Market Data

February 10, 2020

SMU Steel Buyers Sentiment Index: Still Positive

Written by Tim Triplett

Steel buyers remain optimistic about their prospects for success, but perhaps slightly less so than in mid-January. Steel prices have seen modest declines since then, along with headlines on presidential impeachment and a deadly virus in China adding to worries about the economy.

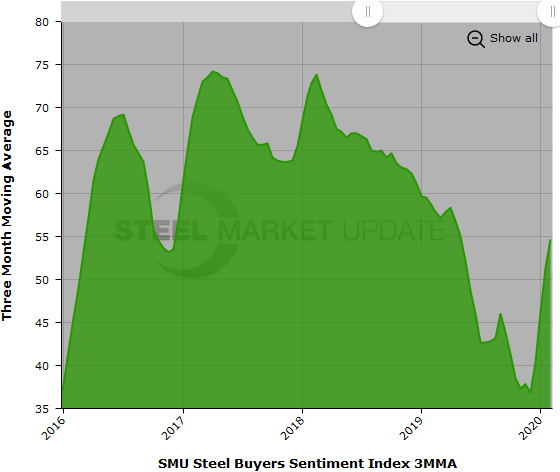

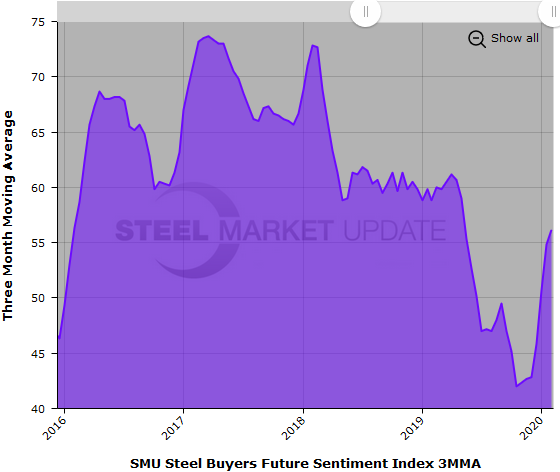

Steel Market Update’s Current Sentiment Index registered +61, down from +63 two weeks ago. The Future Sentiment Index dipped to +58 from +63 in the last survey. A change of just 5 points is not very significant and leaves Future Sentiment at a healthy level well above the readings in the 30s in September and October 2019, which were six-year lows.

The goal of SMU’s index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Sentiment Index), as well as three to six months into the future (Future Sentiment Index). Results from SMU’s market trends questionnaire this week are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend.

As a single data point, the Current Sentiment reading of +61 is slightly higher than at this time last year. Measured as a 3MMA, Current Sentiment is at +54.67, up from +51.33 in mid-January.

Future Sentiment

Future Sentiment as a single data point at +58 is about the same as in February 2019. The Future Sentiment 3MMA is +56.17, up from +54.83 a couple weeks ago and a big gain from the six-year low of +42.00 reached in October 2019.

All the current readings are above zero and on the optimistic half of SMU’s scale, therefore generally positive.

The upturn in sentiment of the past few months can be seen on the right in the chart below, which tracks the annual rate of change in the three-month moving averages.

What Respondents Had to Say

“There’s still too much uncertainty on trade and now the coronavirus is hurting commerce and casts a very negative cloud over world economies. It’s affecting overall business and will hurt steel consumption and demand in the short term.” Trading Company

“The coronavirus will impact our foreign operations along with Asian supply logistics.” Manufacturer/OEM

“External factors related to commodity prices could affect steel pricing negatively.” Steel Mill

“Delayed shipments out of China due to the coronavirus have the potential to change this outlook.” Manufacturer/OEM

“General economic conditions are not that bad in the U.S., but if the world markets falter based on China pulling back, then it could hurt our business in a 3-6 month timeframe.” Trading Company

“As long as the weather is good, we should have a strong year. Demand is high.” Manufacturer/OEM

“We had a fair amount of carryover from December, and demand for January was pretty strong.” Service Center

“Business is good, 90 percent based on the weather.” Manufacturer/OEM

“We are looking for the first six months of the year to be strong.” Service Center

“Good, as long as pricing does not slide in the second half.” Service Center

“Steady as she goes….” Service Center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.