Prices

April 9, 2020

Hot Rolled Futures: Who is in the Driver's Seat - Sentiment or Fundamentals?

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

While our focus in this article is commodity futures and markets, we do not mean to take the focus off of people who may be impacted by the current virus outbreak and hope that everyone will remain healthy and safe.

Sentiment has clearly turned more bullish this week based on a few factors. Certainly, there has been some “less bad” news about the virus coming out of Italy, Spain, Germany, and even in the U.S. New cases here fell for the first few days of this week but then moved back up towards the recent highs with the most up-to-date numbers from Johns Hopkins. The other major factor driving things was the massive, and we do mean massive, effort by the Fed to stabilize markets and pump money into the economy. The program will include up to $2.3 trillion in loans, and will help fund municipal debt securities, and may even involve the purchase of junk bonds. At this point the Fed has refrained from outright buying equities, but one can never tell what the future may bring. Throw on top of that a potential deal between the Russians and Saudis to cut oil production and you have the makings of quite a week! Through the close of trading this afternoon, the S&P 500 has had its largest weekly rally since 1974. Some market technicians have pointed to the 2,800 level on the S&P as a key resistance point, and we are rapidly approaching that level as you can see in the following chart.

The Fed actions are indeed important, and according to some observers, may have taken some of the worst case scenarios off the table (i.e. a seizing up of credit markets that prolongs this current downcycle). Or maybe the Fed has just postponed them to another time—though that is beyond the scope of this article! The positive sentiment from equities also flowed into some of the ferrous markets. The busheling curve had a major move up over the past week as a potential lack of supply became a bigger story than the demand disruptions, at least in the short term. We’ve also seen a significant pickup in trading volumes in the busheling contract, which has lagged behind the HRC contract.

Speaking of HRC, that contract also saw strength this week as the index print fell less than some expected, and the equity market and oil deal buoyed sentiment. How the oil deal really comes together is still too early to tell, and while crude traded over $28/bbl early today, there was a major selloff late in the day, which saw prices fall all the way back down to just over $23/bbl.

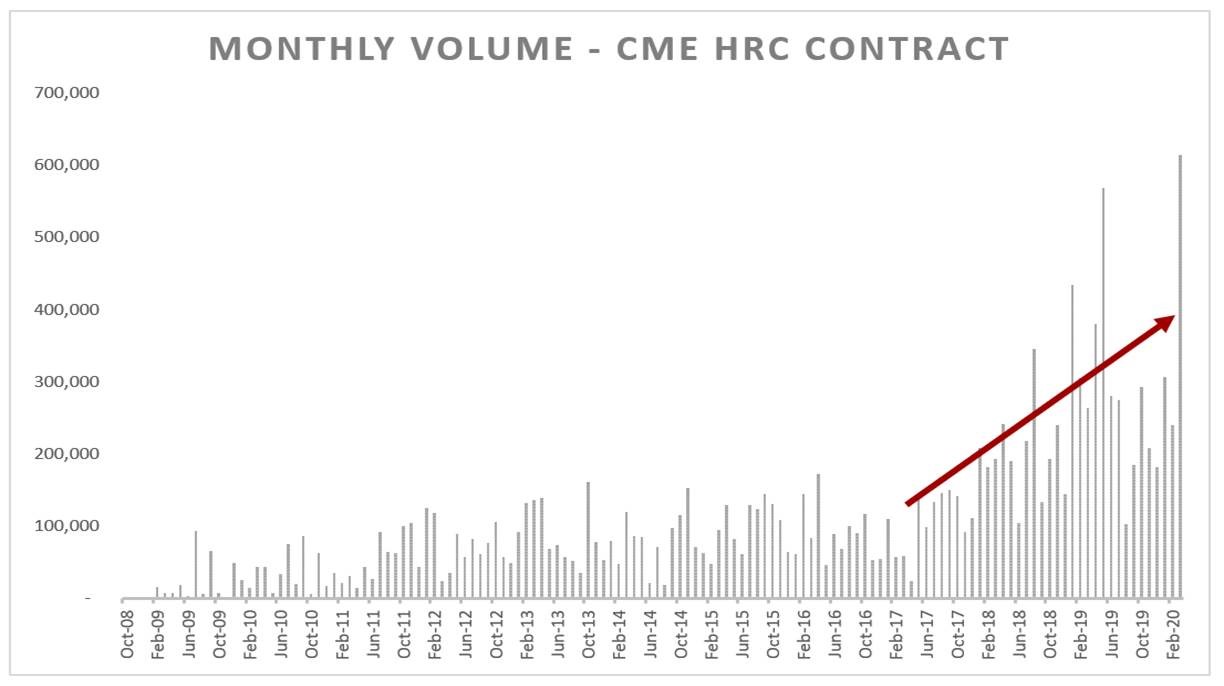

As we mentioned earlier, trading volumes on the HRC contract continue to build, with last month reaching a new record. The incredible volatility we have seen lately has clearly been a driver, as market participants look to either protect margins, preserve inventory values or just plain speculate.

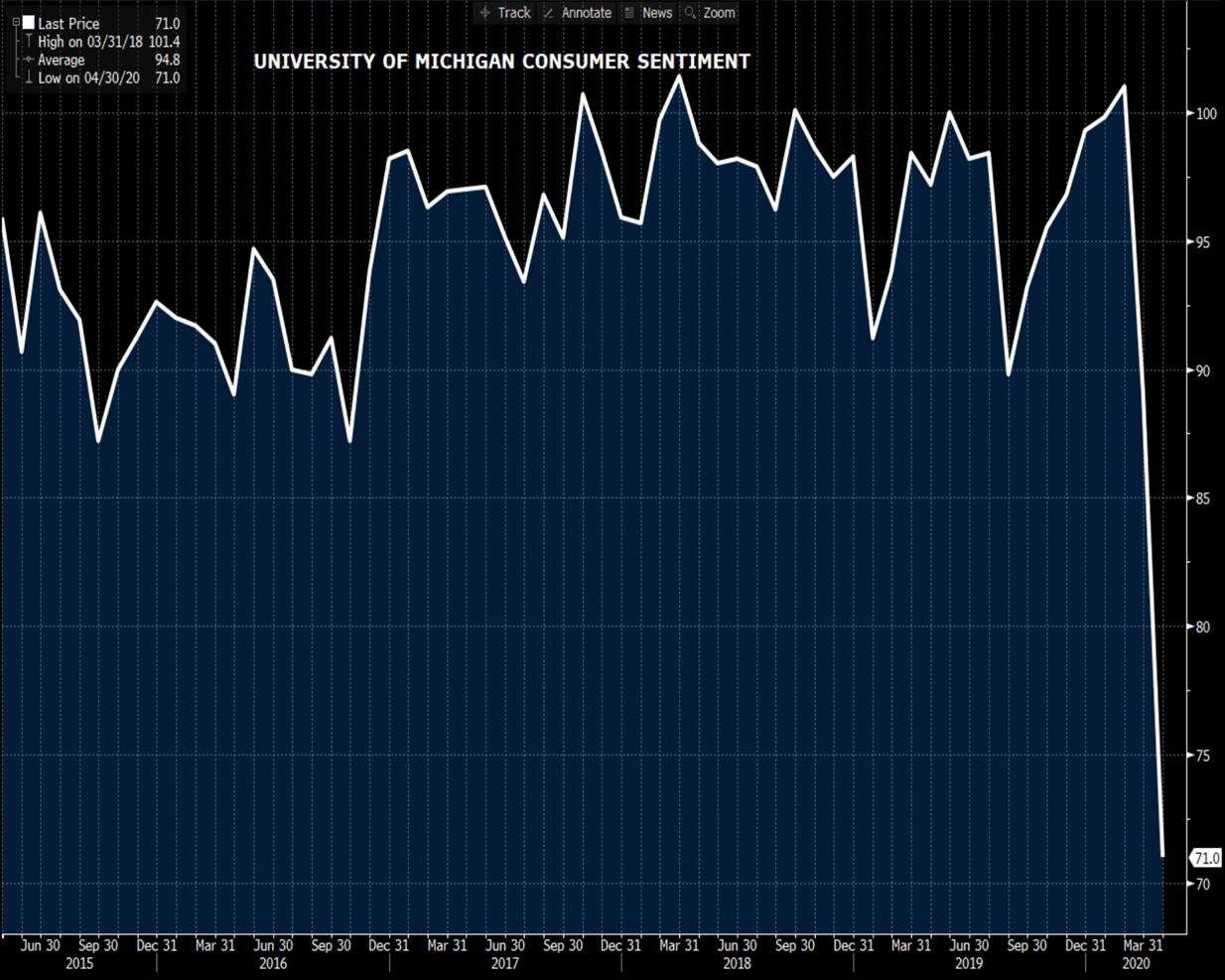

As we look into the fundamental picture, we will look at consumer sentiment and the ISM New Orders index. Why? Consumer sentiment is an important driver of major purchases like cars, houses and appliances. This month’s University of Michigan survey fell by the most on record:

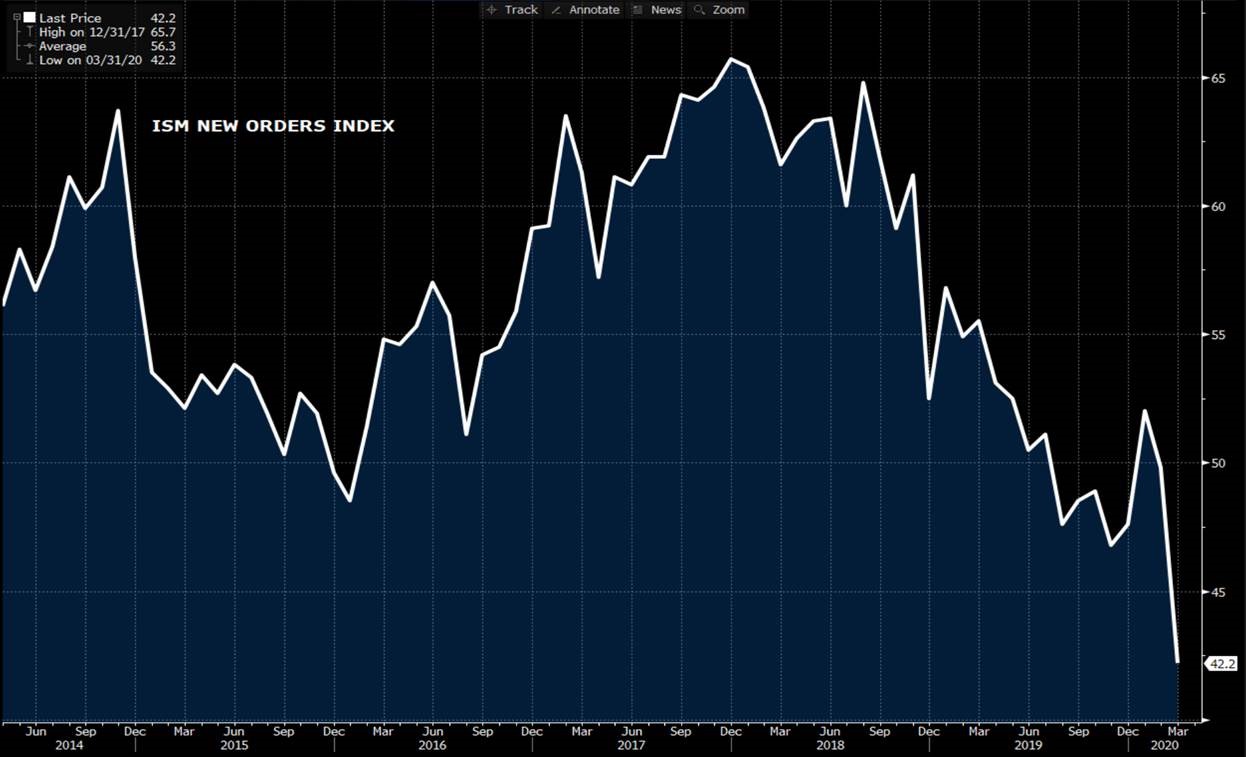

The ISM New Orders index also paints a bleak picture for short-term demand, as companies reign in spending:

Orders of manufactured goods are unsurprisingly weak. This should put pressure on manufacturing activity for at least a few months. We shall see if the rallies in the equity and ferrous markets are truly indicating a short-term turn in the economy for the better, or if they are purely based on sentiment.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information