Market Data

April 6, 2020

Employment by Industry in March

Written by Peter Wright

The U.S. lost a net 701,000 jobs in March as the economy struggled with the coronavirus, and the labor situation is expected to be much worse in April. The brunt of March’s employment decline was felt by service industries. In the coming months, manufacturing and construction jobs will suffer more as well.

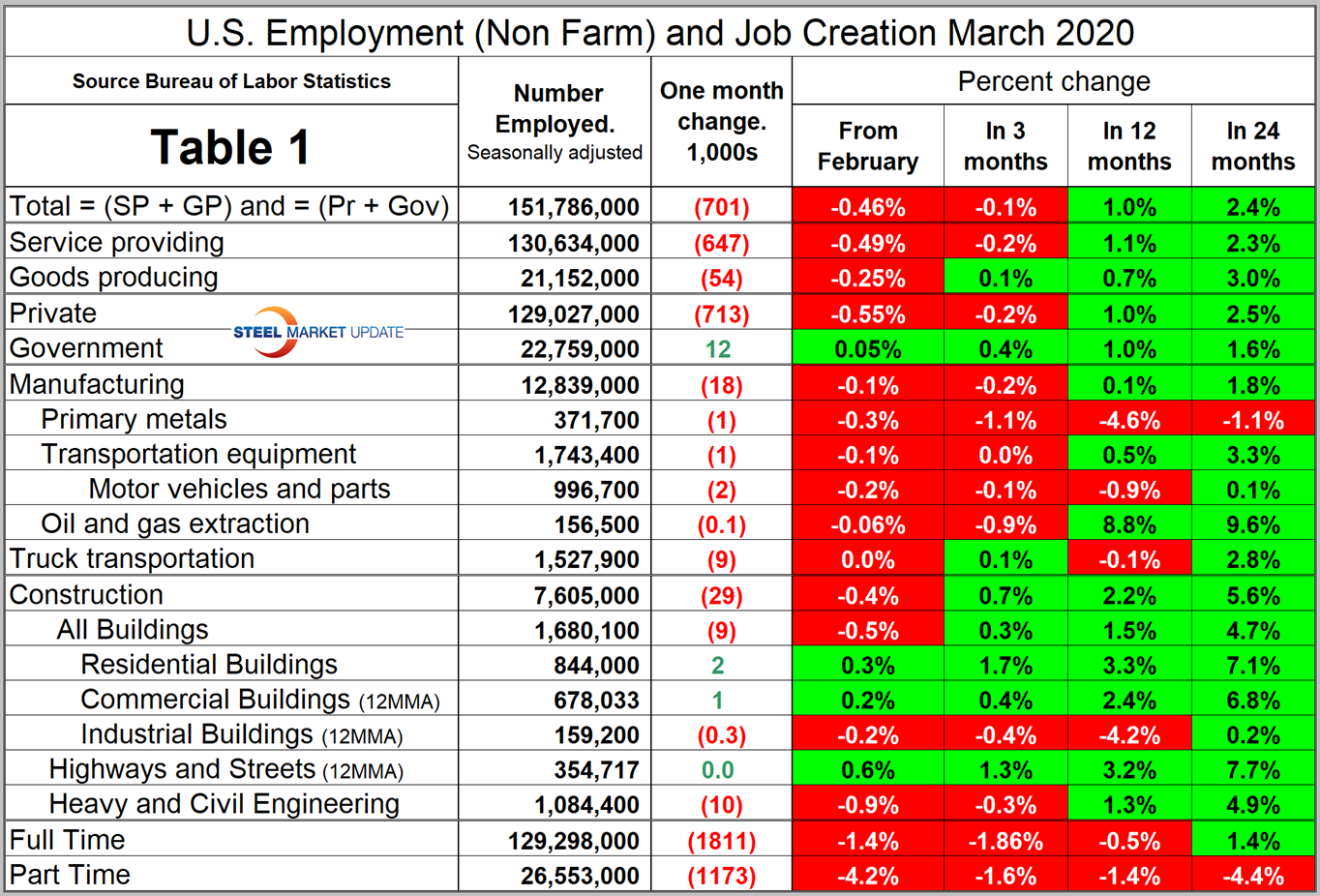

Table 1 breaks total employment down into service and goods-producing industries and then into private and government employees, based on data from an interim report from the Bureau of Labor Statistic for the first half of March. Most of the goods-producing employees work in manufacturing and construction; the components of these two sectors of most relevance to steel people are broken out in Table 1. Note, the subcomponents of both manufacturing and construction shown in Table 1 don’t add up to the total because we have only included those with the most relevance to the steel industry.

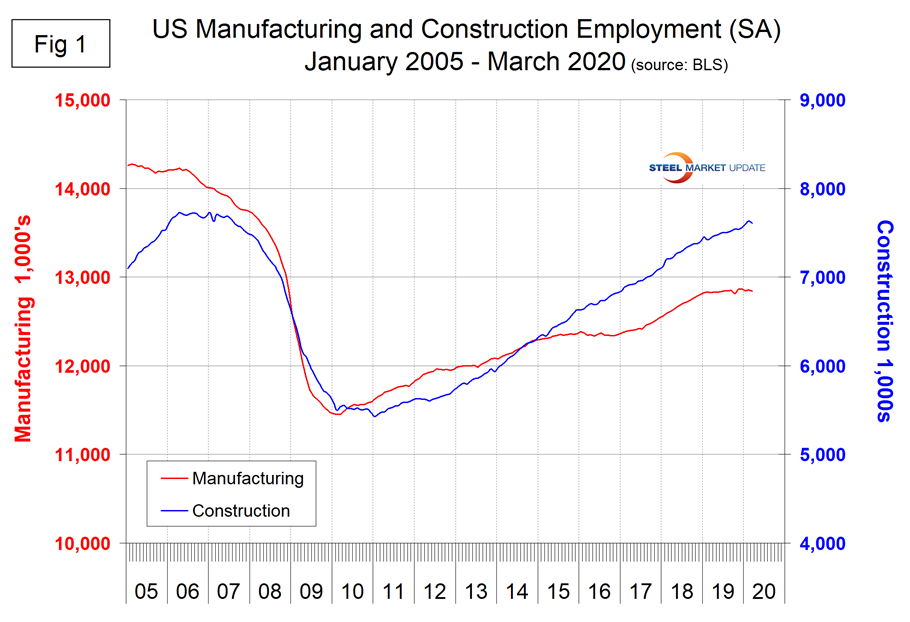

March data only accounts for the first half of the month and through that period the effect of the pandemic on manufacturing and construction employment was minimal (Figure 1).

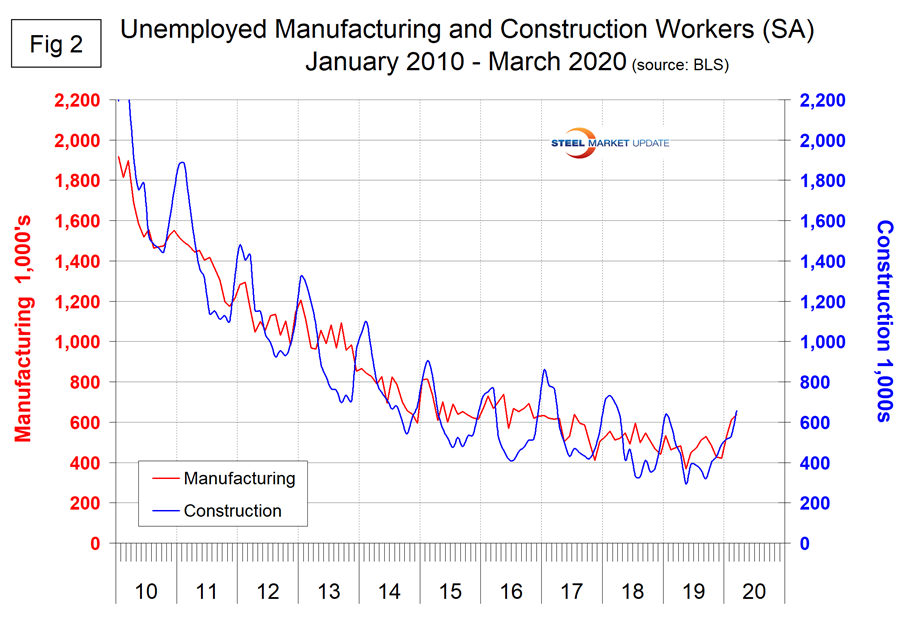

This month we have created new charts showing unemployment in manufacturing and construction industries. These are shown in Figure 2 and through the latest data didn’t show the magnitude of the situation. This will change in our April report. In March, service industries such as retail saw the biggest job declines. Service industries lost 647,000 jobs as goods-producing (mainly construction and manufacturing) lost 54,000 positions.

Explanation: On the first or second Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS employment database is a reality check for other economic data streams such as manufacturing and construction. It is easy to drill down into the BLS database to obtain employment data for many subsectors of the economy. The important point about all these data streams is the direction in which they are headed.