Market Data

March 22, 2020

Steel Mill Negotiations: Like Market, Prices in Flux

Written by Tim Triplett

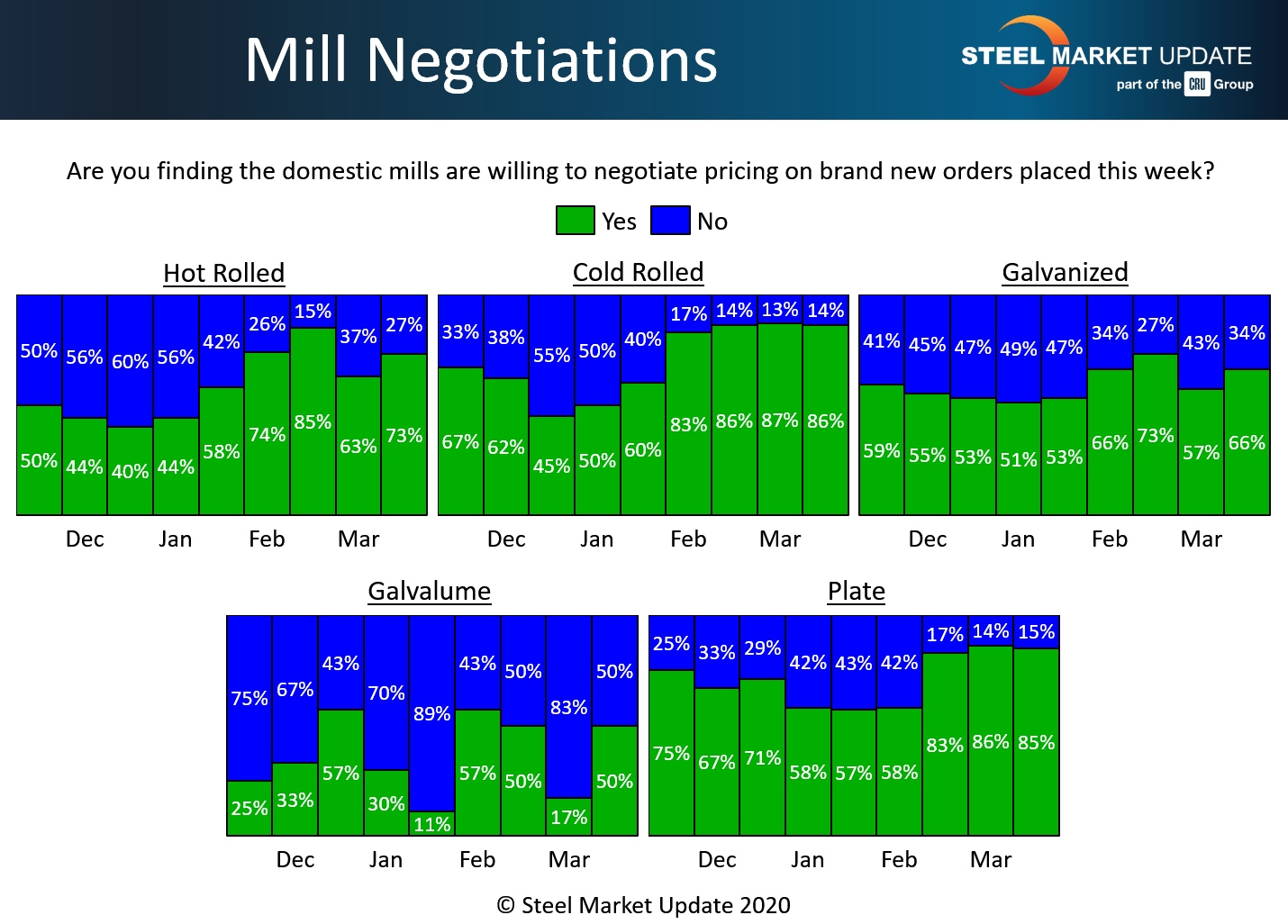

Steel producers and distributors told Steel Market Update this week that they remain busy serving customers, despite the disruption to the economy from the coronavirus. Not surprisingly, the mills appear very willing to negotiate spot prices to keep business flowing. The majority of service center and manufacturing executives responding to SMU’s questionnaire on Monday and Tuesday said the mills are talking price on all types of products.

In the hot rolled segment, 73 percent of the steel buyers said the mills are willing to negotiate prices on HR, up 10 points from 63 percent in early March. The percentage reporting mills holding the line on HR has declined to 27 percent.

In the cold rolled segment, there has been little change in the tone of negotiations with 86 percent reporting the mills still willing to talk price and 14 percent reporting the mills holding firm on CR orders.

In galvanized, 66 percent reported the mills open to negotiation, up 9 points from the 57 percent two weeks ago, while 34 percent said the mills would not discount to win the order. It’s a 50-50 proposition to find a mill willing to compromise on Galvalume prices.

The plate sector is little changed over the past two weeks. About 85 percent said the plate mills are now open to negotiations, down a tick from 86 percent in the last poll.

Benchmark hot rolled steel prices declined by $15, to $565 per ton, according to SMU’s canvass of the market earlier this week. It’s likely the market is just beginning to see the impact of the coronavirus on steel prices and negotiations.

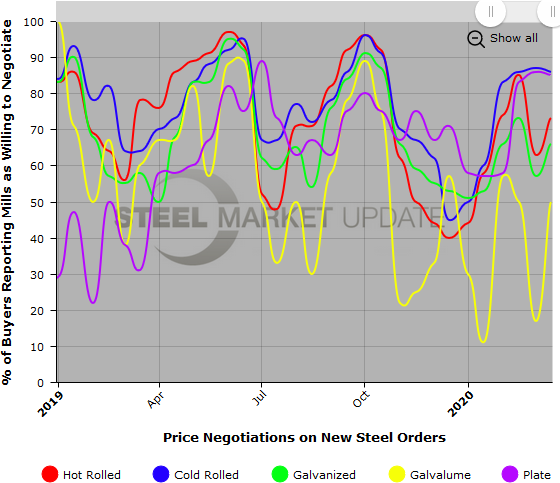

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (second example below), visit our website here.