Prices

March 24, 2020

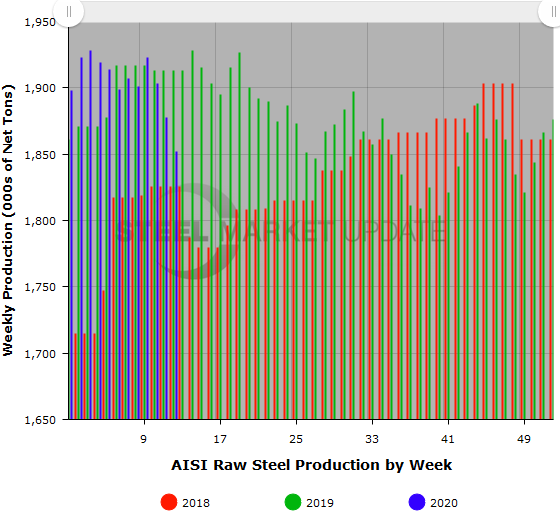

Mill Utilization Rate Dips Below 80 Percent

Written by Tim Triplett

Raw steel production saw its third weekly decline of 1 percent or more, taking the mill capability utilization rate below 80 percent for the first time since mid-December 2019 as the coronavirus crisis begins to affect steel demand.

Production for the week ending March 21 totaled 1,852,000 net tons, for a utilization rate of 79.4 percent. That’s down 1.4 percent from the prior week, and a 3.2 percent decrease from the same period last year, reported the American Iron and Steel Institute.

Adjusted year-to-date production through March 21 totaled 21,983,000 net tons at an average utilization rate of 81.5 percent. That’s still up 0.1 percent from production in the same period last year when the average utilization rate was 81.6 percent.

Following is production by district for the March 21 week: North East: 214,000 net tons; Great Lakes, 677,000 net tons; Midwest, 184,000 net tons; South, 718,000 net tons; and West, 59,000 net tons, for a total of 1,852,000 tons. Declines were seen in the North East, Great Lakes and Midwest regions, and increases in the South and West.

The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage from 50 percent of the domestic producers combined with monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI monthly production report provides a more detailed summary of steel production based on data supplied by companies representing 75 percent of U.S. production capacity.

Note, capability for first-quarter 2020 is approximately 30.3 million tons compare with 29.9 million tons for the same period last year and 30.4 million tons for fourth-quarter 2019.