Analysis

March 5, 2020

Auto Sales Robust in February, But Decline Expected

Written by Sandy Williams

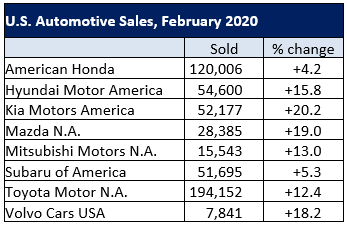

February was a good month for auto sales, with automakers posting higher sales as buyers took advantage of incentives and President’s Day discounts. Toyota sales moved up 12 percent to 194,152 units, while Honda sales gained 4.2 percent. Hyundai sales were driven by consumer enthusiasm for crossover vehicles, gaining 15.8 percent for the month. Most automakers have moved to quarterly sales reports rather than monthly.

“If the U.S. does not see a severe outbreak leading to travel restrictions and quarantines like China, South Korea, Japan, and Italy, then the impact to the economy and auto market should be subdued,” said Jonathan Smoke, chief economist at Cox Automotive. “Nevertheless, cascading issues around the world should cause the U.S. economy to see less growth. Likewise, new vehicle sales could fall from the 16.6 million in our original forecast due to COVID-19.”

Analysts at LMC Automotive agree that a decline in the light-vehicle market is likely.

“Uncertainty seems to be the buzz word for the auto industry right now, even if the causes change,” said Jeff Schuster, president, Americas operations and global vehicle forecasts, LMC Automotive. “While we expect the light-vehicle market to decline further in 2020, the factors that play a part in that decline are numerous. The coronavirus is not expected to have an immediate effect on sales in the U.S., but its effect on the global supply chain and production puts every global manufacturer and the global economy potentially at risk. A slowing U.S. economy and higher transaction prices are already contributing to the headwinds.”