Market Data

April 2, 2020

SMU Steel Buyers Sentiment Index: Confidence Dips into Pessimistic Territory

Written by Tim Triplett

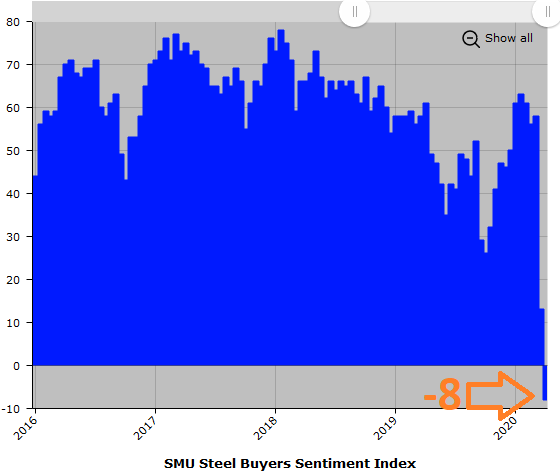

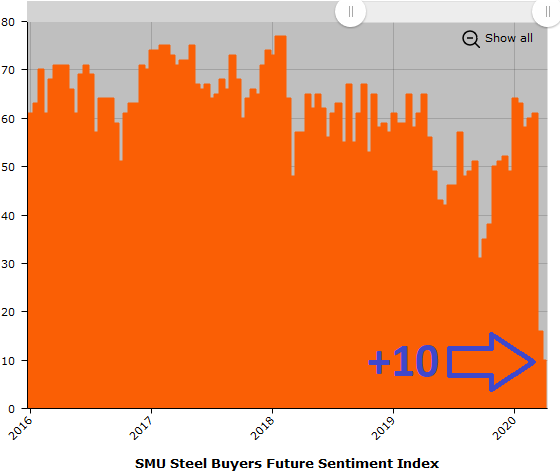

Steel Buyers Sentiment—how steel executives view their prospects for success—has continued to deteriorate as the market struggles with the coronavirus restrictions. Current sentiment dipped into pessimistic territory to a reading of -8 this week, the lowest level since November 2010. It is also the first time we have entered the pessimistic portion of our index since November 2010. Future Sentiment—how buyers feel about their company’s prospects three to six months down the road—was just slightly better and still in the optimistic portion of our index at a reading of +10.

Current Sentiment experienced the sharpest one-month decline in the 11-year history of SMU’s index, plunging 66 points from a reading of +58 in the beginning of March. Likewise, Future Sentiment dropped by 51 points from a fairly optimistic level of +61 a month ago.

To offer more perspective, SMU’s Steel Buyers Sentiment was negative for two years, from late-2008 to late-2010, as the economy slowly recovered from the Great Recession. The index hit bottom at a reading of -85 in March 2009. By January 2018, industry sentiment had rebounded, along with the economy, to an all-time high reading of +78.

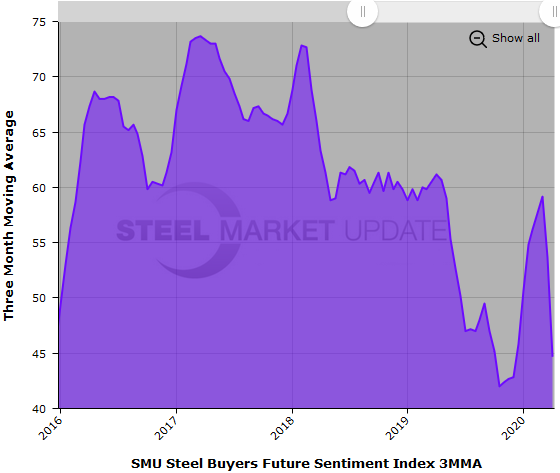

Results from SMU’s market trends questionnaire are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend. Both Current and Future Sentiment measured as 3MMAs saw big declines in the past two weeks as news of the virus worsened. The Current Sentiment 3MMA declined to +40.50 from +52.00, while the Future Sentiment 3MMA dipped to +44.67 from +53.67.

Although the current readings are down dramatically, they are still considerably more positive than sentiment during the big economic downturn that began in 2008.

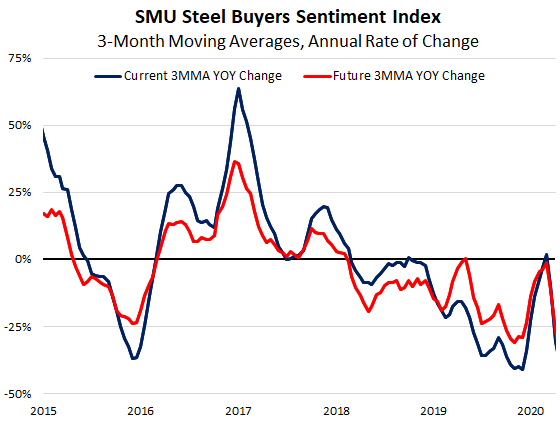

The sharp downturn in market sentiment over the past few weeks can be seen on the right in the chart below, which tracks the annual rate of change in the three-month moving averages.

What Respondents Had to Say

“Construction has been halted due to COVID-19.”

“If we can find some normalcy in the next six weeks, I would quickly raise my outlook to good.”

“We are very financially fit, and have worked inventories lower.”

“We have yet to see any significant changes in our business.”

“Our order rate has dropped for four days straight, not a lot, but the trend is there. April is a big concern.”

“Steel and aluminum trade have been under fire for three years and the current global pandemic will exacerbate countries setting up walls and changing trade flows. These are fundamental changes and U.S. presence in world markets will diminish in a more and more destabilized and uncertain world.”

“Too much uncertainty regarding the coronavirus and knowing when the economy might be allowed to rebound.”

“Not sure how long it will take to get things back to normal.”

“We are counting on a “V” shaped recovery. Fingers crossed.”

“Once we do find some normalcy, there will be good deals on lending money and people will want to spend a little.”

“We are hoping this will be short-lived and there will be opportunities once our nation rebounds.”

“Once the black cloud is gone, I’m hoping we return to some normalcy.”

“Much will depend on actual demand in the coming months as we go through various stages of virus containment.”

“We have some orders, but all are subject to release by customers.”

“I see no light at the end of the tunnel yet. But trade will be less of a factor in the future.”

“Waste containers are essential to the economy and we make about half of the containers used in America.”

“It looks like the Covid-19 impact will be through Q2 for sure. Q3 may also be impacted.”

“Unfortunately, the tin market will be strong for the coming months as food cans, etc. are an in-demand product.”

“Our company is closed.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.