Market Data

February 4, 2020

Global Manufacturing Optimism Expands

Written by Sandy Williams

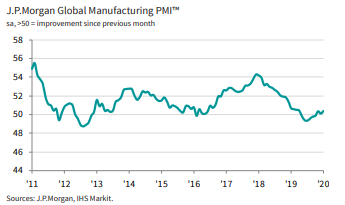

Global manufacturing performed slightly better in January, according the latest J.P. Morgan Global Manufacturing PMI. The composite PMI rose to a nine-month high of 50.4 from December’s reading of 50.1, although only slightly above the no-growth mark of 50.0.

Consumer and intermediate goods led the increase as investment goods continued to contract further.

Output rose for the sixth consecutive month as new orders increased to a 13-month high. Input costs rose moderately and increased costs were passed on in output charges. Exports continued to be lackluster and international trade volumes declined for the 17th month.

Data showed manufacturing expanded in 14 of the 30 countries covered in the January index. Optimism improved among manufacturing firms in both emerging markets and developed nations.

“The global manufacturing PMI resumed its upward trajectory in January,” commented Olya Borichevska from J.P. Global Economic Research. “Overall this suggests that the global economy is well positioned for a recovery in the goods sector. However, this will be interrupted by the outbreak of the nCoV in China. As for the PMI, the output index reached a high since January 2019 suggesting global IP growth of 1.0 percent pace. Actual output contracted last quarter as idiosyncratic factors in Japan related to the consumption tax hike and the U.S. related to the auto-sector strike played a role. With output, new orders and business confidence all rising, the PMI in January sent a positive message for the global industry.”

The Eurozone manufacturing sector contracted to a PMI of 47.9 in January, but the downward rate was the slowest since April 2019. All eight countries saw a rise in the January PMI with Greece emerging as the strongest performer. The decline in production and new order levels slowed at the start of 2020 with order books beginning to stabilize as warehouse inventories fell. Optimism in the region was at the highest level since August 2018. IHS Markit Chief Economist Chris Williamson noted that the region still faces risks, including the threat of U.S. tariffs, trade war escalation, Brexit-related trade disruptions and potential impacts to business from the coronavirus.

The Caixin China General Manufacturing PMI dropped to a five-month low in January, registering 51.1. New orders and output increased at a slower rate as export orders fell for the first time in four months. The sector reported continued pressure from rising raw material costs. The Phase 1 trade deal with the U.S. helped to boost business confidence, but the emergence of the coronavirus is expected to impact China’s economy.

The contraction in Russia’s manufacturing sector slowed in January, leading to renewed business confidence. The PMI rose to 47.9 from 47.5 the previous month. New orders continued to decline domestically and abroad. Lower demand and weak purchasing power were blamed for the latest, albeit softer, decline in production. IHS Markit is predicting industrial production will grow under 2.0 percent during the first three months of 2020 and increase as the year progresses.

Mexico recovered slightly from its worse December in nine-years as the decline in new orders, output and input buying eased in January. The PMI remained in contraction at 49.0 but gained almost two points from December’s reading of 47.1.

“The downturn of Mexico’s manufacturing industry appears to have bottomed out, with key PMI indices moving higher in January. In addition to softer contractions in new orders, exports, input buying and output, the latest results bring welcoming news on the employment and business sentiment fronts,” said Pollyanna De Lima, principal economist at IHS Markit. “IHS Markit forecasts only marginal economic growth in 2020, +0.7 percent, as policy uncertainty prevails and constrained investment remains an issue. The rise in GDP is predicted to be driven by private consumption, aided by interest rate cuts and credit expansion.”

Manufacturing conditions in Canada were lackluster in January, improving only slightly from December. The PMI rose 0.2 points to 50.6 due to a modest uptick in new orders, but was restrained from further growth due to falling export sales. Production volumes dipped and lack of capacity pressure led to a reduction in backlogs. Purchasing activity was restrained by continued inventory destocking. Lead times increased as a result of deteriorating supplier performance due to weather conditions, transport shortages, and low stocks at vendors. Lower steel prices helped to alleviate overall cost pressures in January, noted several survey respondents. Manufacturers, hopeful of improved global trade conditions, expressed the highest confidence levels since July 2019.

Business conditions improved slightly in the United States during January. The U.S PMI lost traction, dipping to 51.9 from 52.4 in December. New orders and production slowed, reducing capacity pressure and backlogs. Export orders fell for the first time since September. Manufacturers blamed rising operating expenses on higher input prices, particularly metals pricing and tariffs.

Williamson, at IHS Markit, said: “U.S. manufacturing limped into 2020, with falling exports dampening output growth and causing a pull-back in hiring. The survey data are consistent with factory production falling moderately, meaning the manufacturing sector looks set to act as a drag on the overall economy once again in the first quarter.

“Weakness looks broad-based. Rising demand from households has helped support production in recent months, but January saw a marked slowing in new orders for consumer goods. Production of capital goods such as business equipment, plant and machinery meanwhile fell for the first time in almost four years, hinting at weakened business investment.

“More encouragingly, business expectations for the year ahead perked up, coinciding with an easing of trade tensions and the signing of new North American and Chinese trade deals. Companies are therefore expecting the soft patch to be short-lived, though fears surrounding the Wuhan coronavirus and any further potential escalation of trade tensions could erode this optimism.”