Prices

February 25, 2020

CRU: Metallurgical Coal Prices See Further Gains on Constrained Chinese Supply

Written by CRU Americas

By Senior Coal Analyst Ben Carstein, from CRU’s Metallurgical Coal Market Outlook

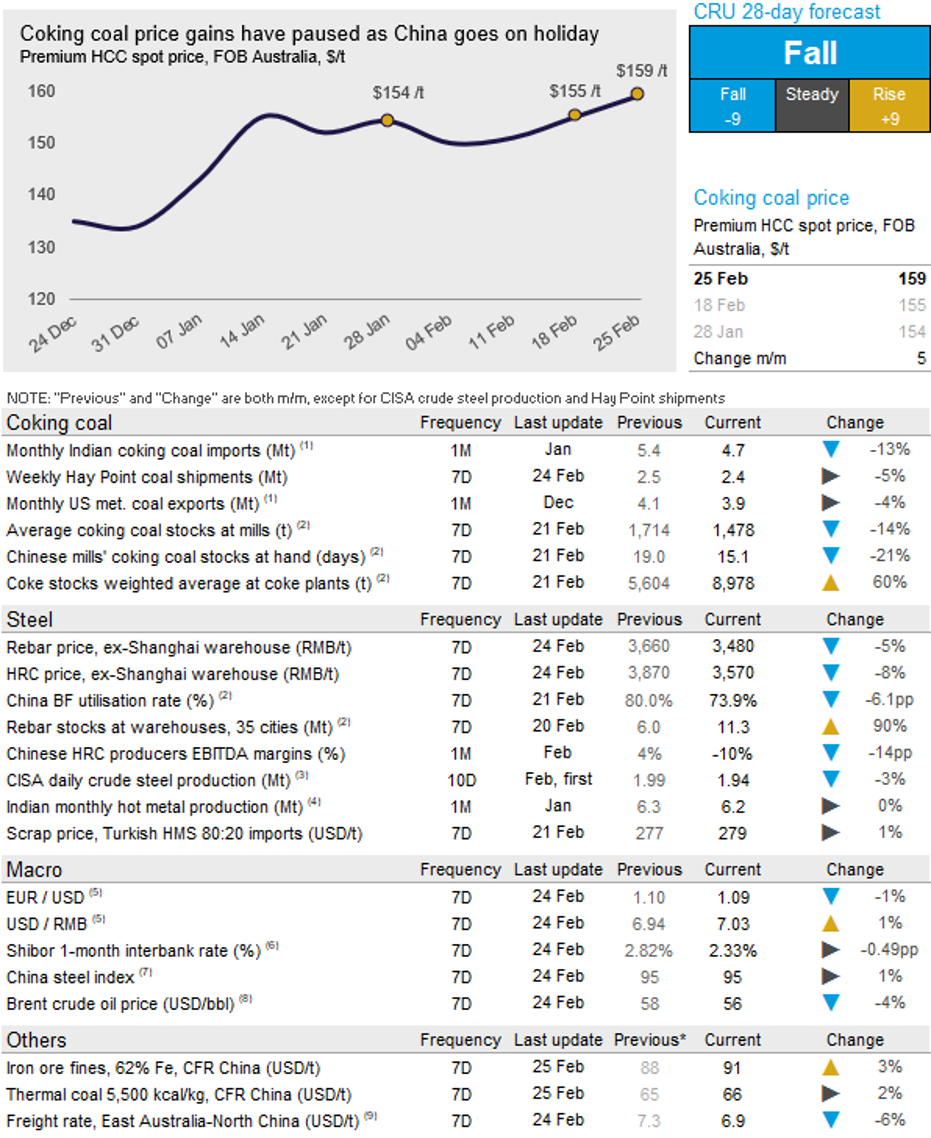

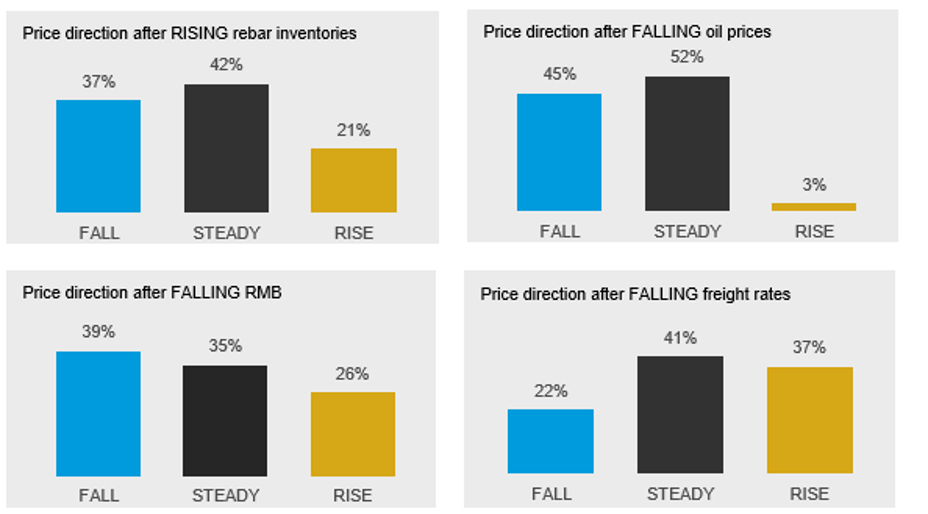

Despite weakening fundamentals in the Chinese steel market, the seaborne metallurgical coal market, and hence prices, remain supported. Chinese HRC and rebar prices are up about RMB90 /t over the week. However, we believe this largely reflects trader purchases that have not been matched by underlying demand. This can be seen in rebar inventories held by traders, which have risen to 11 Mt, up 14 percent w/w. Meanwhile, finished steel inventories at Chinese steel mills are estimated to be almost 13 Mt, the highest on record and 5 Mt higher than the previous high of 8 Mt in February 2017. As a result, Chinese mills have started to cut production and finished steel production fell by a further 2 percent w/w to its lowest level since February 2017. With underlying demand recovering only gradually, CRU expects further cuts in steel production in the coming weeks.

Metallurgical coal supply constraints, however, continue to support prices. While domestic Chinese mines are gradually restarting and we understand the majority of mines, including privately owned mines, have now restarted, overall capacity utilization still remains well below normal levels. This continuation of lower domestic supply has meant that Chinese steel mill buying interest in the seaborne market remains strong. We also understand that some mills have been buying coke from merchant coke producers in a further sign that coking coal availability remains tight. Overall transport restrictions are easing and we expect domestic supply to continue to improve as workers return and mines begin to increase production to normal levels over the coming month.

Supply disruptions outside of China also continue to support the market. Tropical cyclone Esther has made landfall near the border of Northern Territory and Queensland in Australia, bringing heavy rains over the north of Queensland in recent days. In Mackay, 180mm of rainfall was recorded on Monday and shipments from Hay Point moderated to 2.4 Mt last week, down from 2.7 Mt the week prior. Further, we understand from our sources that adverse weather conditions are still having an impact on production in British Columbia, Canada. Meanwhile, Mongolian exports to China remain suspended and are due to restart on March 2.

In India, overall steel demand remains positive. Rebar prices continue to improve, supported by positive construction and real estate demand. However, HRC prices have fallen because of more competitive import offers from Japan and South Korea.

On Feb. 25, CRU has assessed the premium hard coking coal price at $159 /t, up a further $4 /t w/w. We expect prices to remain supported in the near-term. However, prices are expected to see downward pressure from mid-March as Mongolian and domestic Chinese supply returns to the market and with hot metal production not expected to recover to normal levels until May.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com