Market Data

March 19, 2020

SMU Steel Buyers Sentiment Index: Optimism Drops on Virus Fears

Written by Tim Triplett

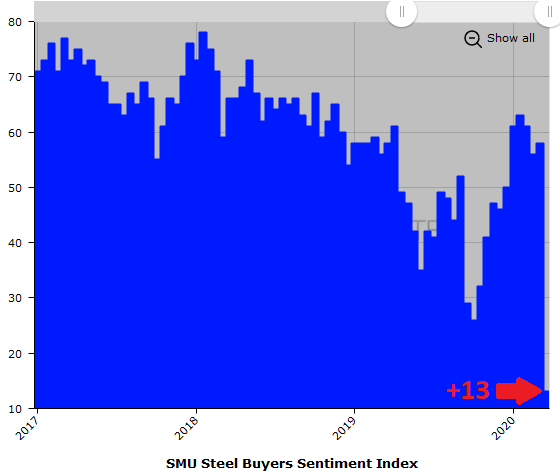

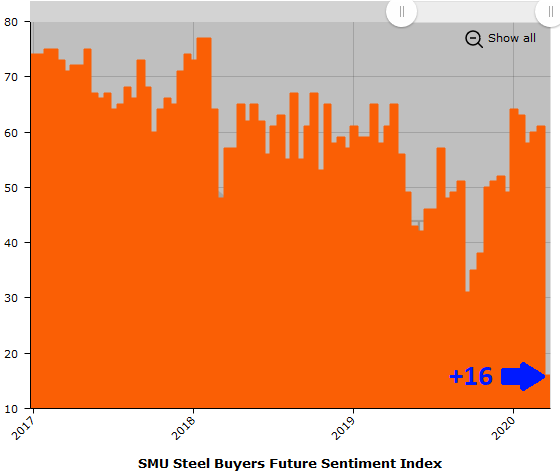

Coronavirus fears have taken a major toll on how steel executives view their prospects for success. Steel Buyers Sentiment, as measured by Steel Market Update, suffered the sharpest one-week decline in the index’s 11-year history. Sentiment plunged by 45 points, from a Current Sentiment reading of +58 down to +13, and a Future Sentiment reading of +61 down to +16. Prior to this, the biggest weekly swing was a 23-point drop in mid-September 2019.

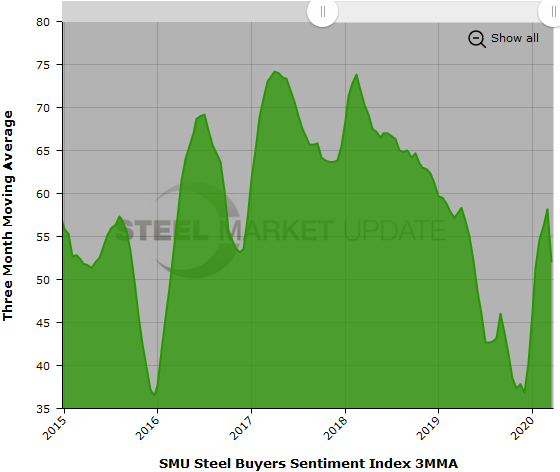

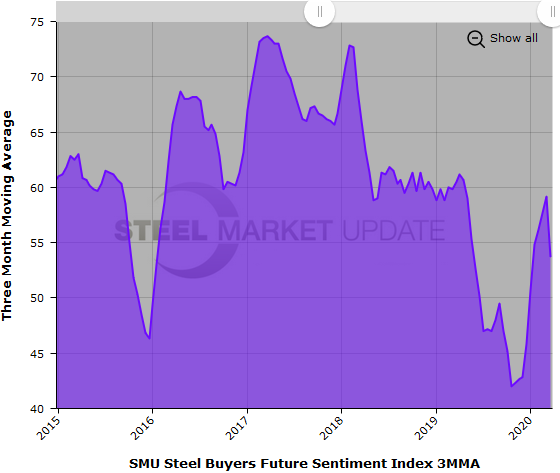

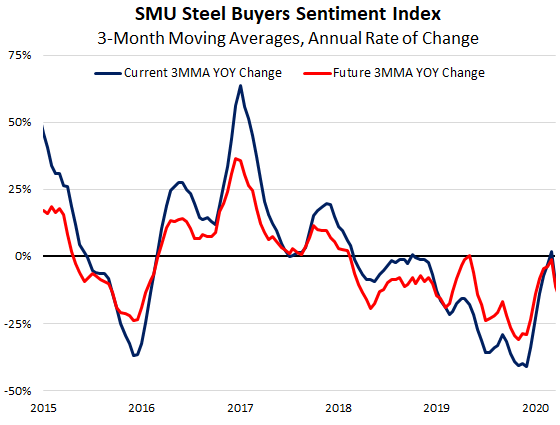

The goal of SMU’s index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Sentiment Index), as well as three to six months into the future (Future Sentiment Index). Results from SMU’s market trends questionnaire this week are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend.

Both Current and Future Sentiment measured as 3MMAs saw 6-point declines, also unprecedented in the history of the index. The Current Sentiment 3MMA declined to +52.00 from +58.17, while the Future Sentiment 3MMA dipped to +53.67 from +59.17

To put the current readings in perspective, SMU’s Steel Buyers Sentiment Index was in negative territory for two years, from late-2008 to late-2010, as the U.S. economy struggled to recover from the Great Recession. The index hit bottom at a reading of -85 in March 2009. By January 2018, the economy and industry sentiment had rebounded to an all-time high reading of +78.

Although the current readings are down dramatically, it’s noteworthy that they remain on the optimistic half of SMU’s scale and are still much more positive than sentiment during the last big economic downturn.

Sentiment was generally positive in the first two months of the year, but the sharp downturn in the past few weeks can be seen on the right in the chart below, which tracks the annual rate of change in the three-month moving averages.

What Respondents Had to Say

“It’s a little too soon to tell, but the reduction in overall business activity will likely hit our market in coming weeks.”

“Things are slowing down.”

“We rely on the spot market and things have really quieted up in the last couple of weeks.”

“Plate lead time is extended to mid-May. Demand remains consistent although it’s showing signs of softening in light of COVID-19 actions/responses.”

“The economic pause of the virus now has me on the fence. If it is short-lived, I believe the world will bounce back quickly. If we are looking at a two-month shutdown, my outlook will turn quite negative.”

“We manufacture building products. Demand so far with the mild winter has been better than the same time last year. There’s a lot of concern, though, that this demand could come to a screeching halt with everything going on across the U.S. with COVID-19.”

“Very worried about the economic effects of the virus that everyone is talking about.”

“I expect a slowdown caused by the effects of construction cutbacks. Minimum 10 percent annual cutback if not higher. When it will hit is unknown. Third or fourth quarter?”

“Let’s see what happens in our industry as the rest of the world shuts down due to the virus.”

“We already have customers shutting down business for a period of time. Unemployment may go through the roof shortly with the state of the country due to the virus. The future’s uncertain.”

“If the coronavirus brings the economy to a halt, I’m sure the last thing on people’s minds will be our products.”

“Business conditions and today’s market make it impossible for most if not all to be successful.”

“Covid-19 is the issue. How long is this going to last? One quarter? Two quarters?”

“We are trying to remain optimistic that the world can get back to normal quickly.”

“Still too soon to tell the longevity of this health/economic crisis.”

“It really depends on how much of the retail business shuts down in the U.S.”

“No idea!”

“With the COVID-19 there are so many unknowns at this time to say with certainty what we think the future holds, but we tend here to keep an optimistic view.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.