Overseas

April 5, 2020

CRU: Expect a 22 Percent Drop in Steel Sheet Demand

Written by Tim Triplett

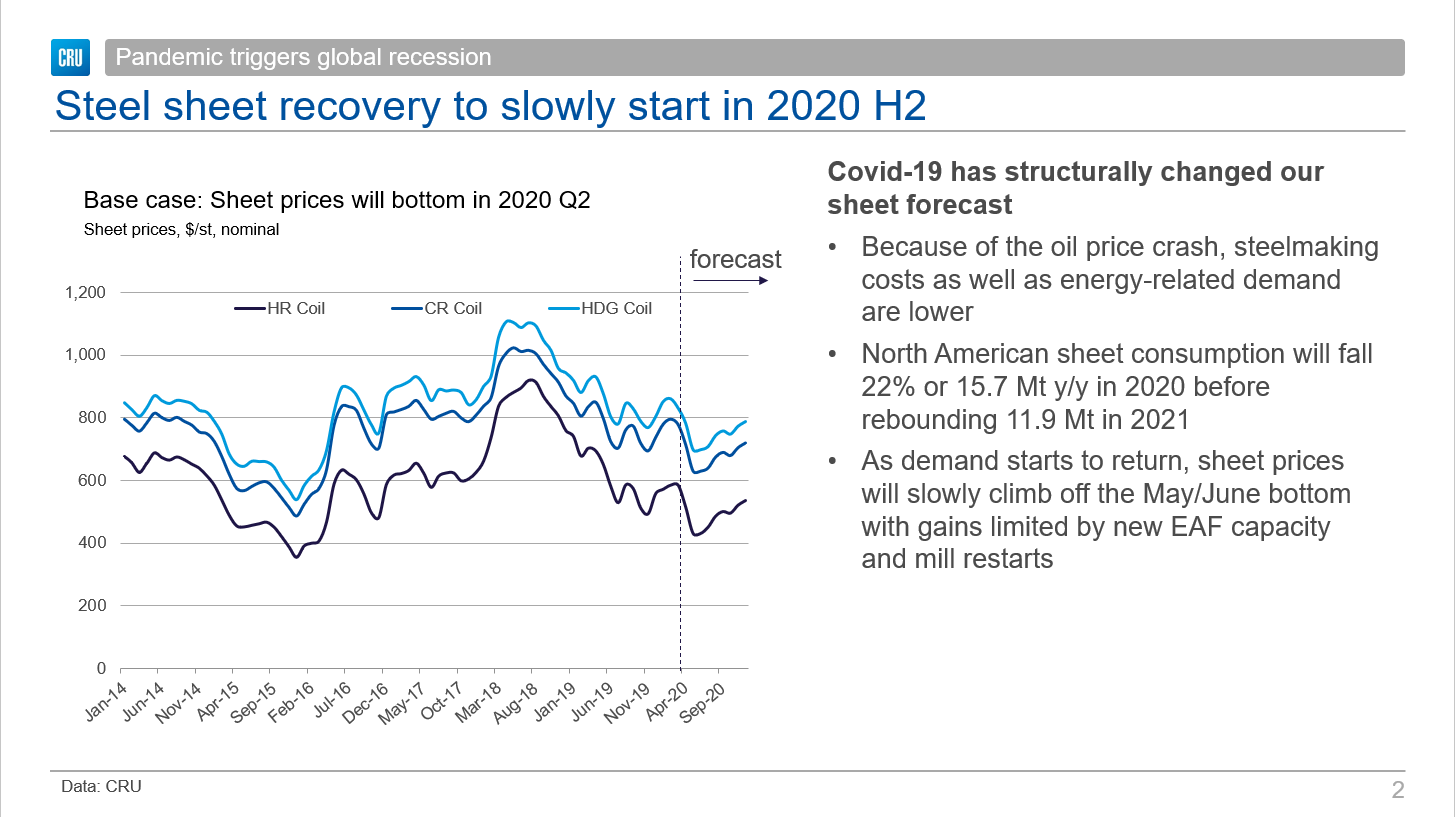

CRU is forecasting that North American steel sheet prices will find a bottom sometime this summer, but will remain volatile while supply and demand gradually rebalance as the coronavirus crisis subsides.

CRU projects steel consumption will decline by 22 percent this year as a result of virus-related shutdowns in automotive and other key manufacturing industries. Adding to the weak steel demand is the low price of oil, which has put the brakes on drilling activity in North America’s energy sector and on orders of oil country tubular goods. In response, various mills have idled furnaces and curtailed operations in an attempt to quickly cut steel output.

“We have tallied 8 million metric tons of production cuts so far this year, but we are seeing demand come down by 16 million tons. So, it is going to be a pretty volatile situation going forward,” said CRU Principal Analyst Josh Spoores during a CRU webinar earlier today.

Because steel demand has fallen so quickly, service centers have been left with a glut of inventory. In January-February, service centers were holding around a 2.4-month supply of sheet products with another 1.7 months of supply on order. “If demand at service centers falls by only 40 percent, this would make the current inventory look as high as six months of supply,” said Spoores.

CRU’s current view is for North American steel sheet demand to rebound by 12 million metric tons in 2021.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com