Market Data

February 13, 2020

Service Center Spot: Has Pendulum Swung the Other Way?

Written by John Packard

Service centers’ support of higher steel prices appears to have turned the corner and begun to recede, which helps to explain the recent downturn in the price of hot rolled coil. Steel Market Update data places the current price for hot rolled at $580 per ton, down $30 from the $610 peak in early January. The mills have only managed to collect a portion of the five price increases, totaling $190 per ton, they have announced since late October, and no doubt were hoping for distributors to help them collect more.

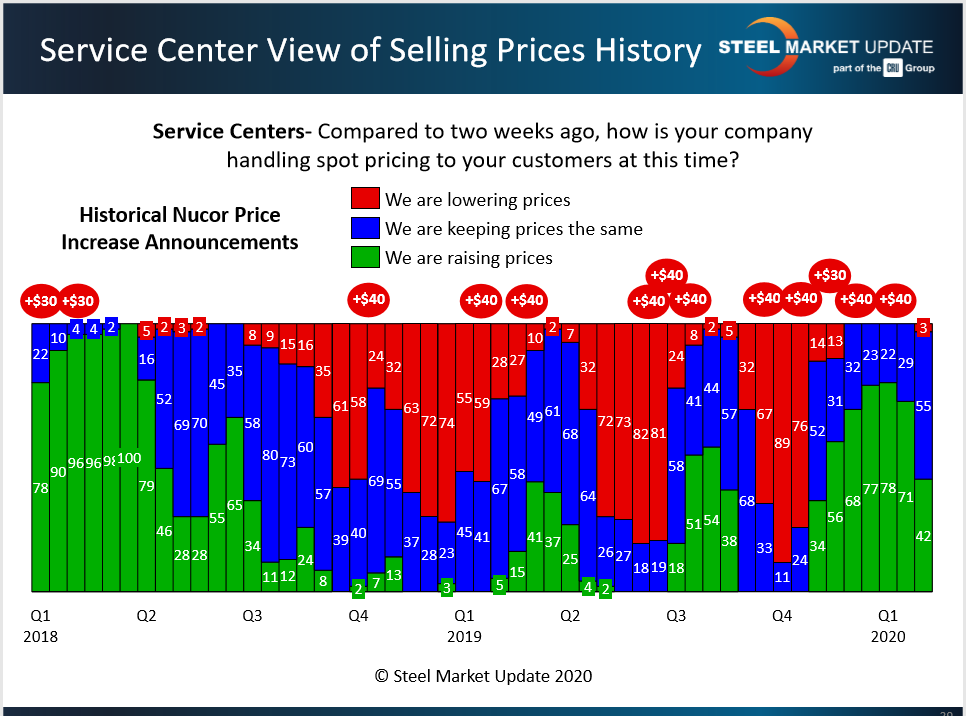

Just 42 percent of the service centers responding to SMU’s questionnaire last week said they are currently raising prices to their customers. That’s down from 71 percent two weeks prior and a peak of 78 percent in mid-January, as can be seen in the green bars in the chart below. A small percentage even indicated they are now lowering prices to secure orders. The last time the red bar appeared on the chart, and service centers were discounting, was back in November.

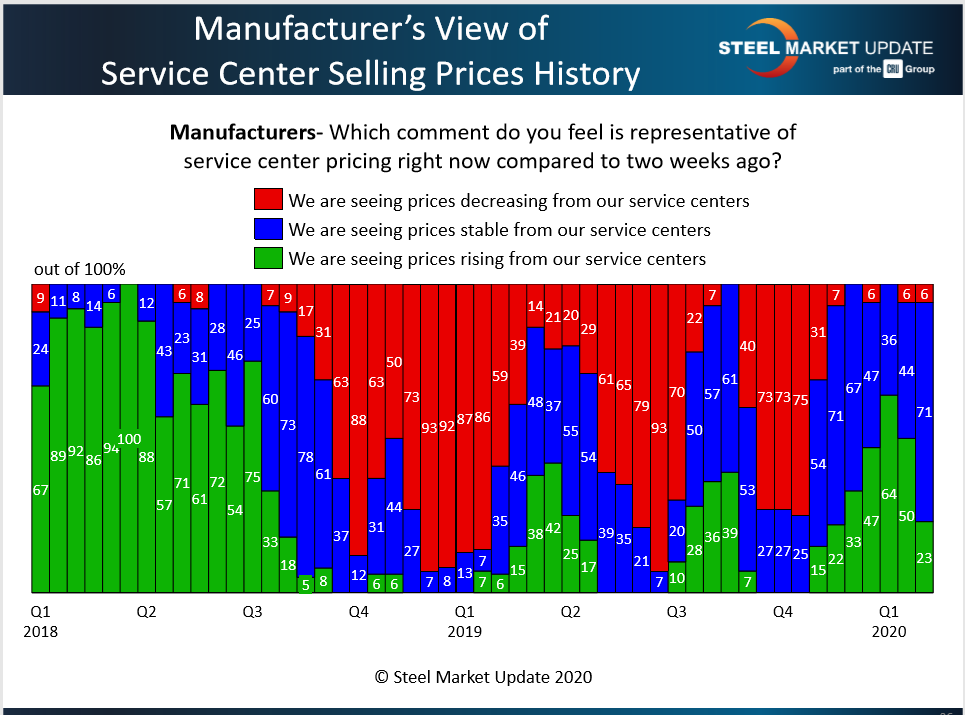

Manufacturers, the service centers’ customers, confirm the trend. Just 23 percent reported last week that their service center suppliers were continuing to raise prices, down from a peak of 64 percent last month. The vast majority, 71 percent, said the prices they are seeing from their suppliers are now stable. About 6 percent even reported lower prices, as seen in the chart below.

Looking at the charts, the red bars at the beginning of Q4, at 75 percent or more, clearly show what Steel Market Update calls the point of capitulation—the point at which steel prices had gotten so low that service centers were more concerned about the value of their inventories than their sales. The current view suggests that the pendulum has swung the other way and service centers are now more aggressively seeking to close orders ahead of declining steel prices.