Market Data

February 6, 2020

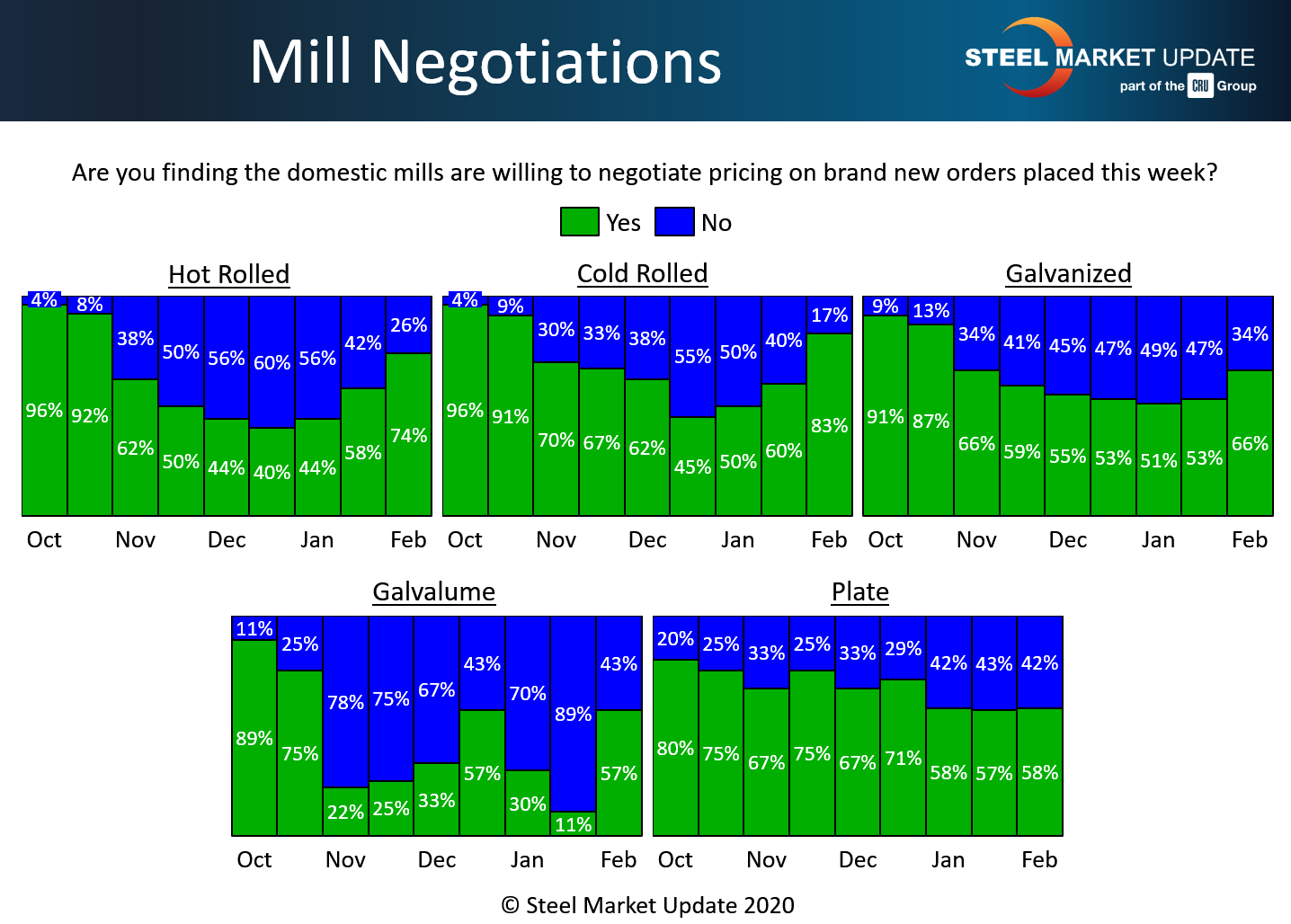

Steel Mill Negotiations: Buyers See Some Wiggle Room

Written by Tim Triplett

Price negotiations between steelmakers and steel users have loosened considerably on most steel products. Buyers report some new wiggle room in talks over spot prices.

In the hot rolled segment, nearly three out of four of the steel buyers responding to SMU’s questionnaire this week (74 percent) said the mills are now more willing to negotiate prices on HR. That’s up from 58 percent two weeks ago and a 30-point jump from this time last month. The percentage reporting mills holding the line on HR has declined to just 26 percent.

Likewise, the cold rolled segment saw a 23-point swing since mid-January with 83 percent of buyers now reporting mills willing to talk price on CR to win the order.

In coated steels, the trend was the same. In galvanized, 66 percent reported the mills open to negotiation, up from 53 percent in the last poll. About 57 percent of the Galvalume buyers said they have found mills willing to compromise on price.

There was little change in plate talks in the past two weeks, as a small majority, 58 percent, reported the plate mills open to negotiations.

Benchmark hot rolled steel prices reached $610 per ton in early January, but have since declined to $585, according to SMU’s canvass of the market this week. The downturn in prices helps to explain why the mills appear to be negotiating more aggressively to secure new spot orders.

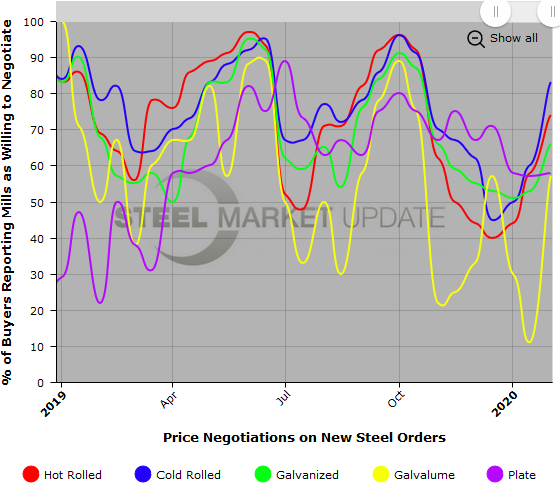

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (example below), visit our website here.