Market Data

March 22, 2020

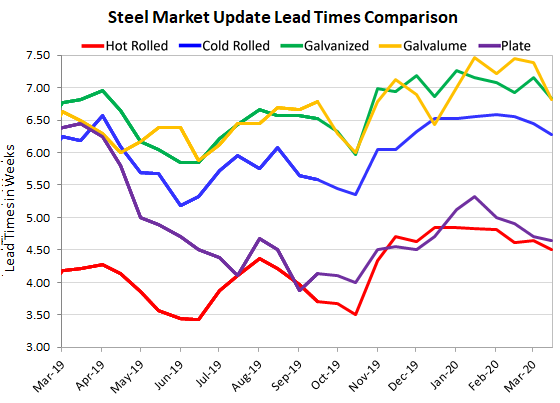

Steel Mill Lead Times: Slightly Shorter

Written by Tim Triplett

Lead times for spot orders of flat rolled and plate steel products showed initial signs of shortening this week, according to returns from Steel Market Update’s market trends questionnaire. Lead times for steel delivery are a measure of demand at the mill level—the longer the lead time, the busier the mill. The current lead times are still at healthy levels, comparable to where they were at this time last year, but they are slightly shorter than they were at the beginning of March.

Hot rolled lead times now average 4.50 weeks, down from 4.64 two weeks ago. Cold rolled orders currently have a lead time of 6.28 weeks, down from 6.44 earlier in the month. The current lead time for galvanized steel is 6.84 weeks, down from 7.16, while Galvalume is at 6.82 weeks, down from 7.38.

Lead times for spot orders of plate products now average 4.64 weeks, down from 4.71 weeks in SMU’s last check of the market.

Commented one manufacturer on lead times: “They might extend slightly with the planned mill outages in April/May, but if there is a rapid erosion in price [due to the virus], mills will see some cancellations or reduction of orders, which could shorten lead times further.”

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.