Market Data

February 17, 2020

Service Center Inventories and Shipments Report for January

Written by Estelle Tran

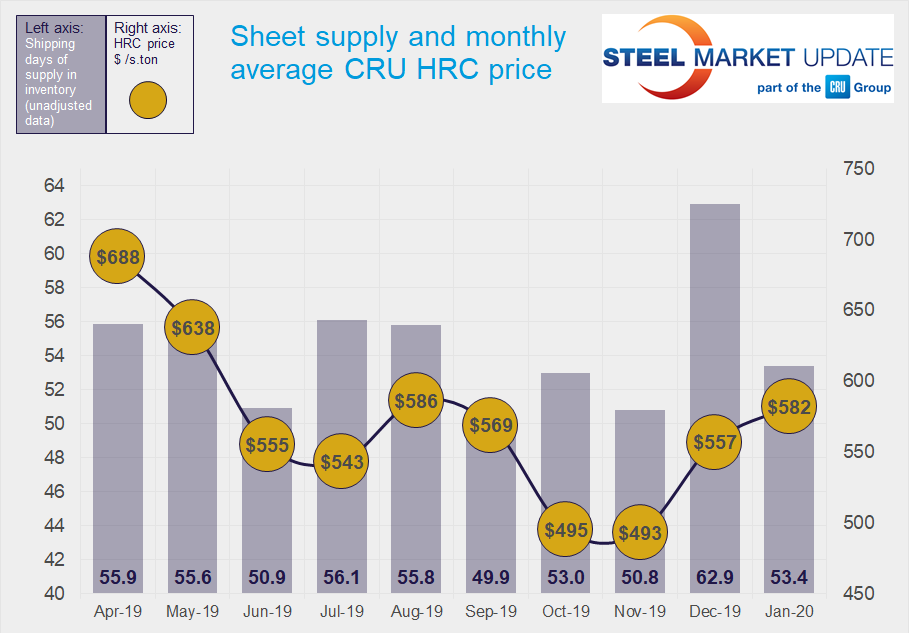

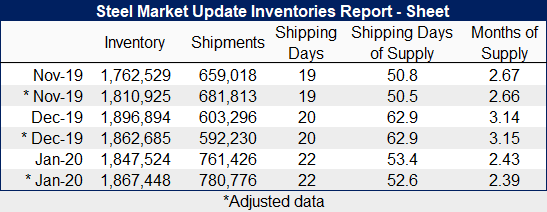

Flat Rolled = 52.6 Shipping Days of Supply

Plate = 48.4 Shipping Days of Supply

Flat Rolled

Service centers scaled back their flat rolled steel inventories at the end of January to 52.6 shipping days of supply on an adjusted basis, down from 62.9 in December, according to the SMU Service Center Inventories Report. This was a function of a 29 percent increase in month-on-month shipments. January had 22 shipping days to December’s 20. The daily shipping rate was up nearly 18 percent as well with a strong seasonal pick up in shipments. In terms of months on hand, service centers carried 2.39 months of flat rolled steel supply in January, down from 3.14 in December.

Despite the drop off in shipping days of supply, overall inventories reduced by only 1.6 percent in January, as inbound volumes remained high.

Looking ahead, we expect the inventories to be in balance with prices looking flat to down. January contract orders based off December index pricing were the last of the material priced significantly cheaper than spot pricing. Going forward, contract prices will be closer to current spot levels, and we expect service centers to ease up on their new orders while shipments remain steady.

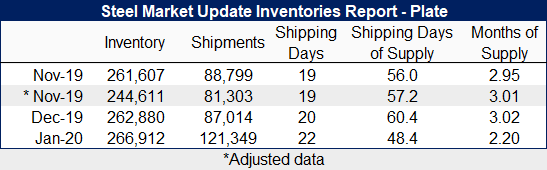

Plate

Plate supply shrank in January with a massive increase in shipments. At the end of January, service centers carried 48.4 shipping days of plate supply, down from 60.4 in December and the lowest level recorded by this survey. Service centers carried 2.2 months of plate supply in January, down from 3.02 in December. The 42 percent month-on-month increase in shipments made inventories look especially lean, as inventory volumes in January only increased 1.5 percent.

The percentage of inventory committed to contracts shrank to 35.6 percent in January, down from 38 percent in December.

Service centers carrying plate followed a similar pattern as those with sheet, keeping their inventories steady despite the seasonal spike in shipments. Plate prices were much slower to rise than sheet and appear to have stalled. Service centers may have to adjust their on-order volumes to keep up with seasonal demand, however, there appears to be no incentive to build inventories with prices just holding at current levels.