Prices

April 7, 2020

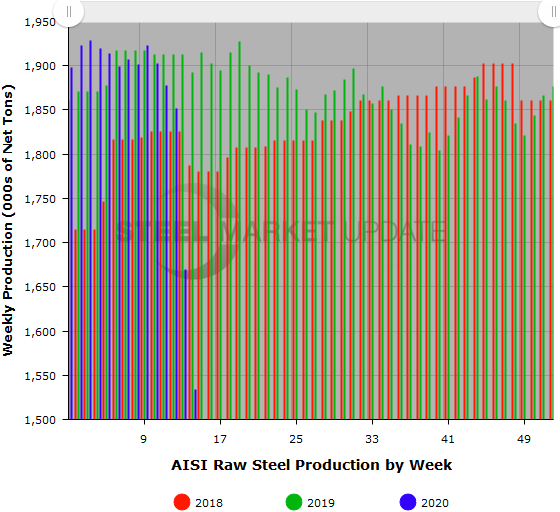

Weekly U.S. Steel Production Declines Another 8 Percent

Written by Tim Triplett

U.S. raw steel production plunged by another 8.1 percent in the week ending April 4, on top of a nearly 10 percent drop the prior week, as the coronavirus crisis eats into steel demand.

Production in the April 4 week totaled 1,534,000 net tons with the mills operating at an average capability utilization rate of 68.5 percent, down from a rate of 71.6 percent in the week ending March 28, reported the American Iron and Steel Institute. The current week’s production represents an 18.9 percent decrease from the same week last year. The last time raw production was this low was the week ending Jan. 2, 2016, when 1,440,000 tons were produced at a capacity utilization rate of 60.2 percent. The last time the capacity utilization rate was this low was the week ending Dec. 31, 2016, when 1,592,000 tons were produced at a rate of 67.1 percent.

AISI’s capacity utilization figures are somewhat misleading as they do not factor in several furnaces that have been idled by various mills in the past few weeks. By some industry estimates, the idlings removed roughly 10 percent of production capacity from the market, much of it temporary. AISI considers a furnace to be part of a mill’s capability until it has been shut down permanently. Thus the furnaces that remain in production must be operating at an average rate somewhat higher than 68.5 percent.

Adjusted year-to-date production through April 4 totaled 25,067,000 net tons at an average utilization rate of 79.4 percent–down 2.7 percent from production in the same period last year when the average utilization rate was 81.5 percent.

Following is production by district for the April 4 week: North East: 194,000 net tons; Great Lakes, 549,000 net tons; Midwest, 139,000 net tons; South, 602,000 net tons; and West, 50,000 net tons, for a total of 1,534,000 tons. Production declined in all regions by a total of 136,000 tons.

The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage from 50 percent of the domestic producers combined with monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI monthly production report provides a more detailed summary of steel production based on data supplied by companies representing 75 percent of U.S. production capacity.