Market Data

March 8, 2020

Steel Mill Negotiations: Talks Tighten Following Increase

Written by Tim Triplett

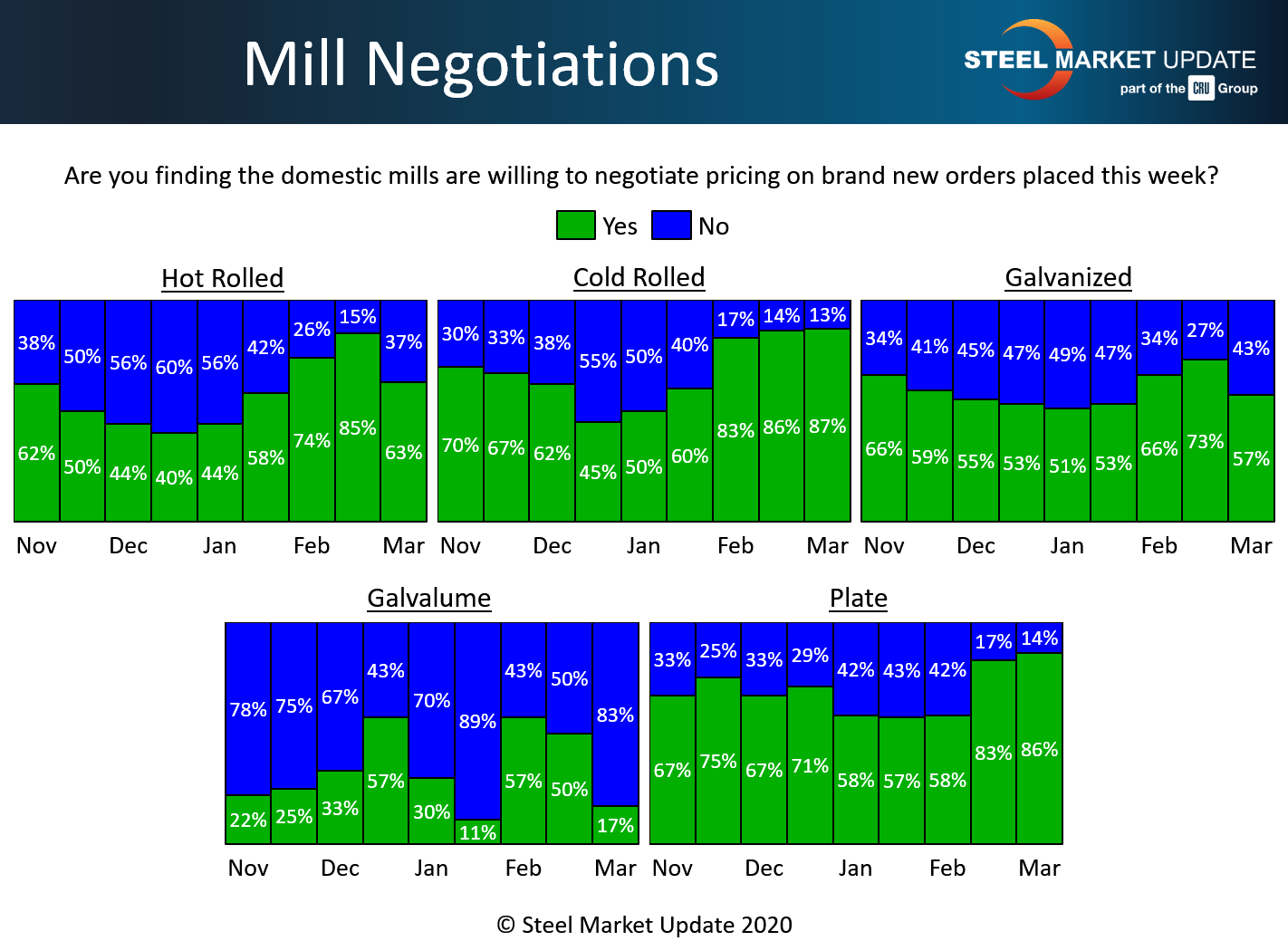

Price negotiations have tightened up noticeably as the mills seek to collect the $40 price increase they announced last week. Significantly more of the service center and manufacturing executives responding to Steel Market Update’s questionnaire this week said the mills are holding the line on prices, especially for hot rolled and galvanized.

In the hot rolled segment, 63 percent of the steel buyers said the mills are still willing to negotiate prices on HR, but that’s down 22 points from 85 percent in mid-February. The percentage reporting mills holding the line on HR has jumped up to 37 percent.

In the cold rolled segment there has been little change in the tone of negotiations with 87 percent reporting the mills still willing to talk price and 13 percent reporting the mills holding firm on CR orders.

In galvanized, 57 percent reported the mills open to negotiation, down 16 points from the 73 percent two weeks ago, while 43 percent said the mills would still discount to win the order. About 83 percent reported the mills as unwilling to compromise on Galvalume prices.

The plate sector is little changed over the past two weeks. About 86 percent said the plate mills are now open to negotiations, up slightly from 83 percent in the last poll.

Benchmark hot rolled steel prices increased by $20, to $580 per ton, according to SMU’s canvass of the market earlier this week, following the mills’ price hike a few days before. Even though the numbers suggest that talks have tightened, the majority of buyers for all products except Galvalume still say the mills are open to negotation. The market had not yet had much time to react as of SMU’s poll, but these percentages cast doubt on the increase.

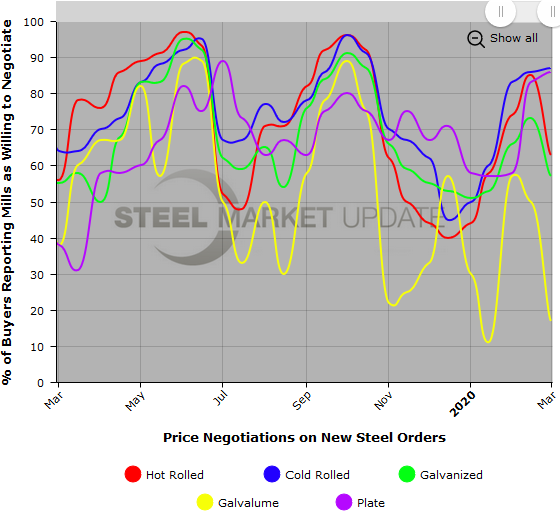

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (second example below), visit our website here.