Market Data

March 8, 2020

SMU Steel Buyers Sentiment Index: Slight Uptick Despite Coronavirus Fears

Written by Tim Triplett

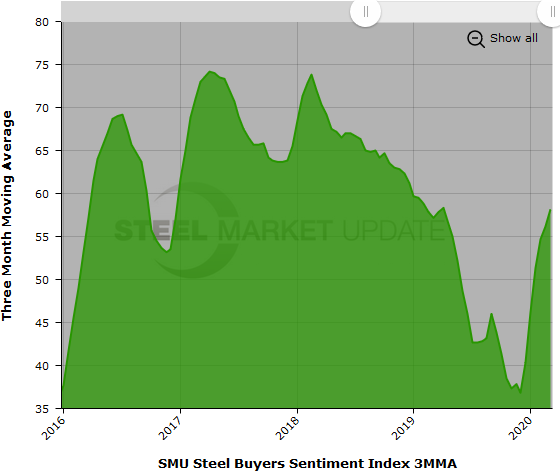

Steel buyers sentiment, as measured by Steel Market Update, has moved up and down within a small, three-point range since the beginning of the year. Both Current and Future Sentiment registered a very slight uptick in the past few weeks and remain in optimistic territory well above the average of +47 to +51 in 2019. But comments from respondents show increasing concern over the coronavirus outbreak.

SMU’s Current Sentiment Index registered +58 this week, up from +56 two weeks ago. The Future Sentiment Index rose one point to +61. Neither change is very significant, but they leave sentiment at strong levels well above the six-year lows in the +20s and +30s in September and October 2019.

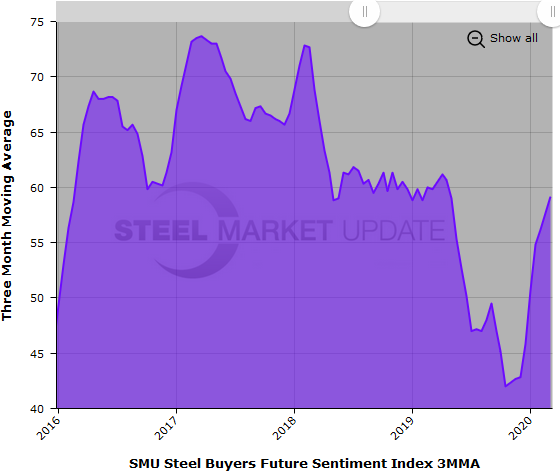

The goal of SMU’s index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Sentiment Index), as well as three to six months into the future (Future Sentiment Index). Results from SMU’s market trends questionnaire this week are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend.

As a single data point, the Current Sentiment reading of +56 is two points higher than at this time last year. Measured as a 3MMA, Current Sentiment is at +58.17, up from +56.17 in mid-February. At this time last year, the Current 3MMA was slightly lower at +57.17.

Future Sentiment

Future Sentiment as a single data point at +61 is three points higher than this time last year. The Future Sentiment 3MMA is +59.17, up from +57.67 a couple weeks ago, but down from +59.83 at this time last year.

All the current readings are above zero and on the optimistic half of SMU’s scale, therefore generally positive.

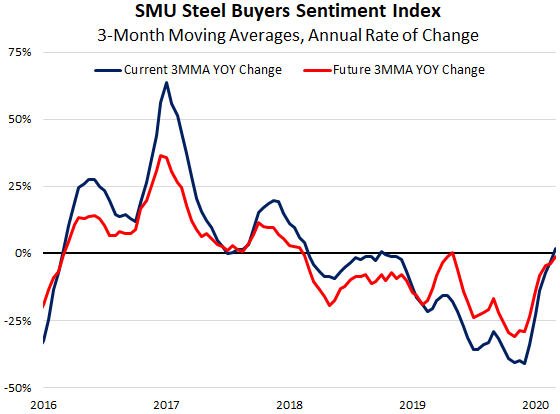

The upturn in sentiment since fourth-quarter 2019 can be seen on the right in the chart below, which tracks the annual rate of change in the three-month moving averages, but the trend has begun to flatten this year.

What Respondents Had to Say

“Currently we feel that business conditions are very favorable, especially for construction markets in the South.”

“February was not as strong as January and the March forecast is subdued.”

“Sentiment positive but cautious due to the situation in China with the coronavirus.”

“The market is struggling for direction on prices, elections and viruses.”

“Our outlook is fair only because we missed the bottom. We will be good as it appears market pricing will stay rangebound for a few months.”

“Due to the threats of the impact of the coronavirus, I believe people will start to pull back. But U.S. construction fundamentals are strong and this will allow steel consumption to continue in the short- and longer-term.”

“We expect business conditions to improve in the second half of the year.”

“We are still optimistic on the construction market, our core business, over the next six months, but the weather, coronavirus and upcoming election could alter that feeling.”

“Optimistic but cautious due to the situation in China with the coronavirus.”

“Market flatness should keep inventory valuation swings under control.”

“The impact of the virus is a concern.”

“Too many uncertainties.”

“Fear of the unknown.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.