Analysis

February 3, 2020

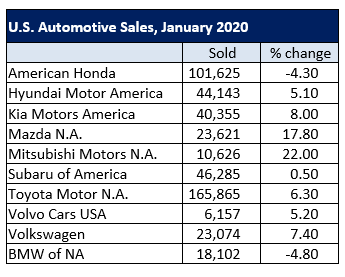

Auto Sales Still Robust in January

Written by Sandy Williams

Automotive sales were up year-over-year for most automakers that reported data for January. Sales last month rose 1.0 percent to a seasonally adjusted annual rate of 17.1 million vehicles, according to auto research firm Edmunds.

Automotive sales declined 1.6 percent in 2019 to 17.1 million vehicles. Edmunds expects sales for 2020 to be flat, but Cox Automotive and LMC Automotive are less optimistic. Analysts at those two companies are predicting sales closer to 16.7 million for this year, breaking the five-year run of 17 million or more.

“This year is starting with less trade uncertainty in the auto sector than in 2019 and, while economic growth is expected to hover just under 2 percent, there could be some upside with trade being less of a drag and it being an election year,” commented Jeff Schuster, president, Americas Operations and Global Vehicle Forecasts, LMC Automotive. “Affordability remains a major concern for the U.S. auto market as transaction prices have continued to rise and used vehicles are a viable substitute for some consumers, especially entry-level buyers.”