Market Data

January 30, 2020

Service Center Spot: Temporary Blip or Change of Direction?

Written by John Packard

The recent rise in flat rolled mill spot prices have, in Steel Market Update’s opinion based on our survey analysis, been supported by a rise in service center spot prices to their end customers. However, the analysis of last week’s flat rolled and plate steel market trends survey indicates that support for higher prices has peaked. We are seeing this in both the analysis of the responses of the service centers themselves as well as the data collected from manufacturing companies who purchase from distributors.

Have rising steel prices turned a corner or is the flattening seen in the past two weeks just a temporary blip? That is the question of the day.

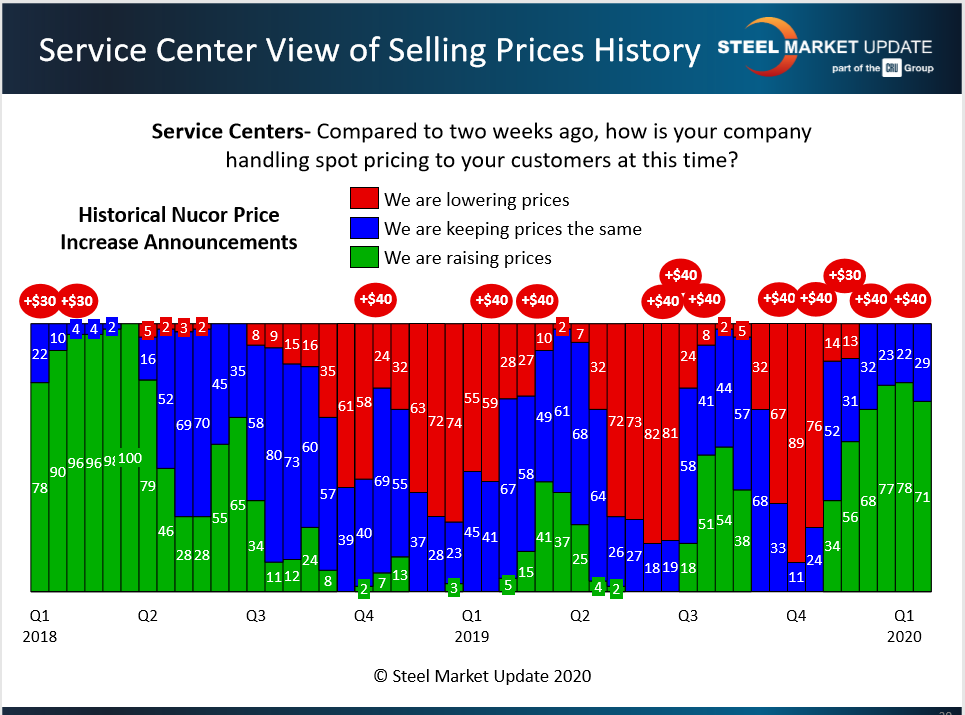

As indicated by the green bars in the charts below, service centers have been raising spot prices to their customers since November. Seventy-one percent of the service center executives responding to SMU’s questionnaire last week reported they are still raising prices to their customers. But that figure is down from 78 percent two weeks earlier. This is a small dip, but as you can see looking back at the green bars on the chart below, during first-quarter 2018 when service centers began to pull back, we saw steel mills stop announcing price increases and ultimately mill prices began to slide.

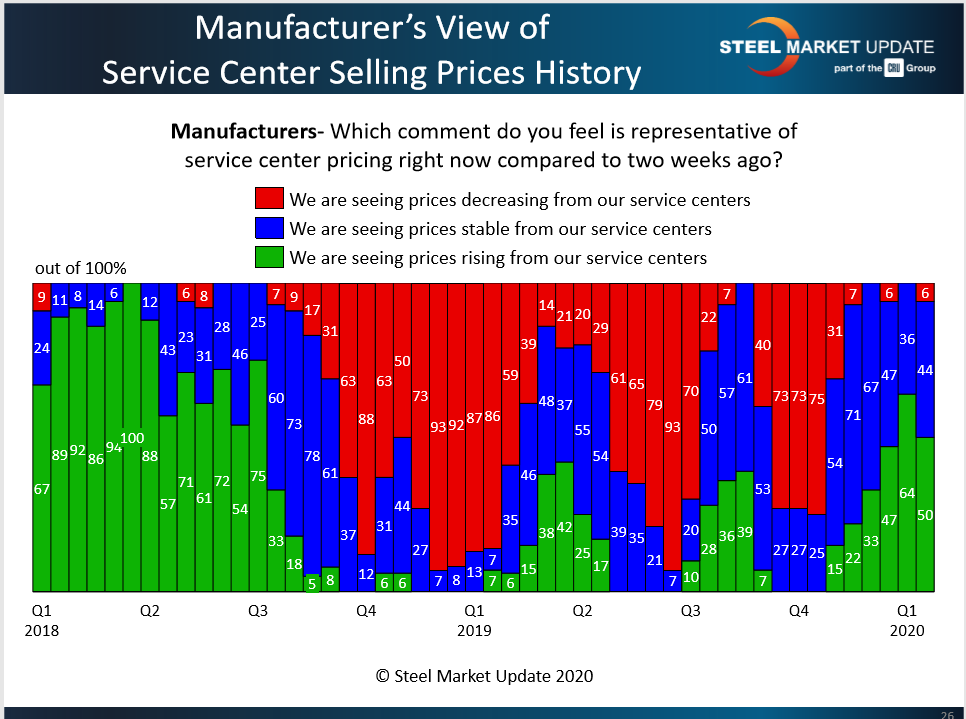

Considering prices from the manufacturer’s point of view, 50 percent of those responding to SMU’s survey Jan. 20 said they were still seeing higher prices from their service center suppliers. While still the majority, that figure is down from 64 percent in the prior survey. And a few (6 percent) even reported service centers decreasing prices. The remaining 44 percent said prices were stable.

Looking back at 2018, we saw manufacturing companies see-saw as they grappled with how service centers were quoting spot prices into their company. As mentioned above, as we entered second-quarter 2018, mill prices came under pressure, which resulted in the red bars – or when discounting by the service centers became rampant.

Steelmakers have raised prices five times since late October for a total of $190 per ton ($9.50/cwt) and have managed to collect more than half. Steel Market Update places the current benchmark price for hot rolled steel at $590 per ton, unchanged from the prior week and down from $610 per ton earlier in the month, which suggests the price hikes may be losing some steam.

Looking at the charts, the red bars at the beginning of Q4, at 75 percent or more, clearly show what Steel Market Update calls the point of capitulation—the point at which steel prices had gotten so low that service centers were more concerned about the value of their inventories than their sales. With more than 75 percent of service centers raising prices as of earlier this the month (green bars), and with steel prices up to healthier levels, that attitude may be reversing. SMU will be watching closely to see if the price pendulum has begun to swing back the other way.