill’s capability until it has been shut down permanently. Thus, the mills that remain in production are most likely operating above the levels currently reported by AISI.

Adjusted year-to-date production through April 11 totaled 26,323,000 net tons at an average utilization rate of 77.9 percent–down 4.9 percent from production in the same period last year when the average utilization rate was 81.5 percent.

Following is production by district for the April 11 week: North East: 104,000 net tons; Great Lakes, 430,000 net tons; Midwest, 122,000 net tons; South, 556,000 net tons; and West, 44,000 net tons, for a total of 1,256,000 tons. Production declined in all regions by a total of 278,000 tons.

The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage from 50 percent of the domestic producers combined with monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI monthly production report provides a more detailed summary of steel production based on data supplied by companies representing 75 percent of U.S. production capacity.