Prices

February 27, 2020

Hot Rolled Futures: Volatility Hits Fever Pitch

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

While our focus in this article is commodity futures and markets, we do not mean to make light of the concerns of people who may be impacted by the current virus outbreak and hope that everyone will remain healthy and safe.

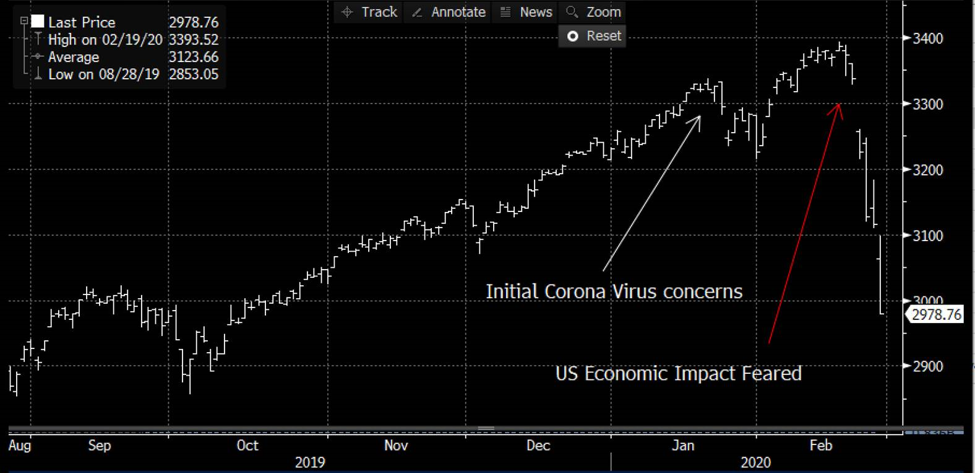

In light of recent developments, we felt like the right place to start this article would be on equities. Our last article discussed how commodity markets had felt the impact from the virus outbreak almost immediately. Equities, on the other hand, had an initial small sell-off and then went on to set new highs before the recent carnage. Why was this? While we can’t know for certain, we would speculate that this reaction was based on a belief that the virus’ impact would be mostly contained within China. The logic being that China is the critical market for most commodities—so those asset classes would bear the brunt of negative developments. However, the U.S. equity market would not be impacted significantly because commodities are not as important to the U.S. economy. With that belief, coupled with the expectation of continued “easy money” policies from the Federal Reserve, investors continued to buy stocks. What in the world changed this thinking and brought about the recent selloff in stocks? And why is the HRC futures curve now higher week over week?

6 Month Chart – S&P 500 Index:

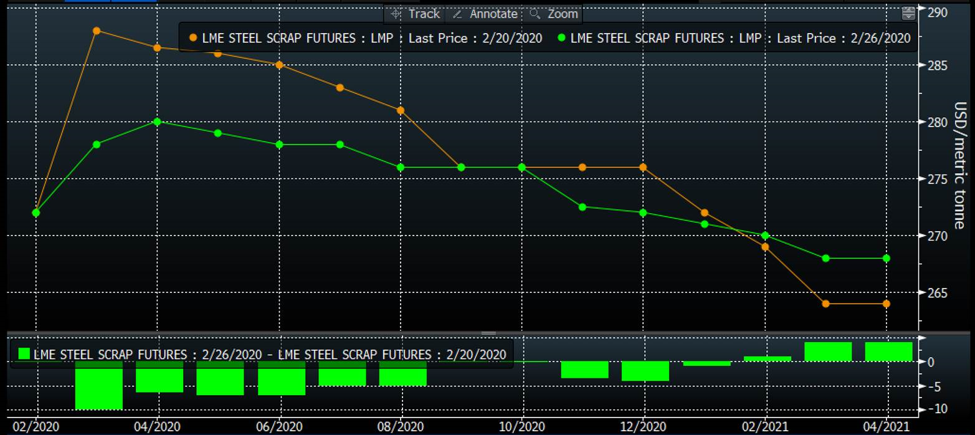

HRC Futures Curve – Week/Week:

We believe that this radical shift in thinking happened when investors came to the realization that the virus was spreading beyond China relatively quickly, and that the impact to supply chains could mean bad things for our economy. We think that when this shift occurred, investors started selling stocks here in the U.S.

So, why the upward shift in the U.S. HRC curve if investors started selling stocks due to fears about the virus potentially impacting the U.S. economy? It appears that a combination of factors drove this development. Lead times were very short at some mills a few weeks ago, but a number of large physical steel buyers came in to “plug some holes,” shifting lead times back out. In addition, some of the service center inventory data appeared to be relatively low coming out of 2019, and January demand up ticked nicely from December. This all led to futures market participants deciding they should be buying HRC futures more aggressively. This has pushed up the curve recently as it appeared that some of the recent doom and gloom on U.S. HRC coil prices may be overdone.

Moving over to scrap, the Turkish scrap curve pulled back moderately this week after having a decent move higher prior to that. We had mentioned that the spread between scrap and pig iron had gotten too large, and that seemed to firm up demand for the Turkish contract. Last week’s pullback may have been driven in part by news that Italy was seeing some increases in virus infections and a tempering of sentiment there.

In a nutshell, the interplay between commodities, equities and sentiment has driven some very different outcomes over the past week. We’d note that futures contracts can be used to dramatically reduce the risks in your business, so when uncertain times come upon us like the ones we are living in now, one may be able to sleep better at night with a well-thought-out hedging plan.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information